Region:Europe

Author(s):Dev

Product Code:KRAA2206

Pages:81

Published On:August 2025

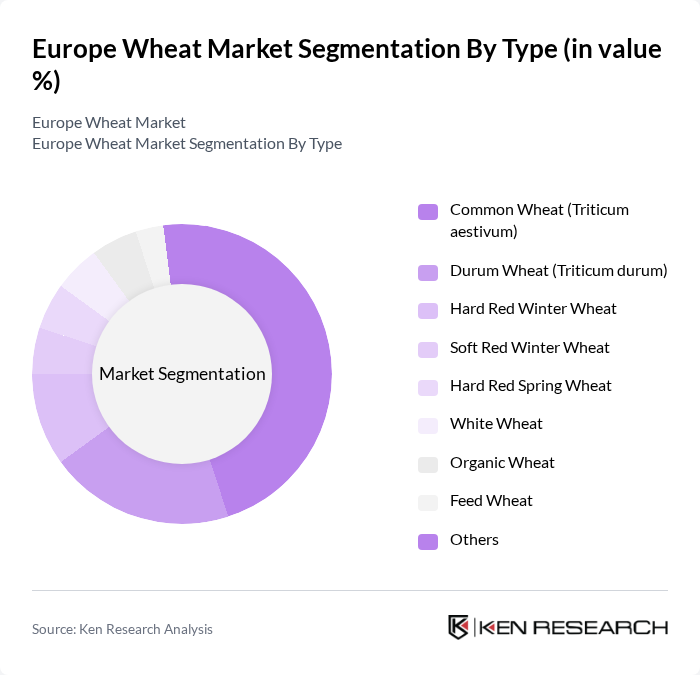

By Type:The wheat market can be segmented into various types, including Common Wheat (Triticum aestivum), Durum Wheat (Triticum durum), Hard Red Winter Wheat, Soft Red Winter Wheat, Hard Red Spring Wheat, White Wheat, Organic Wheat, Feed Wheat, and Others. Among these, Common Wheat is the most widely produced and consumed type due to its versatility in food products and high yield potential. Durum Wheat follows closely, primarily used for pasta production, which has seen a rise in demand due to changing consumer preferences towards healthier diets and the increasing popularity of Mediterranean cuisine. The adoption of hybrid seeds and the trend toward whole grain and organic wheat are also shaping product segmentation .

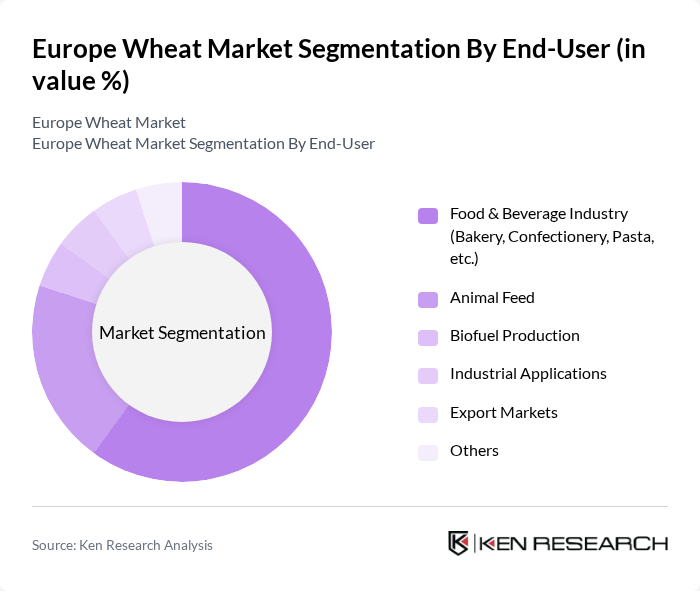

By End-User:The end-user segmentation includes the Food & Beverage Industry (Bakery, Confectionery, Pasta, etc.), Animal Feed, Biofuel Production, Industrial Applications, Export Markets, and Others. The Food & Beverage Industry is the leading segment, driven by the increasing consumption of baked goods and pasta products. The growing trend towards healthy eating, the demand for whole grain and organic wheat products, and the popularity of plant-based and clean-label foods have further solidified the Food & Beverage sector's dominance in the market. Animal feed and biofuel production remain important secondary segments, supported by the versatility of wheat as a raw material .

The Europe Wheat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, Louis Dreyfus Company, Syngenta AG, Bayer AG, Olam International, COFCO International, Euralis Semences, Limagrain, Tereos, Viterra, GrainCorp, RAGT Semences, DLG Group, BayWa AG, Glencore Agriculture (now Viterra), Agrofert Group, Soufflet Group (InVivo Group), Agrifirm Group contribute to innovation, geographic expansion, and service delivery in this space.

The Europe wheat market is poised for significant transformation as it adapts to evolving consumer preferences and environmental challenges. With a growing emphasis on sustainability, innovations in crop management and organic wheat production are expected to gain traction. Additionally, the rise of e-commerce in food distribution will facilitate access to wheat products, enhancing market reach. As farmers increasingly adopt precision agriculture techniques, overall productivity is likely to improve, ensuring a stable supply to meet the rising demand for wheat-based products in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Common Wheat (Triticum aestivum) Durum Wheat (Triticum durum) Hard Red Winter Wheat Soft Red Winter Wheat Hard Red Spring Wheat White Wheat Organic Wheat Feed Wheat Others |

| By End-User | Food & Beverage Industry (Bakery, Confectionery, Pasta, etc.) Animal Feed Biofuel Production Industrial Applications Export Markets Others |

| By Distribution Channel | Direct Sales (Mills, Processors) Retail Outlets (Supermarkets, Grocery Stores) Online Platforms Wholesale Distributors Cooperatives Others |

| By Region | Western Europe (France, Germany, UK, etc.) Eastern Europe (Russia, Ukraine, Poland, etc.) Northern Europe (Scandinavia, Baltics) Southern Europe (Italy, Spain, Greece, etc.) Others |

| By Quality Grade | Premium Quality Standard Quality Feed Quality Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wheat Farmers | 120 | Farm Owners, Agricultural Managers |

| Grain Traders | 60 | Trade Analysts, Export Managers |

| Food Manufacturers | 50 | Production Managers, Quality Control Officers |

| Agricultural Policy Makers | 40 | Government Officials, Policy Analysts |

| Research Institutions | 40 | Agricultural Researchers, Economists |

The Europe Wheat Market is valued at approximately USD 194 billion, driven by increasing demand for wheat in food production, animal feed, and biofuel applications, alongside technological advancements and sustainable agricultural practices.