Region:Europe

Author(s):Shubham

Product Code:KRAA1827

Pages:99

Published On:August 2025

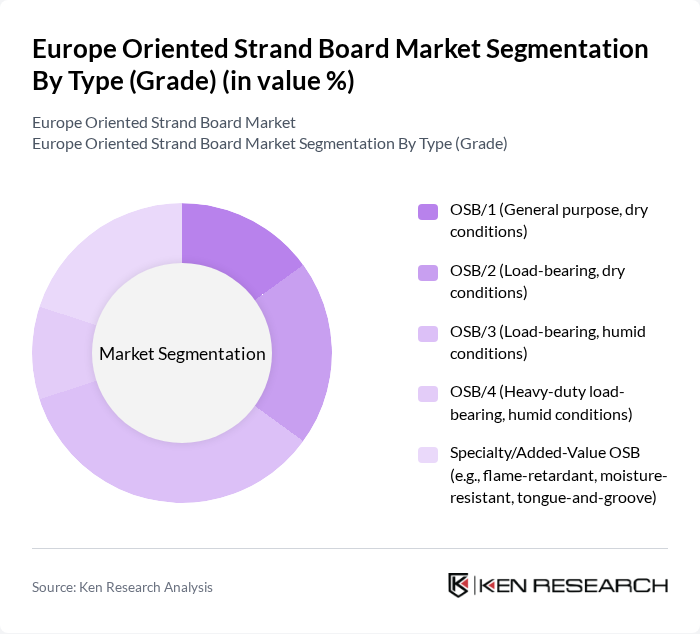

By Type (Grade):The market is segmented into various grades of oriented strand boards, each catering to different applications and performance requirements. The subsegments include OSB/1 (General purpose, dry conditions), OSB/2 (Load-bearing, dry conditions), OSB/3 (Load-bearing, humid conditions), OSB/4 (Heavy-duty load-bearing, humid conditions), and Specialty/Added-Value OSB (e.g., flame-retardant, moisture-resistant, tongue-and-groove). Among these, OSB/3 is the leading subsegment due to its versatility and suitability for a wide range of applications, including structural and non-structural uses.

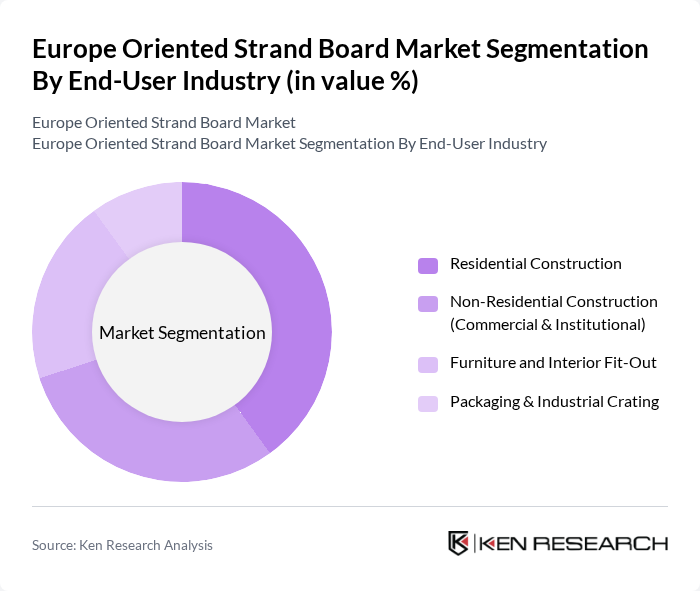

By End-User Industry:The Europe Oriented Strand Board Market is segmented by end-user industries, including Residential Construction, Non-Residential Construction (Commercial & Institutional), Furniture and Interior Fit-Out, and Packaging & Industrial Crating. The Residential Construction segment is the largest, driven by the increasing demand for affordable housing and the trend towards sustainable building practices. This segment's growth is supported by the rising popularity of OSB in home construction due to its cost-effectiveness and environmental benefits.

The Europe Oriented Strand Board Market is characterized by a dynamic mix of regional and international players. Leading participants such as EGGER Group, Kronospan, West Fraser (Europe), Swiss Krono Group, SMARTPLY Europe (Coillte), Sonae Arauco, FINSA (Forestal del Atlántico, S.A.), Pfleiderer Group, UPM-Kymmene Corporation, Metsä Wood (Metsä Group), Kronospan OSB UK Ltd. (Jasien, Bjelovar, Riga – regional units), Arbec Forest Products Europe, Builder Merchant Partners (e.g., Saint-Gobain Building Distribution, Travis Perkins plc), Louisiana-Pacific Corporation (LP Building Solutions – European presence), ARAUCO Europe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the OSB market in Europe appears promising, driven by a strong emphasis on sustainability and innovation. As the construction sector increasingly adopts eco-friendly practices, OSB is well-positioned to benefit from this trend. Additionally, advancements in manufacturing technologies will likely enhance product quality and reduce costs, making OSB more competitive. The market is expected to see a rise in demand for customized solutions, catering to specific construction needs, further solidifying OSB's role in the evolving building landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (Grade) | OSB/1 (General purpose, dry conditions) OSB/2 (Load-bearing, dry conditions) OSB/3 (Load-bearing, humid conditions) OSB/4 (Heavy-duty load-bearing, humid conditions) Specialty/Added-Value OSB (e.g., flame-retardant, moisture-resistant, tongue-and-groove) |

| By End-User Industry | Residential Construction Non-Residential Construction (Commercial & Institutional) Furniture and Interior Fit-Out Packaging & Industrial Crating |

| By Application | Flooring & Subfloor Wall Sheathing Roof Decking Structural Elements (e.g., beams, rim boards) Furniture Components & Shopfitting |

| By Distribution Channel | Direct Sales (Mill-to-Project/Key Accounts) Distributors & Builders’ Merchants Online & E-Procurement Portals |

| By Country | Germany United Kingdom France Italy Rest of Europe |

| By Price Band (Average Selling Price) | Economy Mid Premium |

| By Certification | CE Marking (EN 13986, EN 300) FSC Certification PEFC Certification Low-Emission/Indoor Air Labels (e.g., E1, CARB Phase 2 equivalent) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 140 | Architects, General Contractors |

| Commercial Building Applications | 100 | Project Managers, Developers |

| OSB Distribution Channels | 80 | Distributors, Retail Managers |

| Environmental Impact Assessments | 70 | Sustainability Consultants, Regulatory Officers |

| End-user Feedback on OSB Products | 90 | Builders, DIY Enthusiasts |

The Europe Oriented Strand Board Market is valued at approximately USD 7.5 billion, driven by increasing demand for sustainable building materials and a rise in construction activities across the region.