Region:Asia

Author(s):Geetanshi

Product Code:KRAB0138

Pages:92

Published On:August 2025

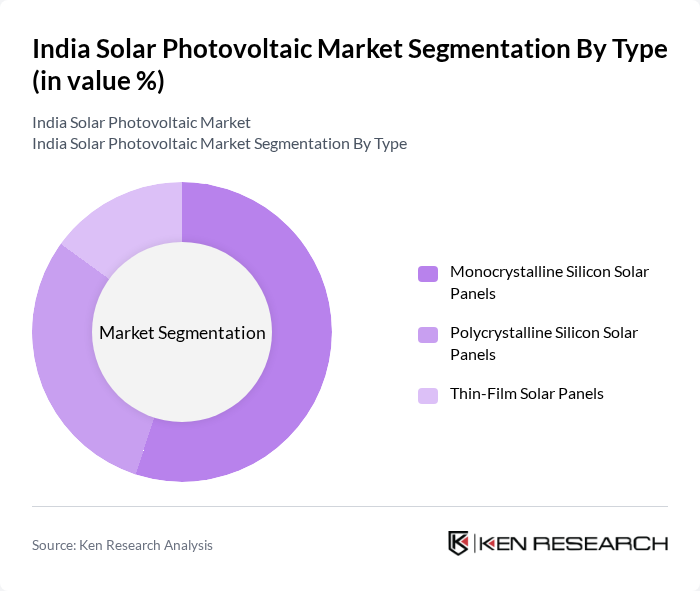

By Type:The solar photovoltaic market is segmented into three main types: Monocrystalline Silicon Solar Panels, Polycrystalline Silicon Solar Panels, and Thin-Film Solar Panels. Monocrystalline panels are currently leading the market due to their higher efficiency and space-saving design, making them a preferred choice for residential and commercial installations. Polycrystalline panels provide a cost-effective alternative and remain widely used in both rooftop and utility-scale projects. Thin-film panels are gaining traction in niche applications, especially where lightweight and flexible modules are required, such as on industrial rooftops and certain off-grid solutions .

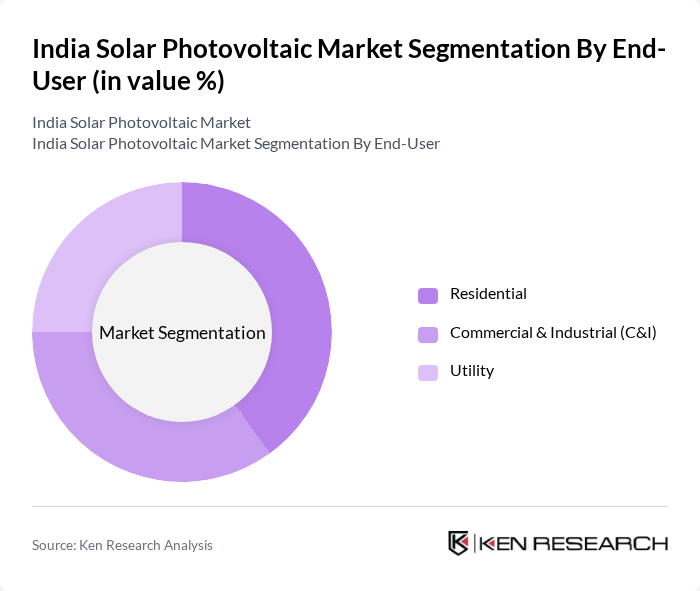

By End-User:The end-user segmentation includes Residential, Commercial & Industrial (C&I), and Utility sectors. The residential segment is experiencing rapid growth as homeowners increasingly adopt solar solutions to reduce energy costs and enhance sustainability, supported by government subsidies and net metering policies. The C&I sector is expanding as businesses seek to lower operational expenses and meet sustainability targets, with rooftop solar adoption accelerating among factories and commercial buildings. The utility segment remains significant, driven by large-scale solar farms and government-backed tenders contributing to the national grid .

The India Solar Photovoltaic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Power Solar Systems Ltd., Adani Solar, Vikram Solar Ltd., Waaree Energies Ltd., Renew Power (ReNew Power Pvt. Ltd.), Mahindra Susten Pvt. Ltd., Azure Power Global Ltd., EMMVEE Solar Systems Pvt. Ltd., Jakson Group, Goldi Solar Pvt. Ltd., Adani Green Energy Ltd., Sterling and Wilson Solar Ltd., Loom Solar Pvt. Ltd., Rays Power Infra Pvt. Ltd., Canadian Solar Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar photovoltaic market in India appears promising, driven by increasing government support and technological advancements. In future, the integration of smart grid technologies is expected to enhance energy efficiency and reliability. Additionally, the growing trend towards decentralized energy systems will empower consumers to generate their own electricity, further boosting solar adoption. As awareness of renewable energy benefits rises, the market is poised for significant growth, attracting investments and fostering innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Monocrystalline Silicon Solar Panels Polycrystalline Silicon Solar Panels Thin-Film Solar Panels |

| By End-User | Residential Commercial & Industrial (C&I) Utility |

| By Region | North India (e.g., Uttar Pradesh, Haryana, Punjab) South India (e.g., Karnataka, Tamil Nadu, Andhra Pradesh, Telangana) East India (e.g., West Bengal, Bihar, Odisha) West India (e.g., Gujarat, Rajasthan, Maharashtra) |

| By Deployment | Ground-Mounted Rooftop Solar |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installation Managers |

| Commercial Solar Projects | 80 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 60 | Project Developers, Energy Analysts |

| Solar Technology Providers | 50 | Product Managers, R&D Engineers |

| Government Policy Makers | 40 | Regulatory Officials, Energy Policy Advisors |

The India Solar Photovoltaic Market is valued at approximately USD 14 billion, driven by increasing investments in renewable energy, government initiatives like the National Solar Mission, and a growing demand for clean energy solutions.