Region:Europe

Author(s):Shubham

Product Code:KRAB0566

Pages:80

Published On:August 2025

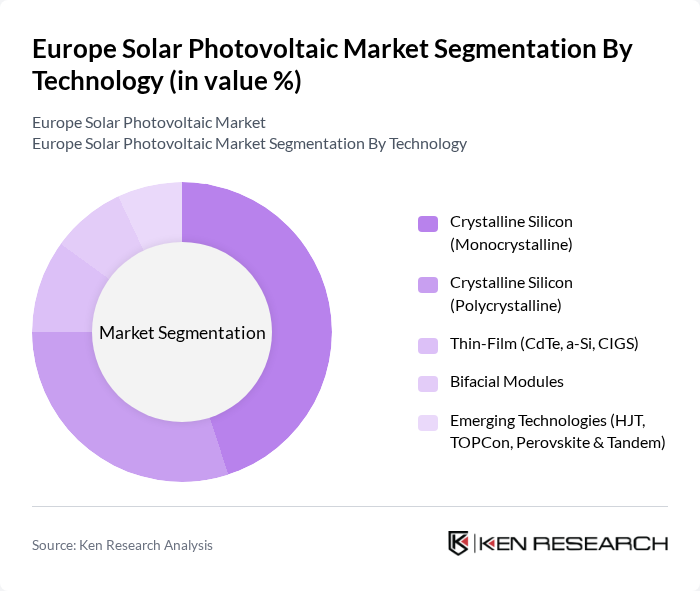

By Technology:The technology segment of the Europe Solar Photovoltaic Market includes various types of solar technologies that cater to different consumer needs and applications. The primary subsegments are Crystalline Silicon (Monocrystalline), Crystalline Silicon (Polycrystalline), Thin-Film (CdTe, a-Si, CIGS), Bifacial Modules, and Emerging Technologies (HJT, TOPCon, Perovskite & Tandem). Each of these technologies has unique characteristics that appeal to different market segments, with Crystalline Silicon technologies being the most widely adopted due to their efficiency and reliability .

The Crystalline Silicon (Monocrystalline) segment leads the market due to its high efficiency and space-saving design, making it ideal for residential and commercial applications. The increasing demand for energy-efficient solutions and the declining costs of production have further propelled its adoption. Additionally, advancements in technology—such as PERC, TOPCon, and HJT transitions—have improved the performance and longevity of monocrystalline panels, solidifying their position as the preferred choice among consumers .

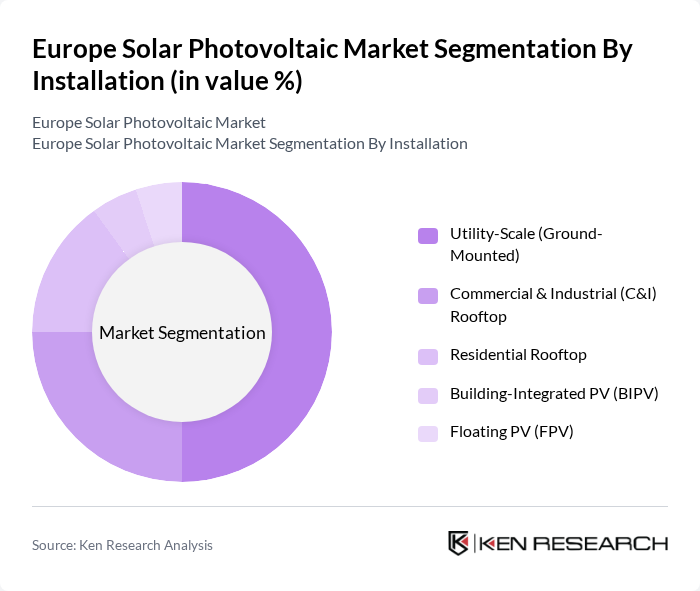

By Installation:The installation segment encompasses various methods of deploying solar photovoltaic systems, including Utility-Scale (Ground-Mounted), Commercial & Industrial (C&I) Rooftop, Residential Rooftop, Building-Integrated PV (BIPV), and Floating PV (FPV). Each installation type serves different market needs, with utility-scale installations being favored for large-scale energy production, while residential and commercial rooftops cater to localized energy consumption .

Utility-Scale (Ground-Mounted) installations dominate the market due to their ability to generate large amounts of electricity efficiently. These installations benefit from economies of scale, making them cost-effective for energy providers. Additionally, strong annual additions across the EU and national tenders for utility-scale capacity have reinforced utility-scale leadership in Europe .

The Europe Solar Photovoltaic Market is characterized by a dynamic mix of regional and international players. Leading participants such as SMA Solar Technology AG, SolarEdge Technologies, Inc., Enphase Energy, Inc., Fronius International GmbH, Huawei Digital Power, Sungrow Power Supply Co., Ltd., LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., Canadian Solar Inc., First Solar, Inc., Meyer Burger Technology AG, Qcells (Hanwha Q CELLS GmbH), REC Group, Risen Energy Co., Ltd., BayWa r.e. AG, Enel Green Power S.p.A., Iberdrola, S.A. (Iberdrola Renovables), Statkraft AS, RWE Renewables GmbH, TotalEnergies SE (TotalEnergies Renewables), ENGIE SA, Vattenfall AB, Lightsource bp, EDPR (EDP Renewables) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar photovoltaic market in Europe appears promising, driven by a combination of technological advancements and increasing environmental regulations. In future, the integration of artificial intelligence and IoT technologies is expected to enhance the efficiency of solar systems, while the rise of community solar projects will democratize access to renewable energy. Furthermore, as energy storage solutions become more affordable, they will complement solar installations, enabling greater energy independence and resilience in the face of fluctuating energy demands.

| Segment | Sub-Segments |

|---|---|

| By Technology | Crystalline Silicon (Monocrystalline) Crystalline Silicon (Polycrystalline) Thin-Film (CdTe, a-Si, CIGS) Bifacial Modules Emerging Technologies (HJT, TOPCon, Perovskite & Tandem) |

| By Installation | Utility-Scale (Ground-Mounted) Commercial & Industrial (C&I) Rooftop Residential Rooftop Building-Integrated PV (BIPV) Floating PV (FPV) |

| By Grid Type | On-Grid (Grid-Connected) Off-Grid and Hybrid Systems |

| By Application | Residential Non-Residential (Commercial & Industrial) Utilities Agrivoltaics and Community Solar |

| By Country | Germany Spain Netherlands Poland Italy France United Kingdom Rest of Europe |

| By Sales & Distribution Channel | Direct EPC/IPP Sales Distributors/Wholesalers Online and Marketplace Channels Retail and Installer Networks |

| By Component | Modules Inverters (String, Central, Micro) Mounting Structures and Trackers Balance of System (Cables, Junction Boxes, Monitoring) Energy Storage (Coupled with PV) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 140 | Homeowners, Solar Installers |

| Commercial Solar Projects | 100 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Farms | 80 | Project Developers, Utility Executives |

| Solar Technology Providers | 70 | Product Managers, R&D Engineers |

| Government and Regulatory Bodies | 50 | Policy Makers, Energy Analysts |

The Europe Solar Photovoltaic Market is valued at approximately USD 65 billion, driven by increasing investments in renewable energy, government incentives, and a focus on energy security following recent energy price shocks.