Region:Middle East

Author(s):Rebecca

Product Code:KRAD1344

Pages:80

Published On:November 2025

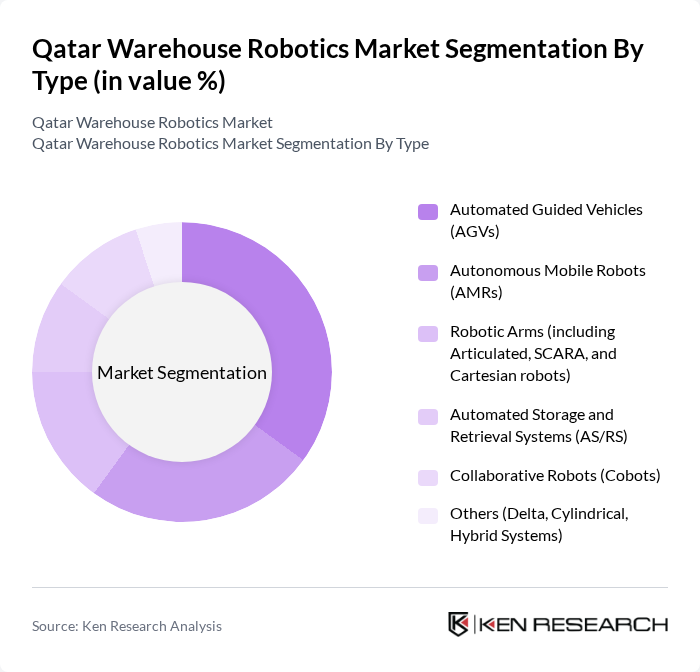

By Type:The market is segmented into various types of robotic solutions, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms, Automated Storage and Retrieval Systems (AS/RS), Collaborative Robots (Cobots), and others. Among these, Automated Guided Vehicles (AGVs) are currently leading the market due to their widespread application in material handling and transportation within warehouses. The increasing need for efficient logistics and the ability of AGVs to operate autonomously in complex environments contribute to their dominance. The adoption of AMRs and Cobots is also rising, driven by their flexibility and ability to work alongside human workers, supporting a trend toward collaborative automation in warehouse environments .

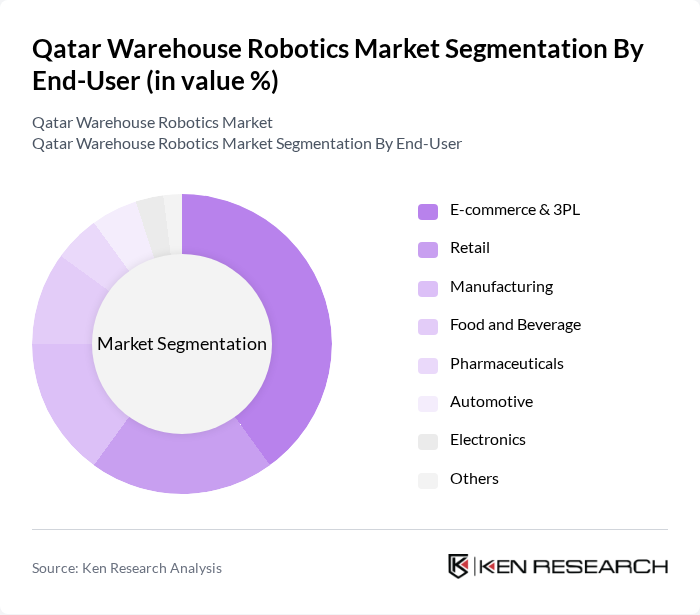

By End-User:The end-user segmentation includes E-commerce & 3PL, Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Electronics, and others. The E-commerce & 3PL sector is the leading end-user of warehouse robotics, driven by the rapid growth of online shopping and the need for efficient order fulfillment processes. Companies in this sector are increasingly adopting robotic solutions to streamline operations and meet customer demands for faster delivery. Retail and manufacturing also represent significant segments, as automation supports inventory management and production efficiency .

The Qatar Warehouse Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, KUKA AG, ABB Ltd., Honeywell Intelligrated, Fetch Robotics, GreyOrange, Omron Adept Technologies, Daifuku Co., Ltd., Panasonic Corporation, Zebra Technologies, Seegrid Corporation, Yaskawa Electric Corporation, 6 River Systems, Locus Robotics, Swisslog AG, Boston Dynamics, Rockwell Automation, Mitsubishi Electric Corporation, Invia Robotics, Robot System Products AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the warehouse robotics market in Qatar appears promising, driven by ongoing technological advancements and increasing demand for automation. As companies strive to enhance operational efficiency, the integration of AI and machine learning into robotic systems will become more prevalent. Additionally, the expansion of e-commerce and government support for smart logistics initiatives will further accelerate the adoption of robotics, positioning Qatar as a regional leader in automated logistics solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms (including Articulated, SCARA, and Cartesian robots) Automated Storage and Retrieval Systems (AS/RS) Collaborative Robots (Cobots) Others (Delta, Cylindrical, Hybrid Systems) |

| By End-User | E-commerce & 3PL Retail Manufacturing Food and Beverage Pharmaceuticals Automotive Electronics Others |

| By Application | Order Fulfillment Inventory Management Packaging Sorting Shipping and Receiving Palletizing & Depalletizing Picking & Placing Others |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Automotive Metals & Heavy Machinery Others |

| By Technology | Machine Learning Computer Vision IoT Integration Cloud Robotics Warehouse Management Systems (WMS) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Doha Al Rayyan Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehouse Automation | 100 | Warehouse Managers, Operations Directors |

| Food and Beverage Logistics | 70 | Supply Chain Managers, Quality Control Officers |

| Pharmaceutical Distribution Centers | 60 | Logistics Coordinators, Compliance Managers |

| Electronics Warehousing Solutions | 80 | IT Managers, Operations Analysts |

| Automotive Parts Warehousing | 50 | Procurement Managers, Inventory Control Specialists |

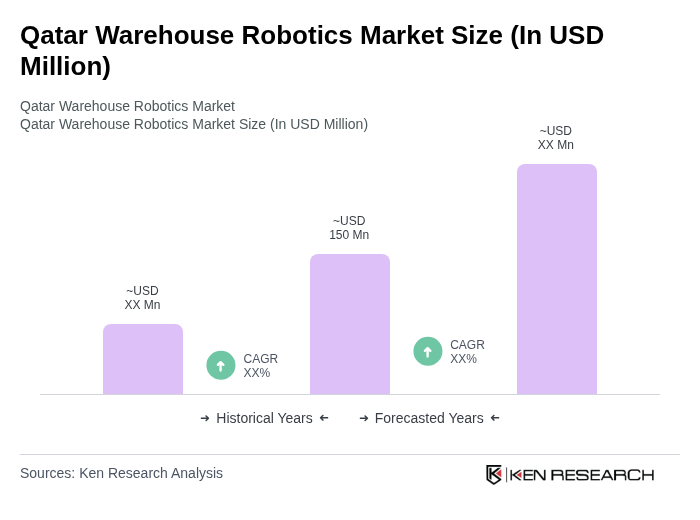

The Qatar Warehouse Robotics Market is valued at approximately USD 150 million, driven by the increasing demand for automation in logistics and warehousing, as businesses aim to enhance operational efficiency and reduce labor costs.