Region:Global

Author(s):Geetanshi

Product Code:KRAD0164

Pages:82

Published On:August 2025

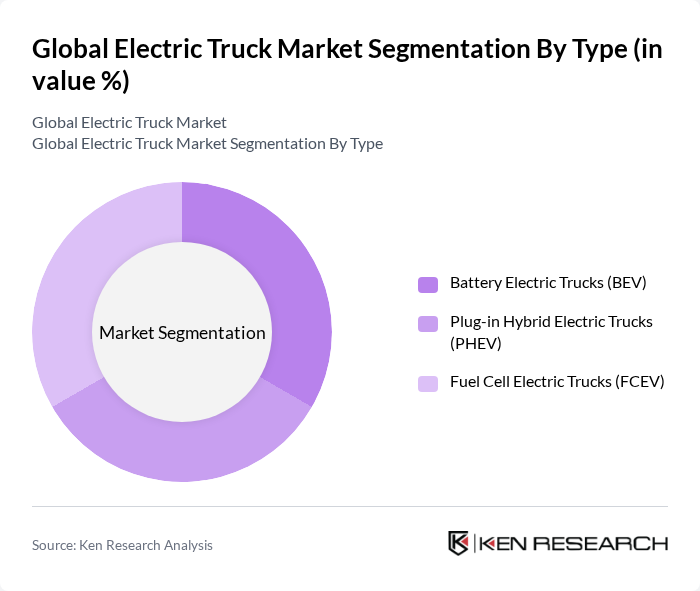

By Type:The electric truck market is segmented into three main types: Battery Electric Trucks (BEV), Plug-in Hybrid Electric Trucks (PHEV), and Fuel Cell Electric Trucks (FCEV). Among these, Battery Electric Trucks (BEV) are leading the market due to their higher efficiency and lower operational costs compared to other types. The growing infrastructure for charging stations and advancements in battery technology further support the dominance of BEVs. PHEVs and FCEVs are also gaining traction, but they currently hold a smaller market share. Light-duty electric trucks represent the largest segment by application, with medium- and heavy-duty segments rapidly expanding .

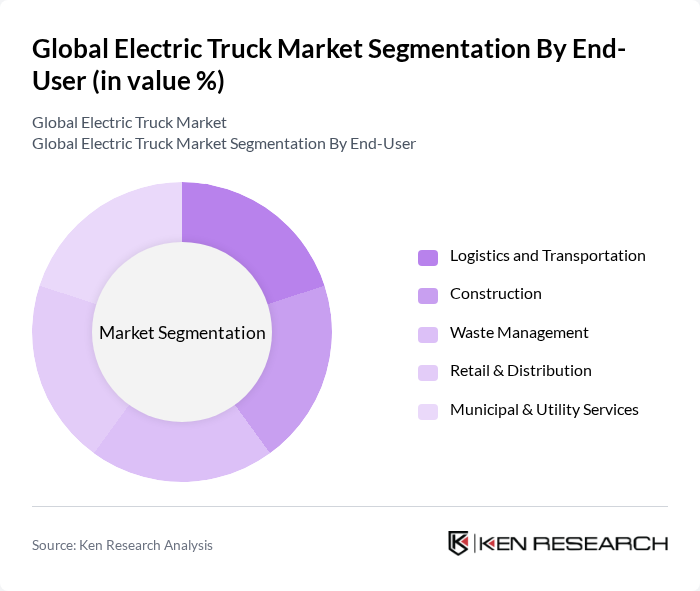

By End-User:The electric truck market is segmented by end-user into Logistics and Transportation, Construction, Waste Management, Retail & Distribution, and Municipal & Utility Services. The Logistics and Transportation sector is the largest end-user, driven by the need for efficient and sustainable delivery solutions. Companies are increasingly adopting electric trucks to reduce operational costs and meet sustainability goals. Other sectors, while growing, are not yet as dominant as logistics. The adoption of electric trucks in waste management and municipal services is also increasing, supported by urban sustainability initiatives .

The Global Electric Truck Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BYD Company Limited, Daimler Truck AG, Volvo Group, MAN Truck & Bus SE, Nikola Corporation, Rivian Automotive, Inc., Workhorse Group, Inc., Hino Motors, Ltd., Scania AB, PACCAR Inc. (Kenworth, Peterbilt, DAF), Isuzu Motors Limited, Freightliner Trucks (Daimler Truck North America), FUSO Truck and Bus Corporation, Tata Motors Limited, Dongfeng Motor Corporation, Ford Motor Company, Yutong Group Co., Ltd., Renault Trucks, TEVVA Motors Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric truck market appears promising, driven by technological advancements and increasing regulatory pressures. As battery technology continues to evolve, electric trucks will become more accessible and efficient, enhancing their appeal to fleet operators. Additionally, the expansion of charging infrastructure, supported by government initiatives, will alleviate range anxiety. The integration of smart technologies will further optimize fleet management, making electric trucks a viable option for logistics and transportation sectors in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Trucks (BEV) Plug-in Hybrid Electric Trucks (PHEV) Fuel Cell Electric Trucks (FCEV) |

| By End-User | Logistics and Transportation Construction Waste Management Retail & Distribution Municipal & Utility Services |

| By Application | Urban Delivery/Last-Mile Delivery Long-Haul Transportation Construction Sites Mining & Industrial |

| By Payload Capacity | Light-Duty Trucks (<6 tons) Medium-Duty Trucks (6–16 tons) Heavy-Duty Trucks (>16 tons) |

| By Charging Type | Fast Charging (DC) Standard Charging (AC) Battery Swapping Wireless Charging |

| By Distribution Channel | Direct Sales (OEM) Dealerships Online Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Companies | 100 | Fleet Managers, Operations Directors |

| Electric Truck Manufacturers | 60 | Product Development Managers, Sales Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Charging Infrastructure Providers | 40 | Business Development Managers, Technical Directors |

| Logistics Consultants and Analysts | 40 | Industry Analysts, Supply Chain Consultants |

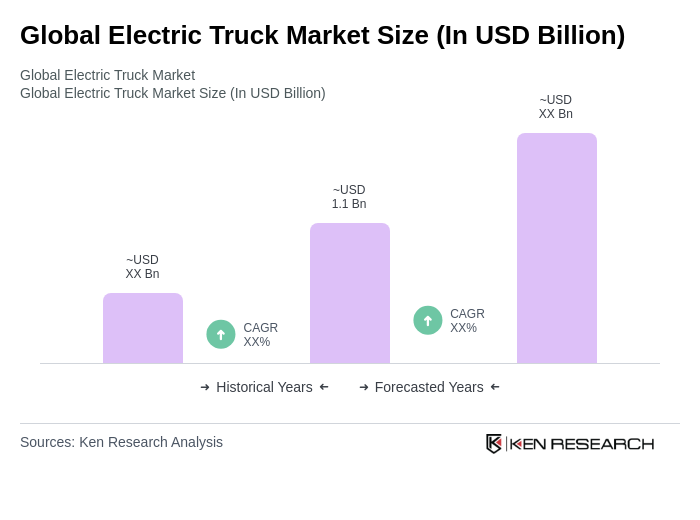

The Global Electric Truck Market is valued at approximately USD 1.1 billion, driven by factors such as environmental regulations, advancements in battery technology, and rising fuel prices, which encourage logistics companies to adopt electric trucks for sustainability and cost efficiency.