Region:Europe

Author(s):Shubham

Product Code:KRAC0635

Pages:88

Published On:August 2025

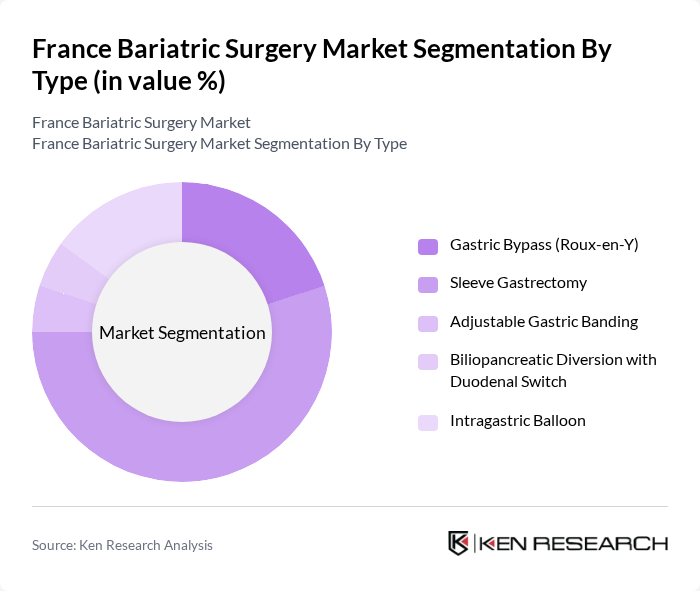

By Type:The market is segmented into various types of bariatric surgeries, including Gastric Bypass (Roux-en-Y), Sleeve Gastrectomy, Adjustable Gastric Banding, Biliopancreatic Diversion with Duodenal Switch, and Intragastric Balloon. Among these, Sleeve Gastrectomy has gained significant popularity due to its minimally invasive nature and favorable outcomes. Patients are increasingly opting for this procedure as it offers effective weight loss with a shorter recovery time compared to traditional methods.

By End-User:The end-user segmentation includes Public Hospitals (CHU/CH), Private Hospitals and Clinics, and Ambulatory Surgical Centers. Public hospitals are the primary providers of bariatric surgeries, as they cater to a larger patient base and offer comprehensive care. However, private hospitals and clinics are gaining traction due to their ability to provide personalized services and shorter waiting times, appealing to patients seeking immediate treatment.

The France Bariatric Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (Ethicon), Olympus Corporation, Intuitive Surgical, Inc., Apollo Endosurgery, Inc. (now part of Boston Scientific), ReShape Lifesciences Inc., Spatz FGIA, Inc., Cousin Surgery (Cousin Biotech), CHU de Bordeaux, AP-HP – Hôpital Européen Georges-Pompidou, AP-HP – Hôpital de la Pitié-Salpêtrière, AP-HP – Hôpital Bichat-Claude Bernard, Groupe Hospitalier Paris Saint-Joseph, Ramsay Santé, Clinique du Parc (Lyon) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France bariatric surgery market appears promising, driven by increasing awareness of obesity-related health risks and advancements in surgical techniques. As the government continues to invest in healthcare initiatives, more patients are likely to seek surgical options. Additionally, the integration of telemedicine and personalized care approaches will enhance patient engagement and follow-up, further supporting market growth. The focus on innovative solutions will likely lead to improved patient outcomes and increased acceptance of bariatric surgery as a viable treatment option.

| Segment | Sub-Segments |

|---|---|

| By Type | Gastric Bypass (Roux-en-Y) Sleeve Gastrectomy Adjustable Gastric Banding Biliopancreatic Diversion with Duodenal Switch Intragastric Balloon |

| By End-User | Public Hospitals (CHU/CH) Private Hospitals and Clinics Ambulatory Surgical Centers |

| By Patient Demographics | Adults (18–64 years) Adolescents (13–17 years) Seniors (65+ years) |

| By Surgical Approach | Open Surgery Laparoscopic Surgery Robot-Assisted Laparoscopic Surgery |

| By Insurance Coverage | Public Insurance (Assurance Maladie/ALD) Complementary Insurance (Mutuelle) Out-of-Pocket |

| By Region | Île-de-France Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Hauts-de-France Nouvelle-Aquitaine Occitanie Others |

| By Price Range | Low Medium High |

| By Device Category | Assisting Devices (staplers, suturing/closure devices, trocars, clip appliers) Implantable Devices (gastric bands, electrical stimulation devices, gastric balloons) Other Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bariatric Surgery Patients | 120 | Patients who have undergone surgery in the last 2 years |

| Bariatric Surgeons | 60 | Surgeons specializing in bariatric procedures across France |

| Healthcare Administrators | 50 | Hospital administrators involved in surgical program management |

| Nutritionists and Dietitians | 40 | Healthcare professionals providing post-operative care and dietary guidance |

| Insurance Providers | 40 | Representatives from health insurance companies covering bariatric surgery |

The France Bariatric Surgery Market is valued at approximately USD 220 million, based on a five-year historical analysis. This figure aligns with procedure volumes and device-market estimates, placing France in the low-hundreds of millions range within Europe.