Region:Middle East

Author(s):Dev

Product Code:KRAD0362

Pages:80

Published On:August 2025

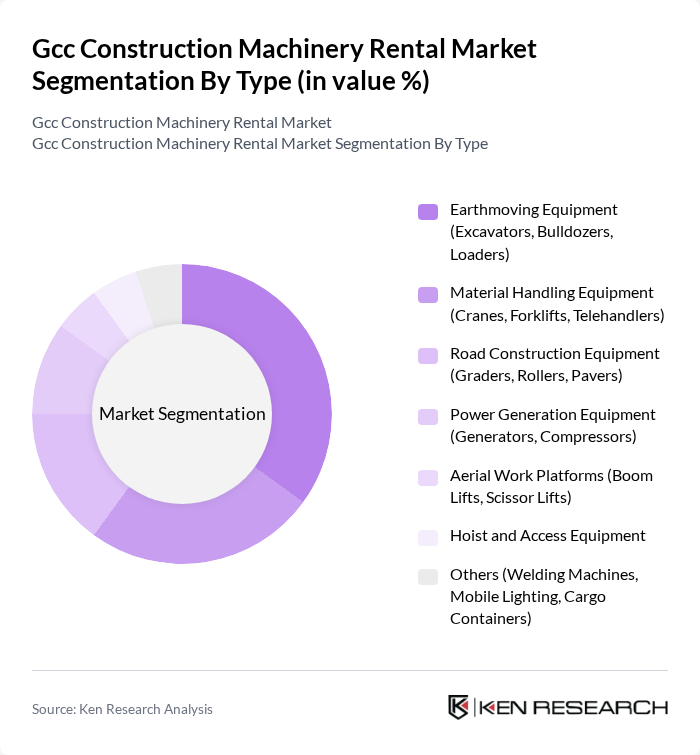

By Type:

The Earthmoving Equipment segment, comprising excavators, bulldozers, and loaders, leads the market due to its critical role in diverse construction projects. The segment's dominance is supported by the ongoing expansion of infrastructure and urban development in the GCC. The versatility, productivity, and technological advancements in earthmoving equipment make it the preferred choice for contractors. Material Handling Equipment is the next largest segment, driven by the need for efficient logistics, lifting, and material transport across construction sites .

By End-User:

The Construction sector is the primary end-user of rental machinery, accounting for the largest market share. This is attributed to the sustained construction boom in the GCC, driven by government-led infrastructure initiatives and private sector investments. The Oil & Gas sector is also a major consumer, requiring specialized and heavy-duty machinery for exploration, extraction, and maintenance activities. Mining and Infrastructure Development segments follow, reflecting the broad application of construction machinery across multiple industries .

The Gcc Construction Machinery Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Faris Group, Bin Quraya Rental, Zahid Tractor & Heavy Machinery Co. Ltd., Arabian Machinery & Heavy Equipment Co. (AMHEC), Byrne Equipment Rental, Mohamed Abdulrahman Al-Bahar LLC, Manlift Group, Al Jaber Group, Al Mulla Group, Al Naboodah Group Enterprises, Al Shafar Group, Johnson Arabia, Kanoo Machinery (Yusuf Bin Ahmed Kanoo Group), Al-Bahar Equipment, Al Jazeera Equipment & Oilfield Supply Co. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC construction machinery rental market is poised for significant evolution, driven by ongoing infrastructure projects and a shift towards sustainable practices. As companies increasingly adopt rental models, the market is expected to embrace digital transformation, enhancing service delivery and customer engagement. Furthermore, the integration of eco-friendly machinery will likely gain traction, aligning with global sustainability trends. These developments will create a dynamic landscape, fostering innovation and competitive advantages for rental service providers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Earthmoving Equipment (Excavators, Bulldozers, Loaders) Material Handling Equipment (Cranes, Forklifts, Telehandlers) Road Construction Equipment (Graders, Rollers, Pavers) Power Generation Equipment (Generators, Compressors) Aerial Work Platforms (Boom Lifts, Scissor Lifts) Hoist and Access Equipment Others (Welding Machines, Mobile Lighting, Cargo Containers) |

| By End-User | Construction Oil & Gas Mining Infrastructure Development Manufacturing Power & Utilities Others (Telecom, Agriculture) |

| By Application | Residential Construction Commercial Construction Industrial Construction Road and Highway Construction Mega Projects (e.g., NEOM, Expo City Dubai) Others |

| By Rental Duration | Short-term Rentals Long-term Rentals Project-based Rentals |

| By Pricing Model | Hourly Pricing Daily Pricing Weekly Pricing Monthly Pricing |

| By Distribution Channel | Direct Sales Online Platforms Rental Agencies Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of GCC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heavy Machinery Rental | 60 | Fleet Managers, Rental Company Executives |

| Construction Equipment Leasing | 50 | Project Managers, Site Supervisors |

| Specialized Equipment Rental | 40 | Operations Managers, Equipment Specialists |

| Infrastructure Project Rentals | 40 | Government Officials, Infrastructure Planners |

| Small Equipment Rental | 45 | Small Business Owners, Contractors |

The GCC Construction Machinery Rental Market is valued at approximately USD 4.8 billion, driven by rapid urbanization and significant infrastructure development across the region. This growth reflects the increasing demand for cost-effective rental solutions in the construction sector.