Region:Asia

Author(s):Shubham

Product Code:KRAC4314

Pages:86

Published On:October 2025

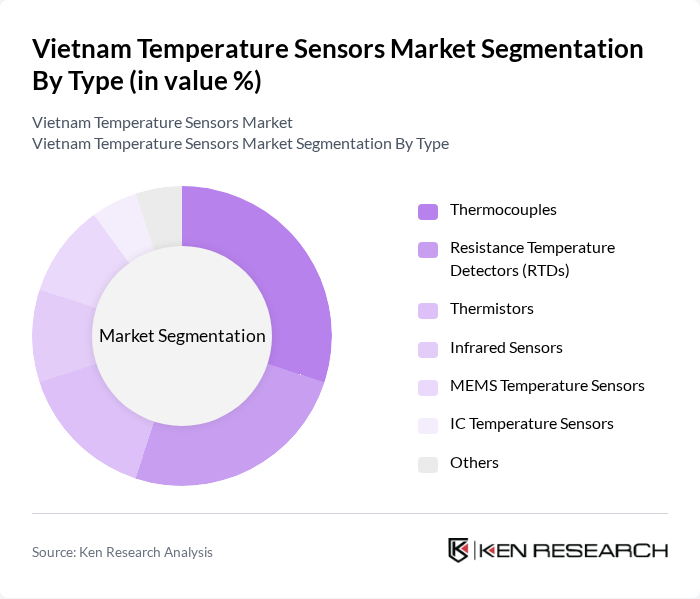

By Type:The temperature sensors market can be segmented into Thermocouples, Resistance Temperature Detectors (RTDs), Thermistors, Infrared Sensors, MEMS Temperature Sensors, IC Temperature Sensors, and Others. Each type serves specific applications and industries, with varying levels of accuracy, response time, and cost. Thermocouples and RTDs are particularly popular in industrial and process automation due to their reliability and wide operating range, while thermistors are favored in automotive and consumer electronics for their sensitivity and cost-effectiveness. MEMS-based sensors are rapidly gaining traction for their miniaturization and integration in smart devices.

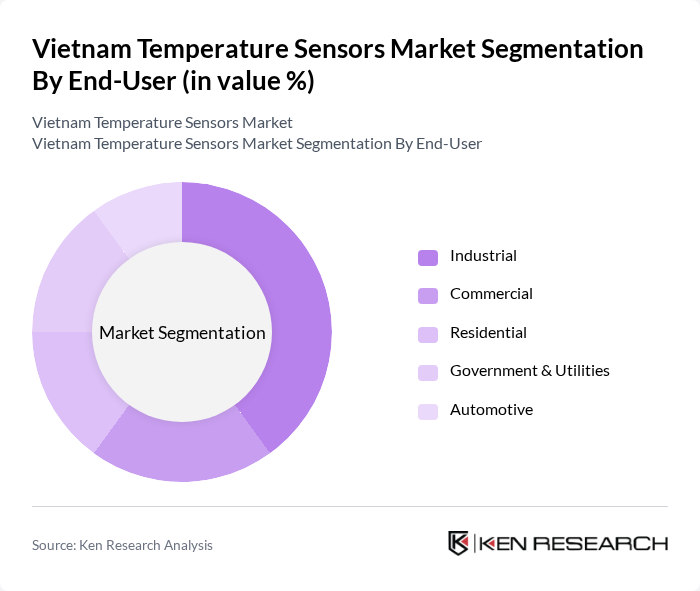

By End-User:The market can also be segmented by end-user categories, including Industrial, Commercial, Residential, Government & Utilities, and Automotive. The industrial sector is the largest consumer, driven by the need for precise temperature control in manufacturing, process automation, and predictive maintenance. The automotive segment is witnessing robust growth due to the adoption of electric vehicles and advanced thermal management systems. Government and utilities are increasing investments in smart infrastructure and energy management, further supporting sensor deployment.

The Vietnam Temperature Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Emerson Electric Co., Schneider Electric SE, Yokogawa Electric Corporation, Texas Instruments Incorporated, Fluke Corporation, Omega Engineering, Inc., ABB Ltd., National Instruments Corporation, Panasonic Corporation, TE Connectivity Ltd., Vishay Intertechnology, Inc., Dwyer Instruments, Inc., Ametek, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam temperature sensors market is poised for significant growth, driven by technological advancements and increasing industrial automation. The integration of artificial intelligence and the Internet of Things (IoT) in temperature monitoring systems is expected to enhance data accuracy and operational efficiency. Additionally, the government's focus on smart city initiatives and renewable energy projects will further stimulate demand for innovative temperature sensing solutions. As industries adapt to these trends, the market is likely to witness a shift towards more sophisticated and sustainable sensor technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermocouples Resistance Temperature Detectors (RTDs) Thermistors Infrared Sensors MEMS Temperature Sensors IC Temperature Sensors Others |

| By End-User | Industrial Commercial Residential Government & Utilities Automotive |

| By Application | HVAC Systems Food Processing Pharmaceutical Automotive (Engine, Exhaust, EV Battery) Environmental Monitoring Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Price Range | Low-End Sensors Mid-Range Sensors High-End Sensors |

| By Technology | Wired Sensors Wireless Sensors Smart Sensors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Temperature Sensors | 45 | Plant Managers, Quality Control Engineers |

| HVAC Applications | 38 | HVAC Technicians, Facility Managers |

| Agricultural Monitoring Systems | 32 | Agronomists, Farm Managers |

| Food Processing Industry | 42 | Food Safety Officers, Production Supervisors |

| Consumer Electronics | 28 | Product Development Managers, Electronics Engineers |

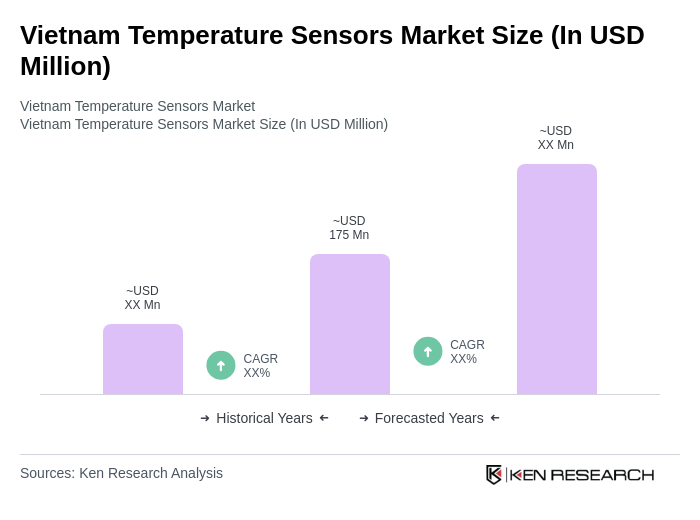

The Vietnam Temperature Sensors Market is valued at approximately USD 175 million, driven by increasing demand across various sectors such as industrial automation, automotive, healthcare, and consumer electronics, along with advancements in IoT technologies and smart infrastructure.