Region:North America

Author(s):Shubham

Product Code:KRAC0864

Pages:87

Published On:August 2025

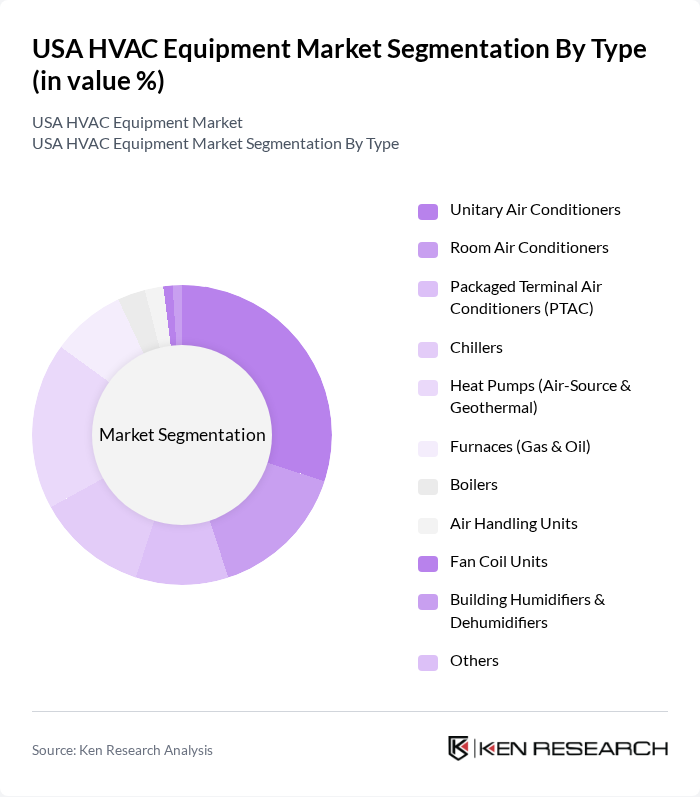

By Type:The HVAC equipment market is segmented into unitary air conditioners, room air conditioners, packaged terminal air conditioners (PTAC), chillers, heat pumps (air-source & geothermal), furnaces (gas & oil), boilers, air handling units, fan coil units, building humidifiers & dehumidifiers, and others. Unitary air conditioners and heat pumps are particularly prominent, reflecting their versatility, high efficiency, and suitability for both residential and commercial applications. Recent trends highlight growing adoption of inverter-driven systems, smart zoning controls, and integrated building automation solutions, especially in new construction and retrofit projects .

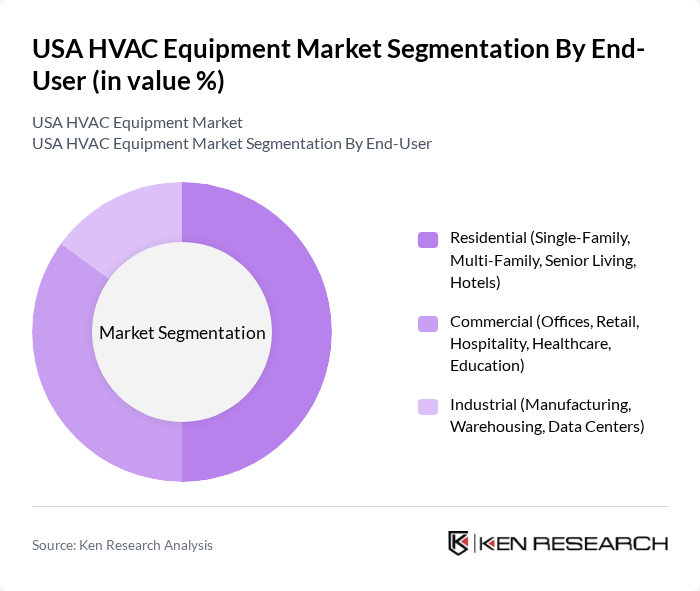

By End-User:The HVAC equipment market is segmented by end-user into residential, commercial, and industrial categories. The residential segment, encompassing single-family homes, multi-family units, senior living facilities, and hotels, is the largest, fueled by home renovations, energy-efficient upgrades, and smart home integrations. The commercial segment is driven by demand for climate control in offices, retail spaces, hospitality, healthcare, and education facilities, with compliance to green building standards and air quality regulations increasingly influencing purchasing decisions .

The USA HVAC Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Trane Technologies plc, Lennox International Inc., Rheem Manufacturing Company, Goodman Manufacturing Company, L.P., Daikin North America LLC, York International Corporation (Johnson Controls), Mitsubishi Electric Trane HVAC US LLC, Bosch Thermotechnology Corp., Fujitsu General America, Inc., Nortek Global HVAC LLC, Johnson Controls International plc, American Standard Heating & Air Conditioning (Trane Technologies), LG Electronics USA, Inc., Panasonic Corporation of North America contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA HVAC equipment market appears promising, driven by technological innovations and a growing emphasis on sustainability. As smart home technologies gain traction, the integration of IoT-enabled HVAC systems is expected to enhance user experience and energy management. Additionally, the increasing focus on indoor air quality will drive demand for advanced filtration and ventilation systems. These trends, coupled with government incentives for energy-efficient solutions, will likely create a favorable environment for market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Unitary Air Conditioners Room Air Conditioners Packaged Terminal Air Conditioners (PTAC) Chillers Heat Pumps (Air-Source & Geothermal) Furnaces (Gas & Oil) Boilers Air Handling Units Fan Coil Units Building Humidifiers & Dehumidifiers Others |

| By End-User | Residential (Single-Family, Multi-Family, Senior Living, Hotels) Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial (Manufacturing, Warehousing, Data Centers) |

| By Application | New Construction Retrofit and Replacement Maintenance and Repair |

| By Sales Channel | Direct Sales Distributors/Dealers Online Sales/E-commerce |

| By Region | West South Midwest Northeast |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Rebates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential HVAC Systems | 100 | Homeowners, HVAC Installers |

| Commercial HVAC Solutions | 80 | Facility Managers, Building Owners |

| Industrial HVAC Equipment | 60 | Plant Managers, Operations Directors |

| Energy-Efficient HVAC Technologies | 50 | Energy Auditors, Sustainability Consultants |

| HVAC Maintenance and Services | 60 | Service Technicians, Maintenance Supervisors |

The USA HVAC Equipment Market is valued at approximately USD 45 billion, reflecting a robust growth trajectory driven by increasing demand for energy-efficient solutions, smart home technologies, and significant investments in building automation systems.