Region:Asia

Author(s):Dev

Product Code:KRAB0660

Pages:88

Published On:August 2025

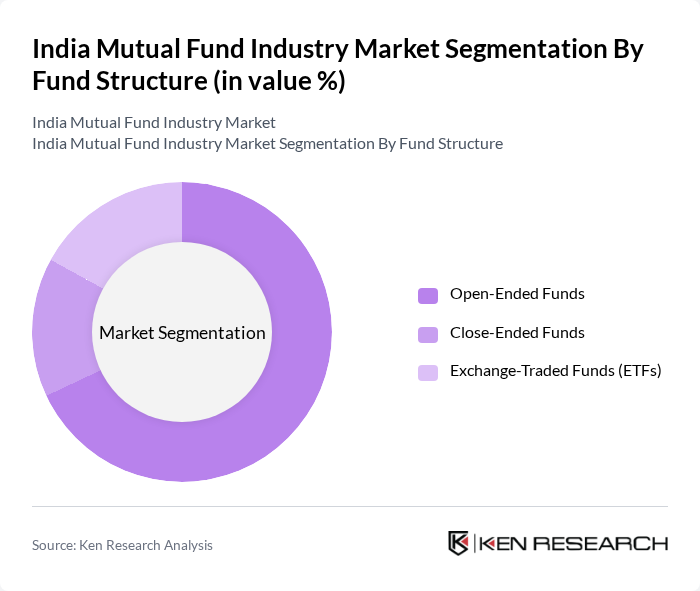

By Fund Structure:The fund structure segmentation includes Open-Ended Funds, Close-Ended Funds, and Exchange-Traded Funds (ETFs). Open-Ended Funds dominate the market due to their flexibility and liquidity, allowing investors to buy and sell units at any time. Close-Ended Funds, while less popular, attract investors looking for a fixed investment period. ETFs have gained significant traction in recent years due to their low expense ratios, transparency, and ease of trading on stock exchanges, with the passive investment segment now accounting for a notable share of industry assets.

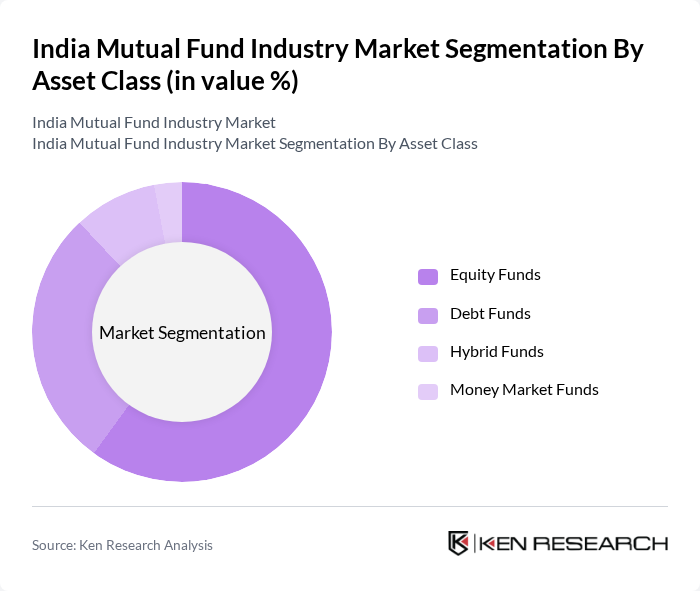

By Asset Class:The asset class segmentation comprises Equity Funds, Debt Funds, Hybrid Funds, and Money Market Funds. Equity Funds lead the market, driven by a growing appetite for equity investments among retail investors seeking higher returns. Debt Funds are favored for their stability and lower risk, while Hybrid Funds attract those looking for a balanced approach. Money Market Funds serve as a safe haven for conservative investors seeking liquidity. The equity-oriented segment constitutes the largest share of total AUM, reflecting strong investor confidence in long-term capital appreciation.

The India Mutual Fund Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as HDFC Asset Management Company Ltd., ICICI Prudential Asset Management Company Ltd., SBI Funds Management Ltd. (SBI Mutual Fund), Aditya Birla Sun Life AMC Ltd., UTI Asset Management Company Ltd., Kotak Mahindra Asset Management Company Ltd., Axis Asset Management Company Ltd. (Axis Mutual Fund), Franklin Templeton Asset Management (India) Pvt. Ltd., Nippon Life India Asset Management Ltd. (Nippon India Mutual Fund), DSP Asset Managers Pvt. Ltd. (DSP Mutual Fund), L&T Investment Management Ltd. (L&T Mutual Fund), Bandhan Mutual Fund (formerly IDFC Mutual Fund), Invesco Asset Management (India) Pvt. Ltd. (Invesco Mutual Fund), Mirae Asset Investment Managers (India) Pvt. Ltd. (Mirae Asset Mutual Fund), Sundaram Asset Management Company Ltd. (Sundaram Mutual Fund) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India mutual fund industry appears promising, driven by increasing retail participation and a growing emphasis on financial literacy. As more individuals become aware of the benefits of mutual funds, the industry is likely to see sustained inflows. Additionally, technological advancements will facilitate easier access to investment platforms, enhancing user experience. The trend towards sustainable investing and the rise of ESG funds will further shape the market, attracting environmentally conscious investors and diversifying the product offerings available to consumers.

| Segment | Sub-Segments |

|---|---|

| By Fund Structure | Open-Ended Funds Close-Ended Funds Exchange-Traded Funds (ETFs) |

| By Asset Class | Equity Funds Debt Funds Hybrid Funds Money Market Funds |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Specialized Investment Funds (e.g., sectoral, thematic, long-short) |

| By Investor Type | Retail Investors Institutional Investors Corporates Non-Resident Indians (NRIs) |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms Banks and Financial Institutions |

| By Fund Size | Small-Cap Funds Mid-Cap Funds Large-Cap Funds |

| By Policy Support | Tax Benefits Regulatory Support Investor Education Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 120 | Individual Investors, Financial Planners |

| Institutional Investment Strategies | 60 | Institutional Fund Managers, Pension Fund Administrators |

| Mutual Fund Distribution Channels | 50 | Wealth Managers, Distributors, Brokers |

| Regulatory Impact Assessment | 40 | Compliance Officers, Regulatory Analysts |

| Market Trends and Sentiment | 45 | Market Analysts, Economic Researchers |

The India Mutual Fund Industry Market is valued at approximately INR 72 trillion, reflecting significant growth driven by increased retail participation, systematic investment plans (SIPs), and digital distribution through fintech platforms.