Region:Europe

Author(s):Geetanshi

Product Code:KRAD0063

Pages:94

Published On:August 2025

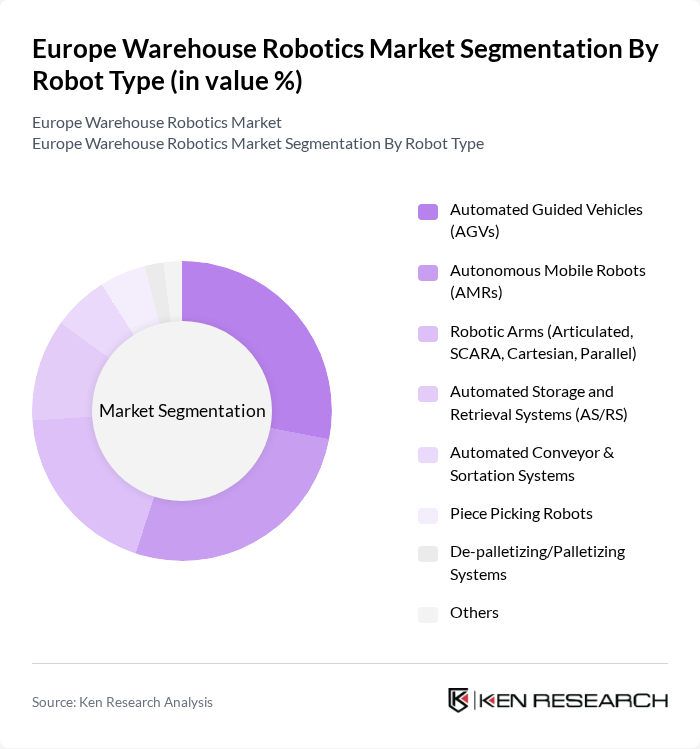

By Robot Type:The market is segmented into various robot types, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms (Articulated, SCARA, Cartesian, Parallel), Automated Storage and Retrieval Systems (AS/RS), Automated Conveyor & Sortation Systems, Piece Picking Robots, De-palletizing/Palletizing Systems, and Others. Among these, Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are leading the market due to their versatility, scalability, and efficiency in material handling and intralogistics operations. The adoption of AMRs is rapidly increasing as they offer greater flexibility and can navigate dynamic warehouse environments without fixed infrastructure .

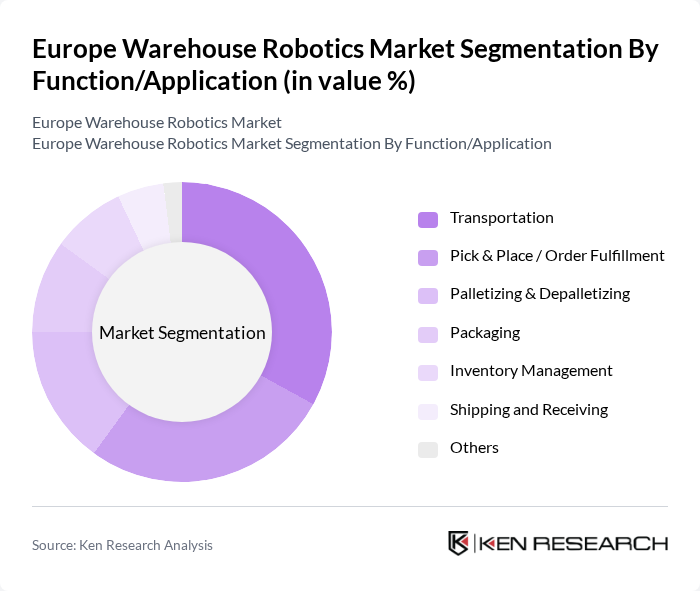

By Function/Application:The applications of warehouse robotics include Transportation, Pick & Place / Order Fulfillment, Palletizing & Depalletizing, Packaging, Inventory Management, Shipping and Receiving, and Others. The Transportation segment remains the most dominant, as it is critical for streamlining logistics, enabling efficient movement of goods, and supporting high-volume order fulfillment. Pick & Place and Order Fulfillment applications are also rapidly expanding, driven by the growth of e-commerce and demand for faster, more accurate order processing .

The Europe Warehouse Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, SSI Schaefer AG, KION Group AG (Dematic), KNAPP AG, Vanderlande Industries B.V., Swisslog Holding AG, Amazon Robotics, HAI Robotics, Geekplus Technology Co., Ltd., Locus Robotics, Omron Corporation, BlueBotics SA, Mobile Industrial Robots (MiR), AutoStore Holdings Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the warehouse robotics market in Europe appears promising, driven by technological advancements and increasing automation adoption. As companies prioritize efficiency and cost reduction, the integration of artificial intelligence and machine learning into robotic systems is expected to enhance operational capabilities. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly robotic solutions, aligning with European Union regulations aimed at reducing carbon footprints in logistics operations.

| Segment | Sub-Segments |

|---|---|

| By Robot Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms (Articulated, SCARA, Cartesian, Parallel) Automated Storage and Retrieval Systems (AS/RS) Automated Conveyor & Sortation Systems Piece Picking Robots De-palletizing/Palletizing Systems Others |

| By Function/Application | Transportation Pick & Place / Order Fulfillment Palletizing & Depalletizing Packaging Inventory Management Shipping and Receiving Others |

| By Payload Capacity | Below 10 kg kg to 80 kg kg to 400 kg kg to 900 kg Above 900 kg |

| By End-User Industry | E-commerce Retail Manufacturing (Durable & Non-Durable) Food & Beverage Pharmaceuticals Post & Parcel Apparel Groceries General Merchandise Logistics and Distribution Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | United Kingdom Germany France Italy Spain Netherlands Belgium Sweden Norway Poland Denmark Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | AI-Driven Robotics Machine Learning Integration Cloud-Based Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehouse Automation | 120 | Warehouse Managers, Operations Directors |

| E-commerce Fulfillment Centers | 90 | Logistics Coordinators, IT Managers |

| Manufacturing Robotics Integration | 70 | Production Managers, Automation Engineers |

| Third-party Logistics Providers | 60 | Supply Chain Executives, Business Development Managers |

| Robotics Technology Developers | 50 | Product Managers, R&D Specialists |

The Europe Warehouse Robotics Market is valued at approximately USD 2.0 billion, driven by the increasing demand for automation in logistics and warehousing, as companies aim to enhance operational efficiency and reduce labor costs.