Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4102

Pages:94

Published On:December 2025

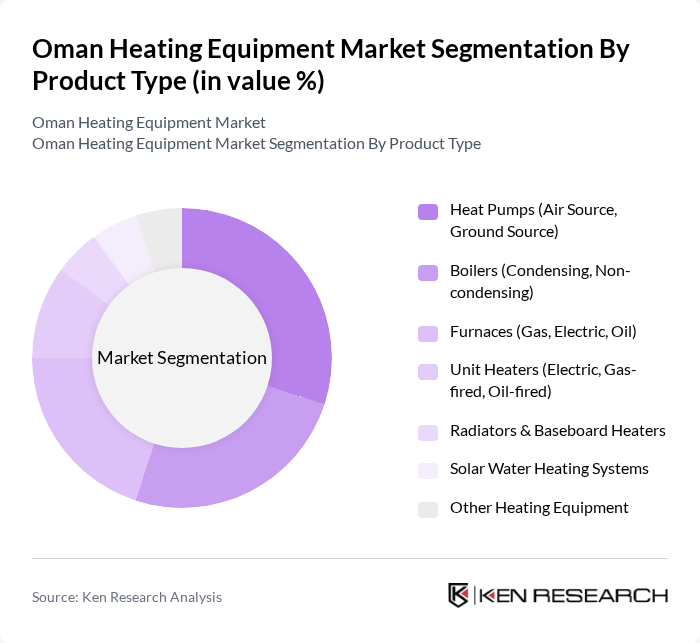

By Product Type:The product type segmentation includes various heating solutions that cater to different consumer needs and preferences. The subsegments are Heat Pumps (Air Source, Ground Source), Boilers (Condensing, Non-condensing), Furnaces (Gas, Electric, Oil), Unit Heaters (Electric, Gas-fired, Oil-fired), Radiators & Baseboard Heaters, Solar Water Heating Systems, and Other Heating Equipment. Among these, heat pumps are gaining traction due to their energy efficiency and environmental benefits, while traditional boilers remain popular in industrial applications.

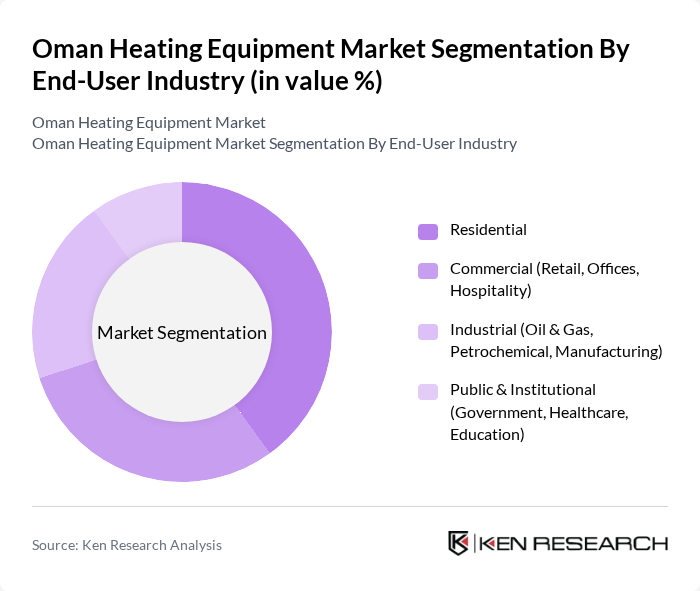

By End-User Industry:The end-user industry segmentation encompasses various sectors utilizing heating equipment, including Residential, Commercial (Retail, Offices, Hospitality), Industrial (Oil & Gas, Petrochemical, Manufacturing), and Public & Institutional (Government, Healthcare, Education). The residential sector is the largest consumer of heating equipment, driven by increasing home construction and renovation activities. The commercial sector follows closely, with a growing demand for efficient heating solutions in retail and hospitality establishments.

The Oman Heating Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Air Conditioning Company LLC (OACC), Bahwan Engineering Company LLC, Daikin Middle East and Africa FZE, Trane Technologies plc, Carrier Middle East LLC, LG Electronics Gulf FZE, Mitsubishi Electric Corporation (Middle East), Honeywell Building Technologies (Middle East), Bosch Thermotechnology (Robert Bosch GmbH), Rheem Manufacturing Company, Johnson Controls – Hitachi Air Conditioning, Zamil Air Conditioners (Zamil Industrial), Fujitsu General (Middle East) FZE, Aermec S.p.A., Vaillant Group contribute to innovation, geographic expansion, and service delivery in this space.

The Oman heating equipment market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As the government continues to promote renewable energy and energy efficiency, the market is likely to see increased adoption of smart heating solutions. Furthermore, the integration of IoT technologies will enhance system performance and user experience. These trends indicate a shift towards more sustainable and efficient heating solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Heat Pumps (Air Source, Ground Source) Boilers (Condensing, Non-condensing) Furnaces (Gas, Electric, Oil) Unit Heaters (Electric, Gas-fired, Oil-fired) Radiators & Baseboard Heaters Solar Water Heating Systems Other Heating Equipment |

| By End-User Industry | Residential Commercial (Retail, Offices, Hospitality) Industrial (Oil & Gas, Petrochemical, Manufacturing) Public & Institutional (Government, Healthcare, Education) |

| By Region | Muscat & Batinah Dhofar (Including Salalah) Dhahirah & Al Buraimi Dakhiliyah, Sharqiyah & Other Governorates |

| By Technology | Conventional Heating Systems High-Efficiency / Condensing Systems Smart & Connected Heating Solutions Renewable & Hybrid Heating Technologies |

| By Application | Space Heating Domestic Hot Water Process Heating District and Central Plant Heating |

| By Fuel / Energy Source | Electricity Natural Gas & LPG Oil & Diesel Solar & Other Renewables |

| By Ownership / Procurement Model | Direct Purchase (Capex) Leasing & Rental Models Energy Service Company (ESCO) / Performance Contracting Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heating Equipment Users | 120 | Homeowners, Property Managers |

| Commercial Heating Solutions | 90 | Facility Managers, Business Owners |

| Heating Equipment Distributors | 60 | Sales Managers, Distribution Executives |

| Installation and Maintenance Service Providers | 60 | Technicians, Service Managers |

| Government and Regulatory Bodies | 40 | Policy Makers, Energy Efficiency Experts |

The Oman Heating Equipment Market is valued at approximately USD 250 million, reflecting a five-year historical analysis. This growth is attributed to urbanization, rising disposable incomes, and a focus on energy-efficient heating solutions.