Region:Europe

Author(s):Dev

Product Code:KRAB0401

Pages:98

Published On:August 2025

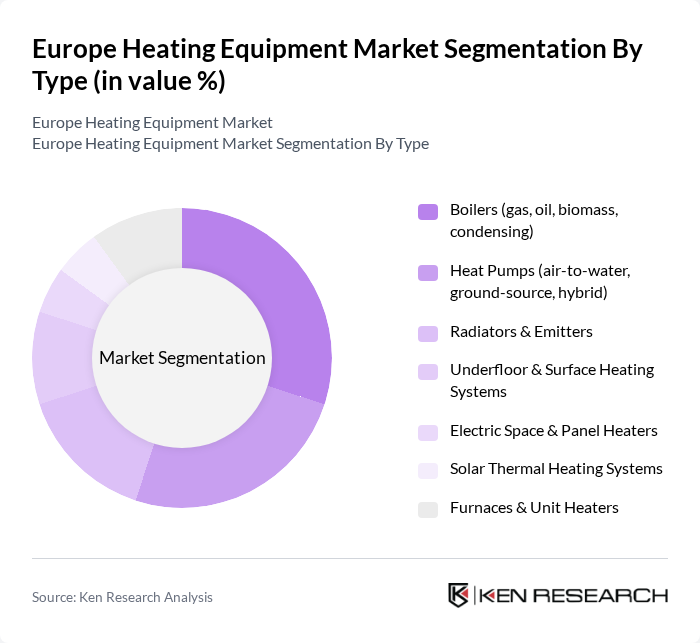

By Type:The heating equipment market can be segmented into various types, including boilers, heat pumps, radiators, underfloor heating systems, electric heaters, solar thermal systems, and furnaces. Each of these subsegments caters to different consumer needs and preferences, with specific applications in residential, commercial, and industrial settings.

The boilers segment, particularly gas and condensing boilers, dominates the market due to their widespread use in residential and commercial applications. The efficiency and reliability of modern boilers, combined with the growing trend towards energy-efficient solutions, have made them a preferred choice among consumers. Additionally, government incentives for upgrading to more efficient systems have further bolstered this segment's growth. The increasing focus on reducing carbon emissions and enhancing energy efficiency is expected to sustain the demand for boilers in the coming years.

By End-User:The market can be segmented based on end-users, including residential, commercial, industrial, and district energy utilities. Each segment has unique requirements and preferences, influencing the types of heating equipment utilized.

The residential segment is the largest end-user category, driven by the increasing number of households and the demand for efficient heating solutions. Homeowners are increasingly investing in modern heating systems that offer better energy efficiency and lower operational costs. The commercial sector follows closely, with businesses seeking to enhance their energy efficiency and reduce heating costs. The industrial segment also plays a significant role, particularly in sectors like food and beverage and pharmaceuticals, where precise temperature control is essential.

The Europe Heating Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vaillant Group, Bosch Thermotechnology (Robert Bosch GmbH), Ariston Group, Viessmann Climate Solutions (Carrier Global Corporation), Daikin Europe N.V., Mitsubishi Electric Corporation, Baxi Heating (BDR Thermea Group), Ferroli S.p.A., Glen Dimplex Group, NIBE Industrier AB, STIEBEL ELTRON GmbH & Co. KG, Remeha B.V. (BDR Thermea Group), Groupe Atlantic, Danfoss A/S, Panasonic Heating & Ventilation A/C Europe (PHVAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe heating equipment market is poised for transformation, driven by technological advancements and a strong push for sustainability. As electrification of heating systems gains momentum, the integration of smart technologies will enhance user engagement and energy efficiency. Additionally, the increasing adoption of renewable energy sources will reshape the market landscape, encouraging manufacturers to innovate and adapt to changing consumer preferences. This dynamic environment presents both challenges and opportunities for stakeholders in the heating equipment sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Boilers (gas, oil, biomass, condensing) Heat Pumps (air-to-water, ground-source, hybrid) Radiators & Emitters Underfloor & Surface Heating Systems Electric Space & Panel Heaters Solar Thermal Heating Systems Furnaces & Unit Heaters |

| By End-User | Residential Commercial (offices, retail, hospitality, public buildings) Industrial (F&B, pharma, chemicals, other manufacturing) District Energy & Utilities |

| By Application | Space Heating Water Heating & DHW Process Heating District Heating Interface Units |

| By Sales Channel | Direct Sales (projects, OEM) Distributors/Installers Online Retail & Marketplaces Wholesale |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Entry/Low-End Mid-Range Premium/High-End |

| By Policy Support | Subsidies & Grants (e.g., national heat pump incentives) Tax Credits/Exemptions Building Codes & Minimum Efficiency Standards Incentives for Renewable & Low-Carbon Heating |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heating Equipment | 150 | Homeowners, HVAC Installers |

| Commercial Heating Solutions | 100 | Facility Managers, Building Owners |

| Industrial Heating Systems | 80 | Operations Managers, Plant Engineers |

| Renewable Heating Technologies | 70 | Energy Consultants, Sustainability Officers |

| Heating Equipment Distribution Channels | 90 | Distributors, Retail Managers |

The Europe Heating Equipment Market is valued at approximately USD 7 billion, based on a five-year historical analysis. This figure reflects the consolidation of revenues specific to heating equipment, excluding the broader HVAC category.