Region:Asia

Author(s):Shubham

Product Code:KRAA0886

Pages:82

Published On:August 2025

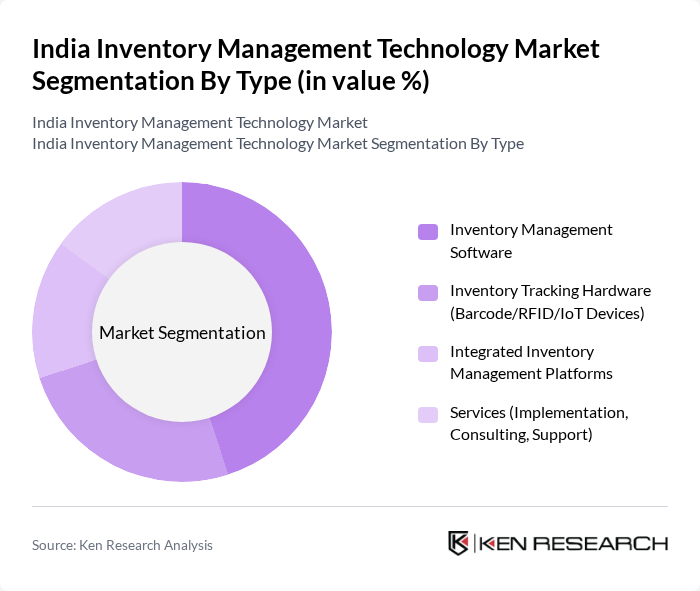

By Type:The market is segmented into Inventory Management Software, Inventory Tracking Hardware (Barcode/RFID/IoT Devices), Integrated Inventory Management Platforms, and Services (Implementation, Consulting, Support). Inventory Management Software is the leading sub-segment, driven by the increasing need for automation, real-time data analytics, and integration with other business systems. Businesses are increasingly adopting software solutions to streamline operations, reduce costs, and improve accuracy in inventory management. The adoption of AI and machine learning in software is further enhancing demand for this segment .

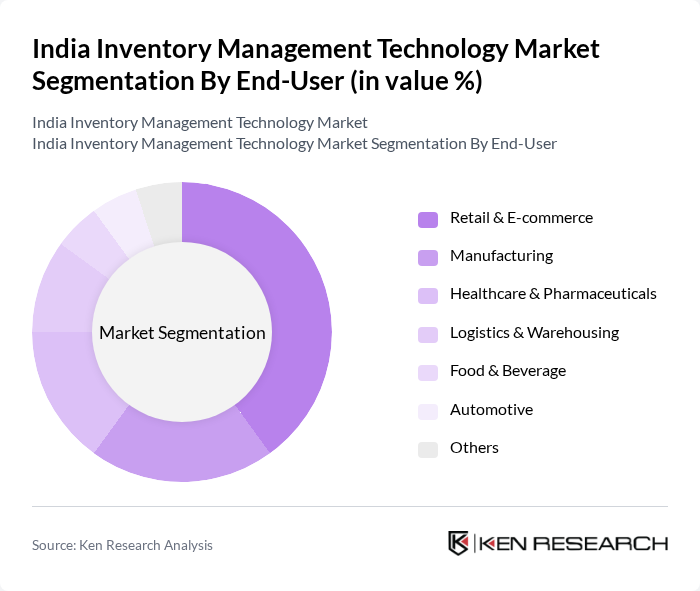

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics & Warehousing, Food & Beverage, Automotive, and Others. The Retail & E-commerce sector is the dominant segment, as the rapid growth of online shopping and omnichannel retailing has necessitated efficient inventory management solutions to meet consumer demand. Companies are increasingly investing in technology to optimize their inventory processes, improve fulfillment speed, and enhance customer satisfaction .

The India Inventory Management Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP India, Oracle India, Zoho Corporation, Tally Solutions, Infor India, Unicommerce eSolutions, Vinculum Group, IBM India, Microsoft India, Marg ERP, Ginesys, Busy Accounting Software, QuickBooks India (Intuit), Browntape Technologies, Eazy ERP contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India inventory management technology market appears promising, driven by technological advancements and increasing digital adoption. As businesses prioritize efficiency, the integration of AI and machine learning will enhance predictive analytics capabilities, enabling better inventory forecasting. Additionally, the rise of mobile inventory management solutions will empower businesses to manage stock on-the-go, further streamlining operations. These trends indicate a shift towards more agile and responsive inventory management practices, essential for meeting evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Inventory Tracking Hardware (Barcode/RFID/IoT Devices) Integrated Inventory Management Platforms Services (Implementation, Consulting, Support) |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics & Warehousing Food & Beverage Automotive Others |

| By Region | North India South India East India West India |

| By Application | Warehouse Management Order & Fulfillment Management Inventory Optimization & Forecasting Asset Tracking Others |

| By Sales Channel | Direct Sales Online Sales Channel Partners/Distributors Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Price Range | Entry-Level/Budget Solutions Mid-Range Solutions Premium/Enterprise Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Store Operations Heads |

| Manufacturing Supply Chain Optimization | 80 | Supply Chain Managers, Production Supervisors |

| E-commerce Inventory Solutions | 90 | eCommerce Operations Managers, Logistics Coordinators |

| Technology Adoption in SMEs | 50 | Business Owners, IT Managers |

| Warehouse Management Systems | 60 | Warehouse Managers, Logistics Directors |

The India Inventory Management Technology Market is valued at approximately USD 2.2 billion, driven by the adoption of advanced technologies like AI and IoT, which enhance operational efficiency and accuracy in inventory management.