Region:Europe

Author(s):Shubham

Product Code:KRAC0716

Pages:94

Published On:August 2025

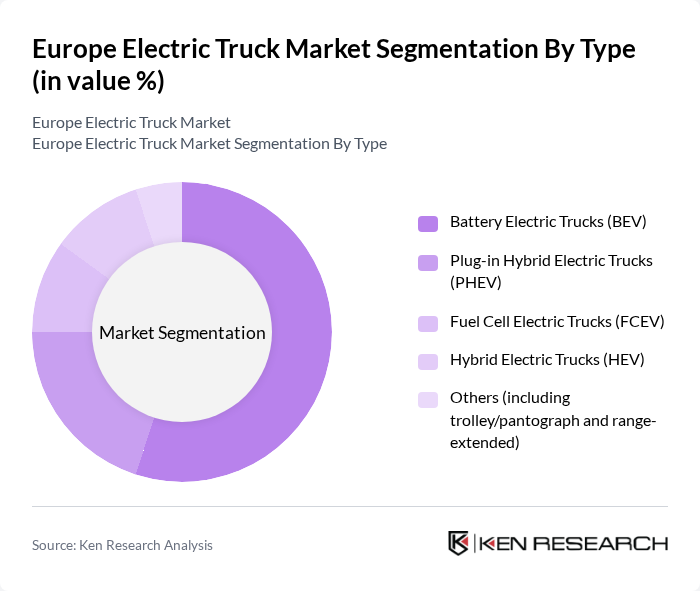

By Type:The electric truck market can be segmented into various types, including Battery Electric Trucks (BEV), Plug-in Hybrid Electric Trucks (PHEV), Fuel Cell Electric Trucks (FCEV), Hybrid Electric Trucks (HEV), and others such as trolley/pantograph and range-extended trucks. Among these, Battery Electric Trucks (BEV) are leading the market due to their zero-emission capabilities and advancements in battery technology, which have significantly improved their range and efficiency; BEV model availability and registrations have expanded rapidly among major European OEMs in medium- and heavy-duty classes . The growing customer preference for sustainable transport solutions and compliance with tightening CO? standards are further driving demand for BEVs .

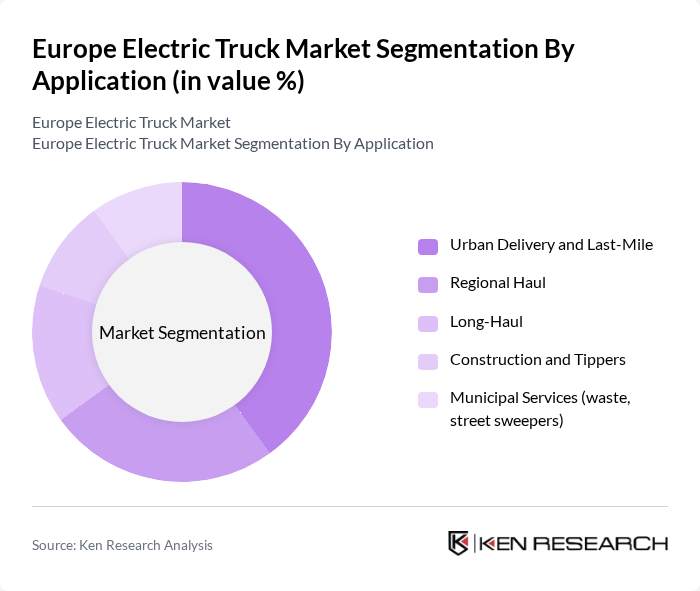

By Application:The applications of electric trucks include Urban Delivery and Last-Mile, Regional Haul, Long-Haul, Construction and Tippers, and Municipal Services such as waste collection and street sweeping. Urban Delivery and Last-Mile applications are currently dominating the market due to the increasing demand for efficient and sustainable delivery solutions in urban areas; zero-emission zones and depot-based overnight charging make BEVs particularly suitable for city logistics . The rise of e-commerce and the need for quick delivery services are propelling the adoption of electric trucks in this segment, with OEMs offering multiple medium-duty urban delivery BEV models .

