Region:Europe

Author(s):Rebecca

Product Code:KRAB5338

Pages:97

Published On:October 2025

By Type:The market can be segmented into various types of carbon capture technologies, including Post-Combustion Capture, Pre-Combustion Capture, Oxy-Fuel Combustion, Direct Air Capture, and Others. Each of these technologies has unique applications and efficiencies, catering to different industrial needs.

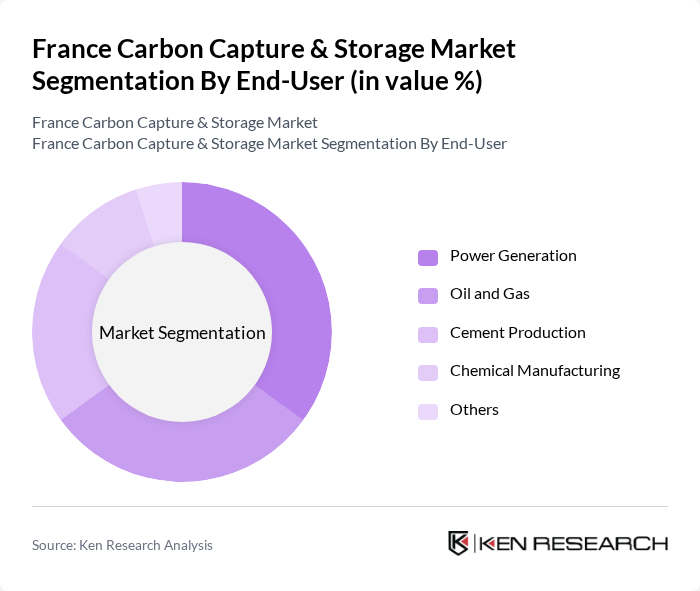

By End-User:The end-user segmentation includes Power Generation, Oil and Gas, Cement Production, Chemical Manufacturing, and Others. Each sector has distinct requirements for carbon capture technologies, influenced by their operational processes and regulatory obligations.

The France Carbon Capture & Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, Air Liquide S.A., Engie S.A., Schlumberger Limited, Carbon Clean Solutions Limited, Linde plc, BASF SE, Siemens AG, Occidental Petroleum Corporation, Climeworks AG, Aker Solutions ASA, Mitsubishi Heavy Industries, Ltd., Baker Hughes Company, CarbonCure Technologies Inc., Global CCS Institute contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carbon capture and storage market in France appears promising, driven by increasing regulatory frameworks and technological innovations. In the future, the integration of carbon capture with renewable energy sources is expected to gain momentum, enhancing overall energy efficiency. Additionally, as public awareness grows, more stakeholders are likely to engage in carbon capture initiatives, fostering collaboration across sectors. This evolving landscape will create a conducive environment for sustainable practices and investment in carbon capture technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-Combustion Capture Pre-Combustion Capture Oxy-Fuel Combustion Direct Air Capture Others |

| By End-User | Power Generation Oil and Gas Cement Production Chemical Manufacturing Others |

| By Application | Enhanced Oil Recovery Industrial Processes Geological Storage Others |

| By Investment Source | Private Investments Public Funding International Grants Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| By Technology | Chemical Absorption Physical Absorption Membrane Separation Others |

| By Market Maturity | Emerging Technologies Established Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Energy Managers, Environmental Compliance Officers |

| Industrial Manufacturing | 80 | Plant Managers, Sustainability Coordinators |

| Transportation and Logistics | 70 | Fleet Managers, Logistics Directors |

| Research Institutions | 60 | Lead Researchers, Policy Analysts |

| Government Agencies | 50 | Regulatory Affairs Specialists, Climate Policy Advisors |

The France Carbon Capture & Storage Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by regulatory pressures to reduce greenhouse gas emissions and investments in sustainable technologies.