Region:Europe

Author(s):Rebecca

Product Code:KRAA1397

Pages:99

Published On:August 2025

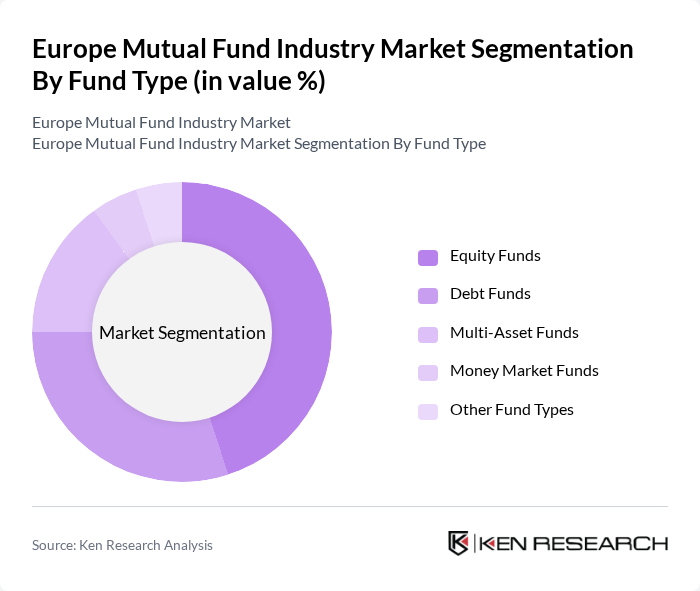

By Fund Type:The mutual fund market is segmented into various fund types, including Equity Funds, Debt Funds, Multi-Asset Funds, Money Market Funds, and Other Fund Types. Among these, Equity Funds are particularly dominant due to their potential for higher returns, attracting a significant portion of retail and institutional investors. Debt Funds also hold a substantial share, appealing to risk-averse investors seeking stable income. The diversification offered by Multi-Asset Funds is increasingly popular, while Money Market Funds provide liquidity and safety, especially in uncertain economic times .

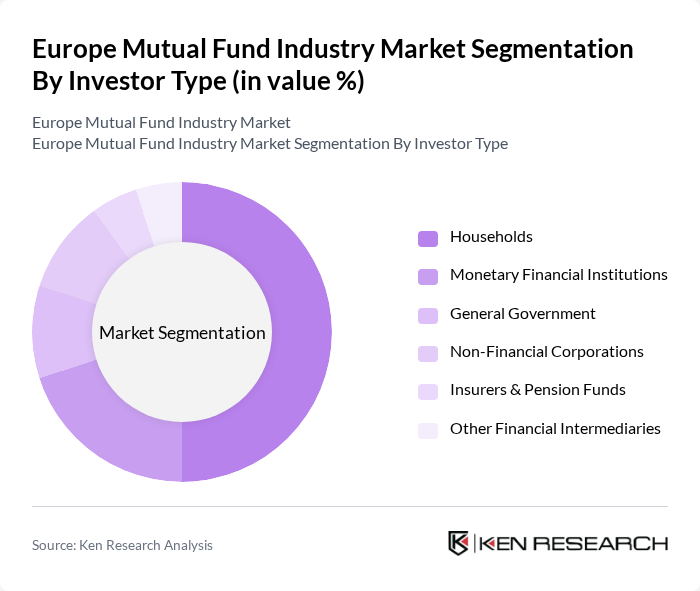

By Investor Type:The investor type segmentation includes Households, Monetary Financial Institutions, General Government, Non-Financial Corporations, Insurers & Pension Funds, and Other Financial Intermediaries. Households represent the largest segment, driven by the increasing trend of individual retirement savings and investment in mutual funds. Monetary Financial Institutions and Insurers & Pension Funds also play significant roles, as they allocate substantial assets into mutual funds for diversification and risk management. The growing awareness among Non-Financial Corporations about the benefits of mutual funds is also contributing to this segment's growth .

The Europe Mutual Fund Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as BlackRock, Inc., Amundi Asset Management, Vanguard Group, Inc., State Street Global Advisors, J.P. Morgan Asset Management, UBS Asset Management, DWS Group GmbH & Co. KGaA, Schroders plc, BNP Paribas Asset Management, AXA Investment Managers, Legal & General Investment Management, Invesco Ltd., Franklin Templeton Investments, T. Rowe Price Group, Inc., and Nordea Asset Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European mutual fund industry appears promising, driven by increasing investor engagement and technological innovations. As more investors seek personalized investment solutions, fund managers are likely to enhance their offerings through digital platforms and tailored products. Additionally, the growing emphasis on sustainable investing will further shape the market, with ESG funds expected to capture a larger share of total assets. Overall, the industry is poised for continued evolution and adaptation to meet changing investor demands.

| Segment | Sub-Segments |

|---|---|

| By Fund Type | Equity Funds Debt Funds Multi-Asset Funds Money Market Funds Other Fund Types |

| By Investor Type | Households Monetary Financial Institutions General Government Non-Financial Corporations Insurers & Pension Funds Other Financial Intermediaries |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation |

| By Fund Size | Small Cap Funds Mid Cap Funds Large Cap Funds |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms |

| By Geography | Luxembourg Ireland Germany France United Kingdom Netherlands Italy Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 100 | Individual Investors, Financial Advisors |

| Institutional Investor Perspectives | 70 | Pension Fund Managers, Insurance Company Analysts |

| Fund Manager Interviews | 50 | Portfolio Managers, Investment Analysts |

| Regulatory Impact Assessment | 40 | Compliance Officers, Regulatory Affairs Specialists |

| Market Trend Analysis | 60 | Market Researchers, Economic Analysts |

The Europe Mutual Fund Industry Market is valued at approximately USD 34 trillion, reflecting a significant growth driven by increasing investor interest, retirement savings trends, and the expansion of digital investment platforms.