Region:Europe

Author(s):Shubham

Product Code:KRAA1813

Pages:81

Published On:August 2025

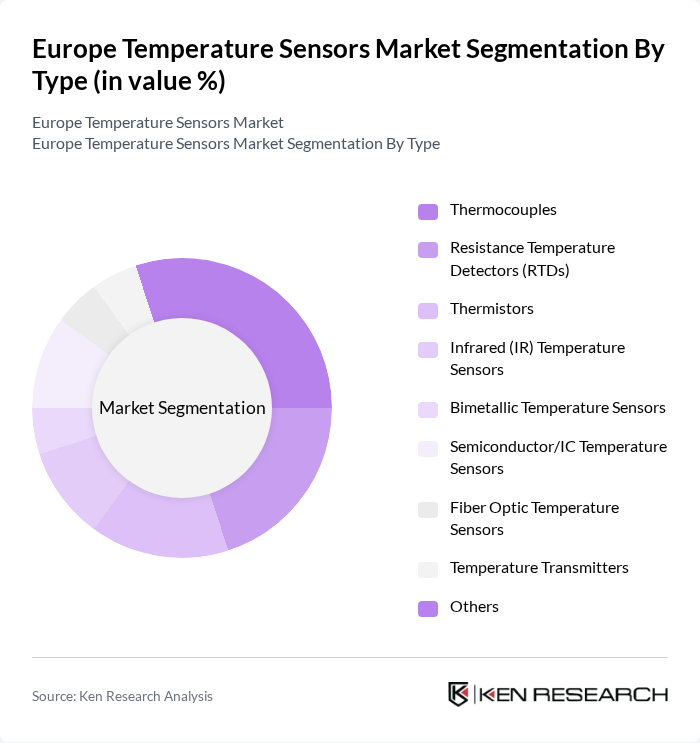

By Type:The temperature sensors market can be segmented into various types, including thermocouples, resistance temperature detectors (RTDs), thermistors, infrared (IR) temperature sensors, bimetallic temperature sensors, semiconductor/IC temperature sensors, fiber optic temperature sensors, temperature transmitters, and others. Each type serves specific applications and industries, contributing to the overall market dynamics.

The thermocouples segment is currently dominating the market due to their wide application range, cost-effectiveness, and ability to measure high temperatures. They are used across industrial furnaces, power generation, petrochemical processing, automotive exhaust and engine monitoring, and HVAC equipment. Their ruggedness, broad temperature range, and relatively low cost reinforce share leadership; meanwhile, RTDs are expanding in precision industrial and medical applications given accuracy and stability, as noted in EU industrial and medical instrumentation trends. Additionally, continued improvements in thermocouple alloys, insulation, and signal conditioning are enhancing accuracy and response times in harsh environments.

