Region:Global

Author(s):Rebecca

Product Code:KRAA2413

Pages:94

Published On:August 2025

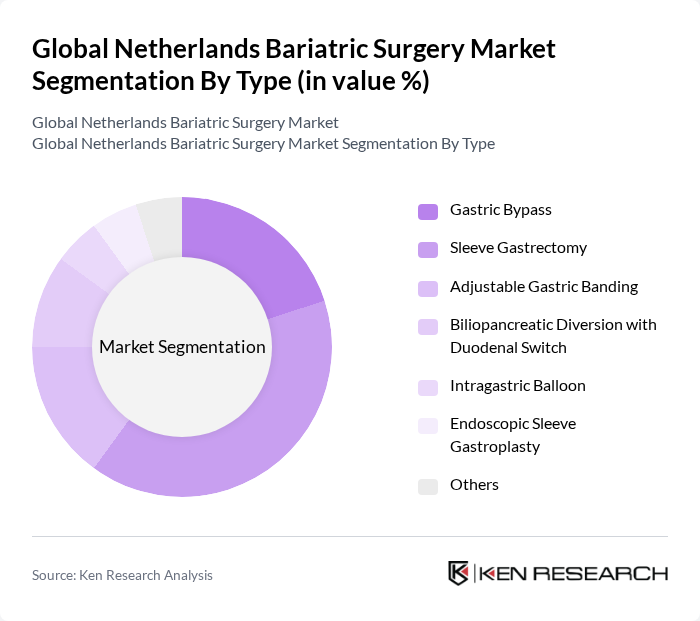

By Type:The market is segmented into various types of bariatric surgeries, including Gastric Bypass, Sleeve Gastrectomy, Adjustable Gastric Banding, Biliopancreatic Diversion with Duodenal Switch, Intragastric Balloon, Endoscopic Sleeve Gastroplasty, and Others. Among these,Sleeve Gastrectomyhas gained significant popularity due to its minimally invasive approach, favorable safety profile, and effective weight loss outcomes. Patients are increasingly opting for this procedure as it offers a shorter recovery time and lower complication rates compared to traditional open surgical methods .

By Device:The market is categorized by devices used in bariatric surgeries, including Assisting Devices (Trocars, Stapling Devices, Suturing Devices, Closuring Devices, Energy Platforms), Implantable Devices (Gastric Bands, Electrical Stimulation Devices, Gastric Balloon, Gastric Emptying Devices), and Other Devices.Assisting Devicescurrently lead the market due to their critical role in enabling minimally invasive procedures, enhancing surgical precision, and improving patient safety during bariatric operations .

The Global Netherlands Bariatric Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ethicon, Inc. (Johnson & Johnson MedTech), Medtronic plc, Apollo Endosurgery, Inc., Intuitive Surgical, Inc., Stryker Corporation, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Hologic, Inc., Cook Medical, CONMED Corporation, Merit Medical Systems, Inc., Boston Scientific Corporation, Surgical Innovations Group plc, Olympus Corporation, Erbe Elektromedizin GmbH, Bariatric Center Nederland, Nederlandse Obesitas Kliniek (NOK), MC Slotervaart Obesitas Centrum contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bariatric surgery market in the Netherlands appears promising, driven by ongoing advancements in surgical techniques and increasing public awareness. As healthcare providers continue to adopt innovative technologies, patient outcomes are expected to improve, fostering greater acceptance of surgical interventions. Additionally, the integration of telemedicine for pre- and post-operative care will enhance patient engagement and accessibility, further supporting market growth. The trend towards outpatient procedures is likely to reshape the landscape, making bariatric surgery more accessible to a broader population.

| Segment | Sub-Segments |

|---|---|

| By Type | Gastric Bypass Sleeve Gastrectomy Adjustable Gastric Banding Biliopancreatic Diversion with Duodenal Switch Intragastric Balloon Endoscopic Sleeve Gastroplasty Others |

| By Device | Assisting Devices (Trocars, Stapling Devices, Suturing Devices, Closuring Devices, Energy Platforms) Implantable Devices (Gastric Bands, Electrical Stimulation Devices, Gastric Balloon, Gastric Emptying Devices) Other Devices |

| By End-User | Hospitals and Clinics Ambulatory Surgical Centers Specialty Clinics |

| By Patient Demographics | Adults Adolescents Seniors |

| By Surgical Approach | Open Surgery Laparoscopic Surgery Robotic-Assisted Surgery |

| By Insurance Coverage | Private Insurance Public Insurance Self-Pay |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Post-Operative Care | Follow-Up Programs Nutritional Counseling Psychological Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bariatric Surgery Patients | 100 | Individuals who have undergone surgery in the last 5 years |

| Bariatric Surgeons | 60 | Surgeons specializing in weight loss procedures |

| Healthcare Administrators | 40 | Hospital administrators overseeing surgical departments |

| Insurance Providers | 40 | Representatives from health insurance companies covering bariatric procedures |

| Nutritionists and Dietitians | 50 | Healthcare professionals providing post-operative care and dietary guidance |

The Netherlands Bariatric Surgery Market is valued at approximately USD 185 million, driven by the rising prevalence of obesity, increased awareness of surgical options, and advancements in minimally invasive techniques.