Region:Europe

Author(s):Geetanshi

Product Code:KRAA1958

Pages:90

Published On:August 2025

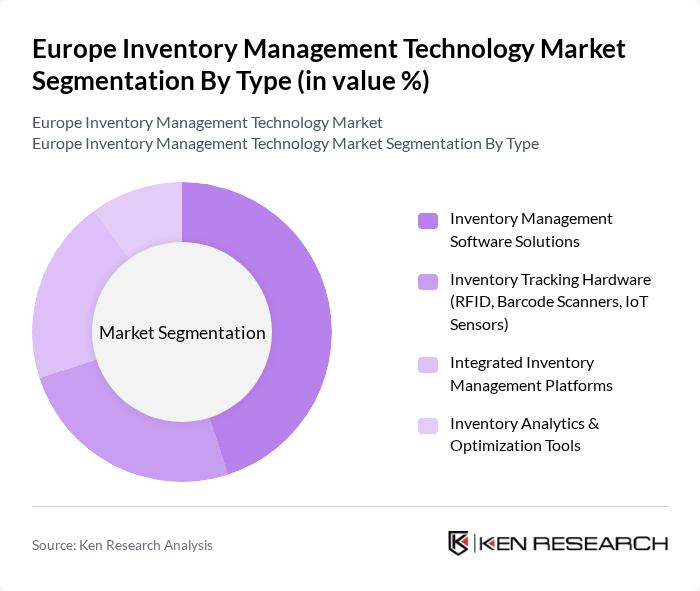

By Type:The market is segmented into Inventory Management Software Solutions, Inventory Tracking Hardware (RFID, Barcode Scanners, IoT Sensors), Integrated Inventory Management Platforms, and Inventory Analytics & Optimization Tools. Inventory Management Software Solutions is the leading sub-segment, driven by the increasing demand for automation, cloud-based platforms, and real-time data analytics in inventory management. Businesses are leveraging software solutions to streamline operations, reduce costs, and enhance decision-making capabilities, with a notable shift toward integrated platforms that offer end-to-end visibility and advanced analytics .

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics, Warehousing & Transportation, Food & Beverage, Automotive, Electronics & Electricals, and Others. The Retail & E-commerce sector remains the dominant segment, fueled by the rapid growth of online shopping, omnichannel retail strategies, and the need for efficient inventory management to meet dynamic consumer demands. Manufacturing and healthcare sectors are also significant adopters, focusing on inventory accuracy, regulatory compliance, and supply chain resilience .

The Europe Inventory Management Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Infor, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Zebra Technologies Corporation, NetSuite Inc. (Oracle NetSuite), Epicor Software Corporation, Microsoft Corporation (Dynamics 365 Supply Chain Management), Zoho Corporation, Brightpearl (a Sage Group company), Unleashed Software, Cin7, SkuVault, Fishbowl Inventory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European inventory management technology market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize efficiency and sustainability, the integration of automated solutions and AI will likely dominate the landscape. Additionally, the growing emphasis on real-time data analytics will enhance decision-making processes, enabling companies to respond swiftly to market changes. This dynamic environment will foster innovation and collaboration among industry players, paving the way for a more resilient supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Solutions Inventory Tracking Hardware (RFID, Barcode Scanners, IoT Sensors) Integrated Inventory Management Platforms Inventory Analytics & Optimization Tools |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics, Warehousing & Transportation Food & Beverage Automotive Electronics & Electricals Others |

| By Component | Software (Standalone & Suite) Hardware (RFID, Barcode, IoT Devices) Services (Implementation, Consulting, Support) |

| By Sales Channel | Direct Sales Distributors & Value-Added Resellers Online Sales Platforms |

| By Deployment Mode | Cloud-Based On-Premises |

| By Country | Germany United Kingdom France Italy Spain Russia Rest of Europe |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Supply Chain Managers, Inventory Analysts |

| Manufacturing Process Optimization | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 70 | Logistics Coordinators, eCommerce Directors |

| Warehouse Automation Technologies | 60 | Warehouse Managers, IT Systems Analysts |

| Supply Chain Sustainability Initiatives | 40 | Sustainability Officers, Compliance Managers |

The Europe Inventory Management Technology Market is valued at approximately USD 600 million, reflecting a five-year historical analysis of revenues from inventory management solutions and software in the region.