Region:Europe

Author(s):Shubham

Product Code:KRAA1789

Pages:93

Published On:August 2025

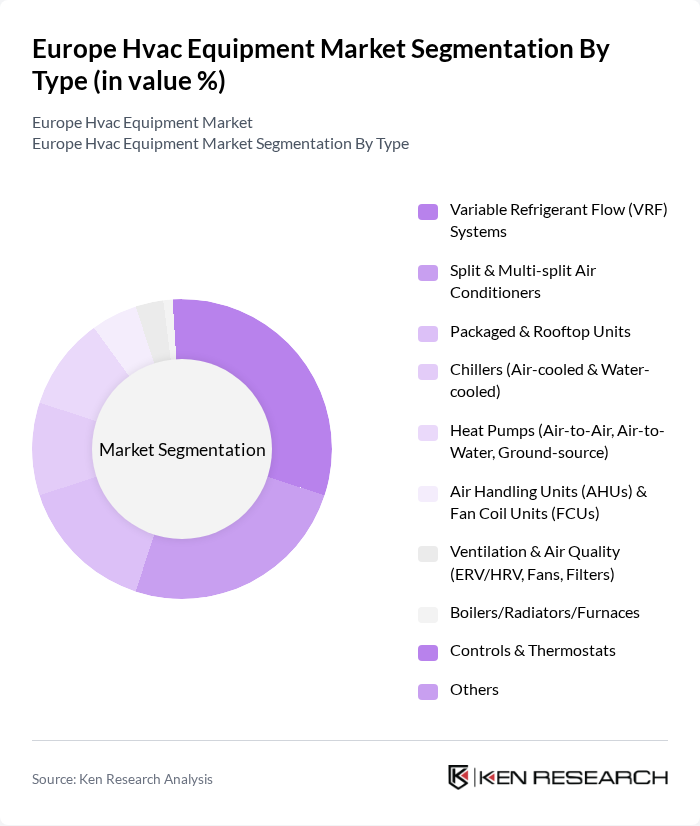

By Type:The HVAC equipment market can be segmented into various types, including Variable Refrigerant Flow (VRF) Systems, Split & Multi-split Air Conditioners, Packaged & Rooftop Units, Chillers (Air-cooled & Water-cooled), Heat Pumps (Air-to-Air, Air-to-Water, Ground-source), Air Handling Units (AHUs) & Fan Coil Units (FCUs), Ventilation & Air Quality (ERV/HRV, Fans, Filters), Boilers/Radiators/Furnaces, Controls & Thermostats, and Others. Among these, VRF systems are gaining traction due to their energy efficiency and flexibility in installation, making them a preferred choice for both residential and commercial applications.

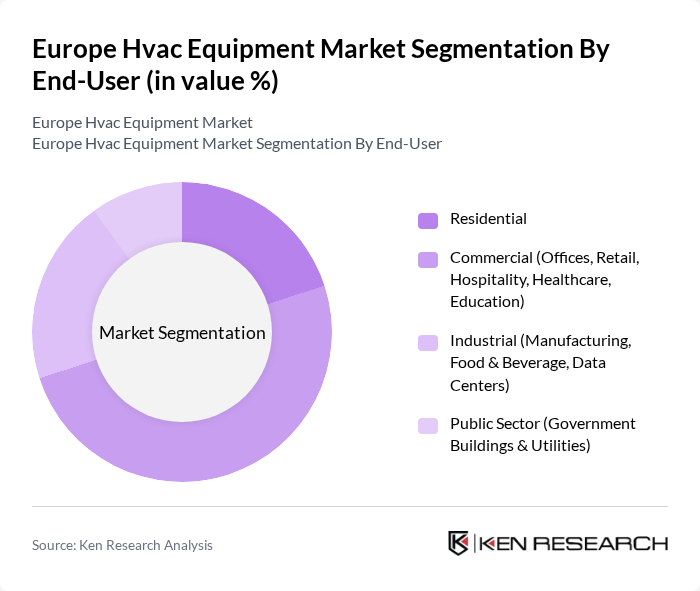

By End-User:The HVAC equipment market is segmented by end-user into Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial (Manufacturing, Food & Beverage, Data Centers), and Public Sector (Government Buildings & Utilities). The commercial sector is currently the largest end-user, driven by the increasing demand for energy-efficient solutions in office buildings and retail spaces, as well as the growing focus on indoor air quality.

The Europe HVAC Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Industries, Ltd., Trane Technologies plc, Carrier Global Corporation, Johnson Controls International plc, Mitsubishi Electric Corporation, Bosch Thermotechnology (Robert Bosch GmbH), Vaillant Group, Viessmann Climate Solutions SE, STULZ GmbH, Bitzer SE, Aermec S.p.A., FläktGroup, Panasonic Corporation, Fujitsu General Limited, Gree Electric Appliances, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HVAC equipment market in Europe appears promising, driven by ongoing technological advancements and a strong regulatory framework. As the demand for energy-efficient and smart systems continues to rise, manufacturers are likely to invest heavily in R&D to innovate and meet evolving consumer needs. Additionally, the integration of renewable energy sources into HVAC systems is expected to gain traction, further enhancing system efficiency and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Variable Refrigerant Flow (VRF) Systems Split & Multi?split Air Conditioners Packaged & Rooftop Units Chillers (Air?cooled & Water?cooled) Heat Pumps (Air?to?Air, Air?to?Water, Ground?source) Air Handling Units (AHUs) & Fan Coil Units (FCUs) Ventilation & Air Quality (ERV/HRV, Fans, Filters) Boilers/Radiators/Furnaces Controls & Thermostats Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial (Manufacturing, Food & Beverage, Data Centers) Public Sector (Government Buildings & Utilities) |

| By Application | Heating Cooling Ventilation & Air Quality Process Refrigeration |

| By Distribution Channel | Direct Sales (Project/Key Accounts) Distributors/Wholesalers Online (Manufacturer & Third?party Platforms) Retail/Installer Networks |

| By Region | Western Europe (Germany, France, U.K., Benelux) Northern Europe (Nordics, Baltics) Southern Europe (Italy, Spain, Portugal, Greece) Eastern Europe (Poland, Czechia, Hungary, Others) |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Conventional Systems (On/Off, Fixed?speed) Smart/Connected Systems (IoT, Remote Monitoring) Inverter/High?Efficiency Systems Low?GWP Refrigerant Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial HVAC Systems | 120 | Facility Managers, Building Owners |

| Residential HVAC Installations | 110 | Homeowners, HVAC Contractors |

| Industrial HVAC Solutions | 80 | Operations Managers, Plant Engineers |

| Energy Efficiency Upgrades | 70 | Energy Auditors, Sustainability Consultants |

| Smart HVAC Technologies | 90 | IT Managers, Technology Officers |

The Europe HVAC Equipment Market is valued at approximately USD 30 billion, reflecting a significant growth trend driven by the demand for energy-efficient heating and cooling solutions, as well as regulatory measures aimed at reducing carbon emissions.