Region:Europe

Author(s):Dev

Product Code:KRAC0519

Pages:86

Published On:August 2025

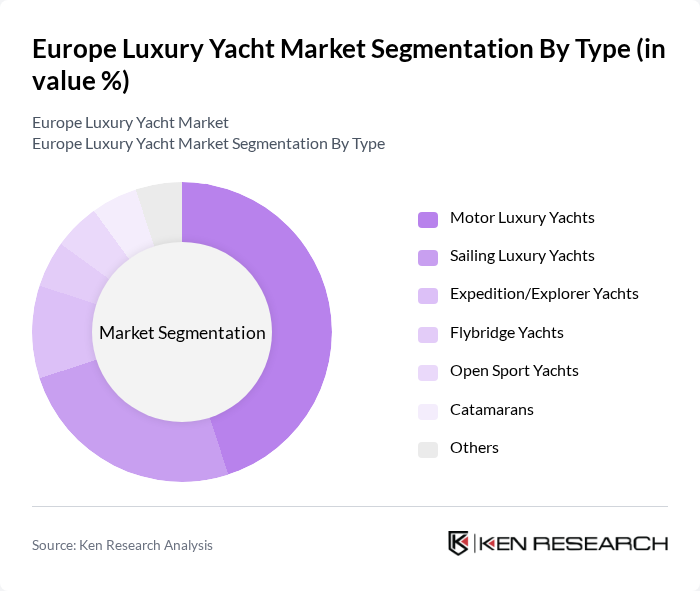

By Type:The luxury yacht market is segmented into various types, including motor luxury yachts, sailing luxury yachts, expedition/explorer yachts, flybridge yachts, open sport yachts, catamarans, and others. Among these, motor luxury yachts are particularly popular and hold the majority share, supported by preferences for speed, comfort, and advanced onboard technology. Sailing luxury yachts retain a significant share among enthusiasts seeking a traditional sailing experience and lower operational fuel use. Demand for expedition/explorer yachts is growing, reflecting interest in longer-range cruising and adventure itineraries to remote destinations, supported by yards introducing ice-class and hybrid-capable explorer platforms.

By End-User:The end-user segmentation includes ultra-high-net-worth individuals (UHNWIs), charter companies, corporate clients, and government/state entities. Ultra-high-net-worth individuals represent the largest segment, reflecting direct private ownership and custom/semi-custom orders. Charter companies are significant purchasers and operators, meeting demand from clients who prefer renting for vacations or events, and increasingly offering experiential itineraries. Corporate clients and government/state entities contribute through procurement and event hosting, including protocol and hospitality use.

The Europe Luxury Yacht Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ferretti Group (Ferretti Yachts, Riva, Pershing, CRN, Custom Line, Wally), Sunseeker International Ltd., Azimut|Benetti Group, Lürssen Werft, Princess Yachts, Heesen Yachts, Feadship (Royal De Vries, Royal Van Lent), Sanlorenzo S.p.A., Oceanco, Baglietto S.p.A., Sunreef Yachts, Bénéteau Group (Beneteau, Jeanneau, Monte Carlo Yachts), Bavaria Yachtbau GmbH, Fairline Yachts, Gulf Craft (Majesty Yachts), Damen Yachting (Amels, SeaXplorer), Royal Huisman, Cantiere delle Marche (CdM), Fincantieri Yachts, Rossinavi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury yacht market in Europe appears promising, driven by a growing emphasis on sustainability and technological innovation. As consumers increasingly prioritize eco-friendly options, manufacturers are likely to invest in green technologies, enhancing yacht efficiency and reducing environmental impact. Additionally, the integration of smart technologies will redefine luxury experiences, making yachts more appealing to tech-savvy buyers. This evolving landscape suggests a dynamic market poised for growth, adapting to changing consumer preferences and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Luxury Yachts Sailing Luxury Yachts Expedition/Explorer Yachts Flybridge Yachts Open Sport Yachts Catamarans Others |

| By End-User | Ultra-High-Net-Worth Individuals (UHNWIs) Charter Companies Corporate Clients Government/State Entities |

| By Sales Channel | Direct Sales (Shipyards) Yacht Brokers/Dealers Online Platforms/Marketplaces Auctions |

| By Price Range | Below €1 Million €1 Million - €5 Million €5 Million - €10 Million Above €10 Million |

| By Region | Western Europe Southern Europe Northern Europe Eastern Europe |

| By Usage Type | Private Commercial/Charter Research and Exploration |

| By Customization Level | Standard/Series Models Semi-Custom Yachts Fully Custom Yachts |

| By Size | Up to 20 Meters (65 ft) to 50 Meters (65–164 ft) Above 50 Meters (165+ ft) |

| By Hull/Build Material | FRP/Composites Metal/Alloys (Aluminum, Steel) Carbon Fiber Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Yacht Owners | 120 | Private Yacht Owners, High-Net-Worth Individuals |

| Yacht Manufacturers | 100 | Production Managers, Sales Directors |

| Charter Companies | 80 | Operations Managers, Marketing Heads |

| Marina Operators | 60 | Marina Managers, Business Development Executives |

| Luxury Yacht Brokers | 90 | Sales Agents, Market Analysts |

The Europe Luxury Yacht Market is valued at approximately EUR 5.5 billion, driven by increasing disposable incomes, a trend in luxury travel, and the popularity of yacht charters and fractional ownership models.