The Europe Electric Truck Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daimler Truck AG (Mercedes-Benz Trucks, eActros, eEconic), Volvo Trucks (Volvo FH/FM/FE/FN Electric), MAN Truck & Bus SE (MAN eTruck, eTGS/eTGX), Scania AB (Scania 45 R/S Electric, regional haul), Renault Trucks (E-Tech D, E-Tech T), Iveco S.p.A. (Iveco HD BEV/FCEV, eDaily), DAF Trucks N.V. (DAF XD/XF Electric), Ford Trucks (Electric F-Line development, Europe), BYD Company Limited (BYD eTrucks in Europe), Tesla, Inc. (Tesla Semi – select EU trials/plans), Nikola Corporation (Nikola Tre BEV/FCEV – EU history and partnerships), Fuso (Daimler Truck) (FUSO eCanter), Quantron AG (BEV/FCEV conversions and new builds), Volta Trucks Ltd. (assets/brand developments impacting EU market), Tevva Motors Ltd. (range-extended/BEV trucks in Europe) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric truck market in Europe appears promising, driven by a combination of regulatory support and technological advancements. As battery costs continue to decline and charging infrastructure expands, the adoption of electric trucks is expected to accelerate. Additionally, the integration of smart technologies and autonomous driving features will enhance operational efficiency. By the near future, the market is likely to witness a significant shift towards electric solutions, aligning with the EU's sustainability goals and the increasing demand for eco-friendly logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Trucks (BEV) Plug-in Hybrid Electric Trucks (PHEV) Fuel Cell Electric Trucks (FCEV) Hybrid Electric Trucks (HEV) Others (including trolley/pantograph and range-extended) |

| By Application | Urban Delivery and Last-Mile Regional Haul Long-Haul Construction and Tippers Municipal Services (waste, street sweepers) |

| By Gross Vehicle Weight (GVW) | Up to 3.5 tonnes (N1) –7.5 tonnes (N2-Low) –16 tonnes (N2-High) Above 16 tonnes (N3) |

| By Range (WLTP/Real-World) | Up to 150 km –300 km –500 km Above 500 km |

| By Charging/Fueling | AC Depot Charging (up to 22 kW) DC Fast Charging (50–350 kW) Megawatt Charging System (MCS) readiness Battery Swapping Hydrogen Refueling (350/700 bar) for FCEV |

| By Body/Superstructure | Box/Distribution Refrigerated Tipper/Construction Tractor (4x2, 6x2) Refuse Collector and Municipal |

| By Sales Channel | Direct OEM and Captive Finance Dealer/Importer Network Leasing-as-a-Service and Truck-as-a-Service (TaaS) |

| By Policy Support Mechanism | Purchase Subsidies and Bonus-Malus Registration Tax Exemptions and Reduced Tolls Infrastructure Grants (charging, depot grid upgrades) CO? Standards Compliance (EU HDV targets) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Companies Using Electric Trucks | 120 | Fleet Managers, Operations Directors |

| Manufacturers of Electric Truck Components | 90 | Product Development Managers, Sales Executives |

| Government Policy Makers on EV Regulations | 60 | Transport Policy Analysts, Environmental Officers |

| End-users of Electric Trucks in Various Sectors | 100 | Supply Chain Managers, Sustainability Coordinators |

| Industry Experts and Consultants | 50 | Market Analysts, Industry Advisors |

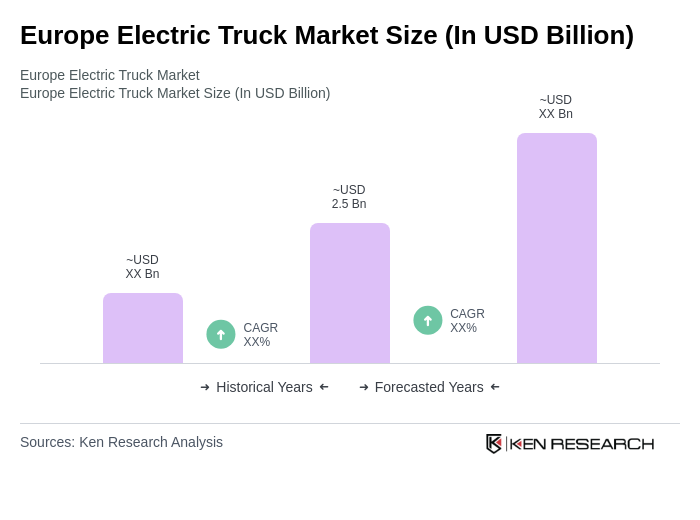

The Europe Electric Truck Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing environmental regulations, advancements in battery technology, and a shift towards sustainable transportation solutions across core EU markets.