Region:Global

Author(s):Geetanshi

Product Code:KRAB0122

Pages:85

Published On:August 2025

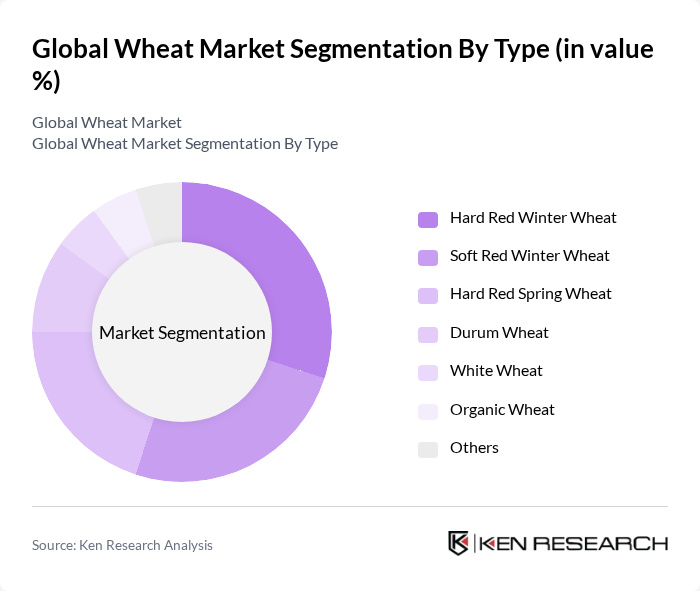

By Type:The wheat market can be segmented into various types, including Hard Red Winter Wheat, Soft Red Winter Wheat, Hard Red Spring Wheat, Durum Wheat, White Wheat, Organic Wheat, and Others. Each type serves different purposes in food production and has unique characteristics that cater to specific consumer needs. The demand for each type varies based on regional preferences and culinary applications.

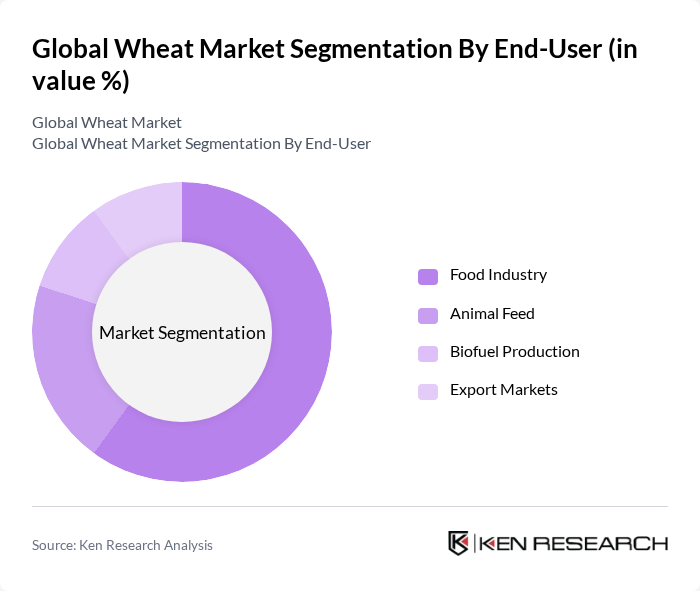

By End-User:The wheat market is also segmented by end-user applications, which include the Food Industry, Animal Feed, Biofuel Production, and Export Markets. The food industry remains the largest consumer of wheat, utilizing it for flour production, baking, pasta, and other food products. Demand from animal feed and biofuel production is also increasing, supported by the need for sustainable energy sources and livestock feed.

The Global Wheat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, Louis Dreyfus Company, General Mills, Inc., Associated British Foods plc, Olam International Limited, COFCO Corporation, Syngenta AG, Bayer AG, Nisshin Flour Milling Inc., Ardent Mills, CHS Inc., Glencore plc, Bay State Milling Company, The Scoular Company, Sunnyland Mills, Grain Craft, Miller Milling Company, Euralis Semences, The Soufflet Group, Adani Wilmar Limited, ITC Limited, Farm Fresh Wheat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wheat market appears promising, driven by technological advancements and a growing focus on sustainability. As agricultural practices evolve, the integration of smart farming technologies is expected to enhance productivity and reduce environmental impact. Additionally, the increasing emphasis on food security will likely lead to greater governmental support for wheat production initiatives. These trends suggest a resilient market poised to adapt to challenges while meeting the rising global demand for wheat in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Red Winter Wheat Soft Red Winter Wheat Hard Red Spring Wheat Durum Wheat White Wheat Organic Wheat Others |

| By End-User | Food Industry Animal Feed Biofuel Production Export Markets |

| By Application | Flour Production Baking Industry Pasta Manufacturing Snack Foods |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Wheat Mid-Range Wheat Budget Wheat |

| By Quality Grade | Grade 1 Grade 2 Grade 3 Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wheat Farmers | 120 | Farm Owners, Agricultural Managers |

| Grain Traders | 80 | Commodity Traders, Supply Chain Analysts |

| Agricultural Policy Makers | 60 | Government Officials, Policy Advisors |

| Food Manufacturers | 50 | Procurement Managers, Product Development Heads |

| Research Institutions | 40 | Agricultural Researchers, Economists |

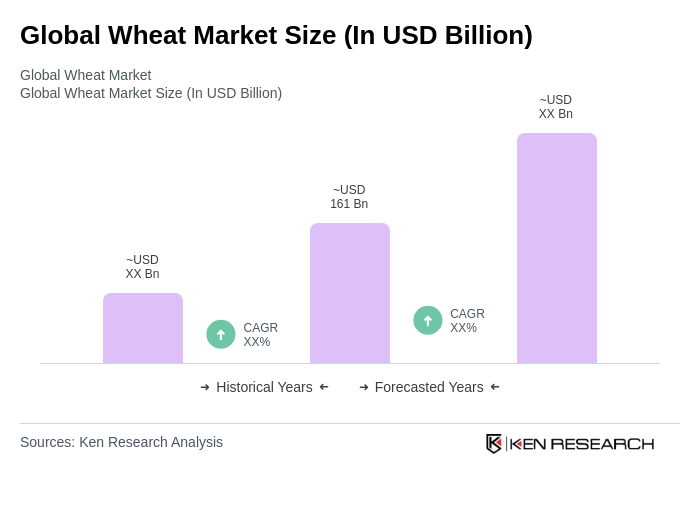

The Global Wheat Market is valued at approximately USD 161 billion, reflecting the aggregate of global wheat trade and production. This valuation is based on a five-year historical analysis and indicates significant growth driven by rising global demand for wheat.