Region:Europe

Author(s):Rebecca

Product Code:KRAC0281

Pages:93

Published On:August 2025

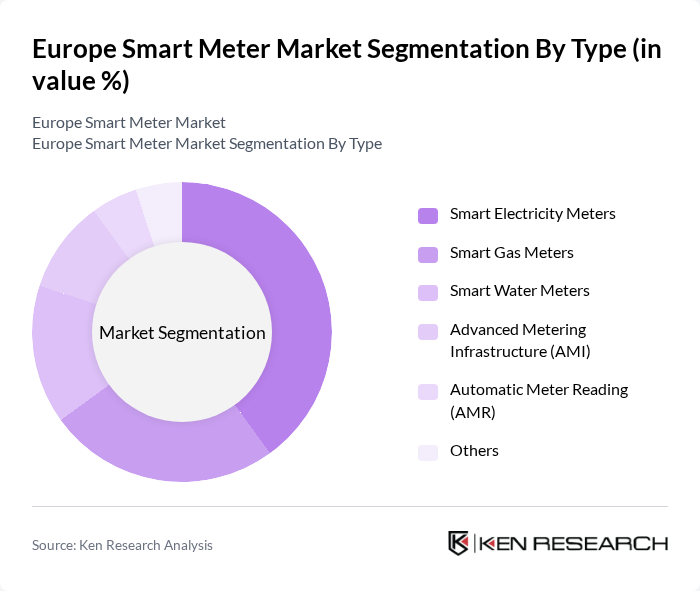

By Type:The market is segmented into various types, includingSmart Electricity Meters, Smart Gas Meters, Smart Water Meters, Advanced Metering Infrastructure (AMI), Automatic Meter Reading (AMR),andOthers. Each of these sub-segments plays a crucial role in the overall market dynamics .

TheSmart Electricity Meterssegment is the leading sub-segment in the market, driven by the increasing demand for energy management solutions and the need for real-time data analytics. Consumers are becoming more aware of their energy consumption patterns, prompting utilities to invest in smart electricity meters that provide detailed usage information. This trend is further supported by government initiatives aimed at enhancing energy efficiency and reducing carbon footprints .

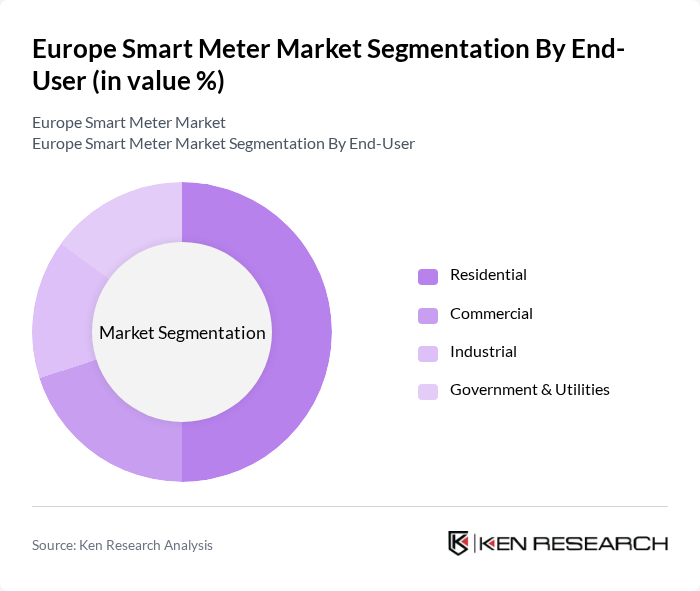

By End-User:The market is segmented intoResidential, Commercial, Industrial,andGovernment & Utilities. Each end-user category has distinct requirements and contributes differently to the overall market growth .

TheResidentialsegment holds the largest market share, driven by the increasing adoption of smart home technologies and the growing awareness of energy conservation among consumers. As households seek to manage their energy consumption more effectively, the demand for smart meters in residential settings continues to rise. This trend is further supported by government incentives aimed at promoting energy efficiency in homes .

The Europe Smart Meter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, Itron, Inc., Landis+Gyr AG, Honeywell International Inc., Sensus (Xylem Inc.), Elster Group GmbH, Kamstrup A/S, Aclara Technologies LLC, Trilliant Holdings Inc., Iskraemeco d.d., Diehl Metering GmbH, EDMI Europe Ltd., Sagemcom SAS, Enel X S.r.l. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smart meter market in Europe appears promising, driven by increasing regulatory support and technological advancements. Integration of smart meters with renewable energy sources is expected to enhance grid stability and efficiency in future. Additionally, the rise of IoT applications in smart metering will facilitate real-time data sharing, improving consumer engagement and energy management. These trends indicate a robust growth trajectory for the smart meter market, fostering a more sustainable energy landscape in Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Electricity Meters Smart Gas Meters Smart Water Meters Advanced Metering Infrastructure (AMI) Automatic Meter Reading (AMR) Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Energy Management Billing and Revenue Management Demand Response Grid Management |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Sales |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Technology | Wireless Communication Technologies Power Line Communication Cellular Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 120 | Energy Managers, Smart Meter Project Leads |

| Smart Meter Manufacturers | 80 | Product Development Managers, Sales Directors |

| Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

| End-User Households | 150 | Homeowners, Renters, Energy Consumers |

| Installation Service Providers | 60 | Operations Managers, Field Technicians |

The Europe Smart Meter Market is valued at approximately USD 6.6 billion, driven by increasing energy efficiency demands, government regulations, and the adoption of renewable energy sources. This market is expected to grow significantly in the coming years.