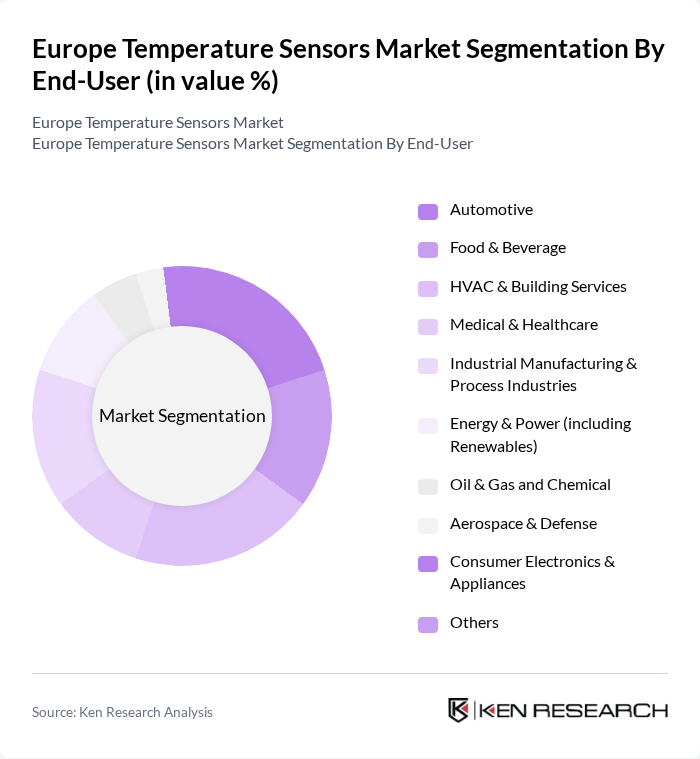

By End-User:The temperature sensors market can also be segmented by end-user industries, including automotive, food & beverage, HVAC & building services, medical & healthcare, industrial manufacturing & process industries, energy & power (including renewables), oil & gas and chemical, aerospace & defense, consumer electronics & appliances, and others. Each end-user segment has unique requirements and applications for temperature sensors.

The HVAC & building services segment is a significant contributor to the temperature sensors market, driven by energy-efficiency retrofits, smart thermostats and BMS integrations, and indoor environmental quality monitoring in commercial buildings. Uptake of IoT-enabled controls and demand response is increasing sensor node density within air handling units, hydronic systems, and zone-level control, supporting sustained demand. In parallel, medical and healthcare equipment, EV battery and power electronics thermal monitoring, and precision industrial automation continue to add high-value sensing points.

The Europe Temperature Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Schneider Electric SE, ABB Ltd., Emerson Electric Co., TE Connectivity Ltd., OMEGA Engineering, Inc., Fluke Corporation, Yokogawa Electric Corporation, Endress+Hauser Group, WIKA Alexander Wiegand SE & Co. KG, Lakeside (formerly National Instruments) – NI, Texas Instruments Incorporated, Analog Devices, Inc., Vishay Intertechnology, Inc., Sensirion AG, Ifm electronic gmbh, Heraeus Nexensos GmbH, Microchip Technology Inc., Amphenol Advanced Sensors (Thermometrics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe temperature sensors market appears promising, driven by ongoing technological innovations and increasing integration with IoT solutions. As industries continue to prioritize automation and energy efficiency, the demand for advanced temperature monitoring systems is expected to rise significantly. Furthermore, the growing emphasis on predictive maintenance and data analytics will enhance the functionality of temperature sensors, making them indispensable in various applications, particularly in healthcare and smart home technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermocouples Resistance Temperature Detectors (RTDs) Thermistors Infrared (IR) Temperature Sensors Bimetallic Temperature Sensors Semiconductor/IC Temperature Sensors Fiber Optic Temperature Sensors Temperature Transmitters Others |

| By End-User | Automotive Food & Beverage HVAC & Building Services Medical & Healthcare Industrial Manufacturing & Process Industries Energy & Power (including Renewables) Oil & Gas and Chemical Aerospace & Defense Consumer Electronics & Appliances Others |

| By Application | Process Control & Safety Environmental & Condition Monitoring Building Automation & HVAC Control Medical Devices & Patient Monitoring Automotive Powertrain & Battery Management Industrial Equipment Monitoring (Predictive Maintenance) Cold Chain & Logistics Others |

| By Distribution Channel | Direct Sales (OEM/Project) Online (Manufacturer & E-commerce) Authorized Distributors/Value-Added Resellers Retail/Electronics Trade Counters Others |

| By Region | Germany United Kingdom France Italy Spain Nordics (Sweden, Denmark, Norway, Finland) Benelux Central & Eastern Europe Rest of Europe |

| By Price Range | Entry-Level (Commodity/High-Volume ICs) Mid-Range (Industrial Grade) Premium (High-Precision/Harsh Environment) |

| By Technology | Wired Wireless Smart/IoT-Enabled (Digital Output, Self-Diagnostics) Analog Output Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Temperature Sensors | 120 | Manufacturing Engineers, Quality Control Managers |

| Automotive Temperature Monitoring | 100 | Automotive Engineers, Product Development Managers |

| Food Processing Temperature Control | 80 | Food Safety Officers, Production Supervisors |

| Consumer Electronics Temperature Sensors | 70 | Product Managers, R&D Engineers |

| HVAC Temperature Regulation | 90 | HVAC Technicians, Building Managers |

The Europe Temperature Sensors Market is valued at approximately USD 3.2 billion, reflecting a robust growth trajectory driven by increasing demand across various industries such as automotive, medical devices, and HVAC systems.