Region:North America

Author(s):Geetanshi

Product Code:KRAB5132

Pages:94

Published On:October 2025

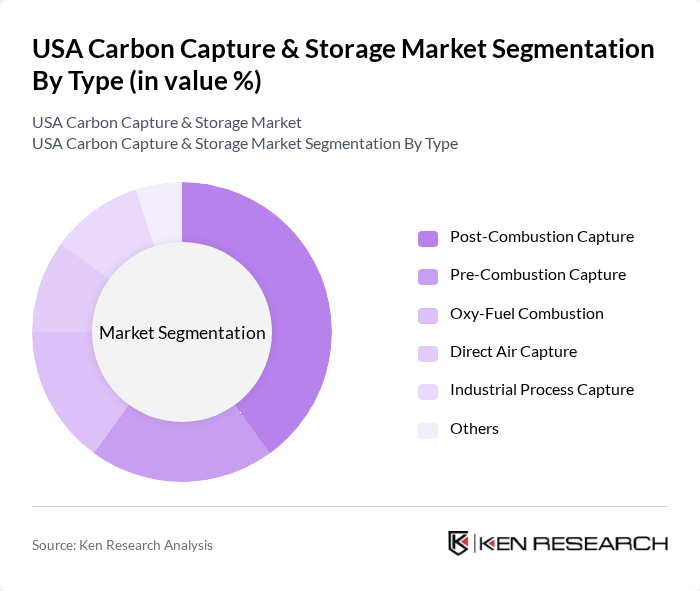

By Type:The market is segmented into various types of carbon capture technologies, including Post-Combustion Capture, Pre-Combustion Capture, Oxy-Fuel Combustion, Direct Air Capture, Industrial Process Capture, and Others. Among these, Post-Combustion Capture is the most widely adopted technology due to its compatibility with existing power plants and industrial facilities. This technology allows for the retrofitting of current systems, making it a preferred choice for many operators looking to reduce emissions without significant capital investment in new infrastructure .

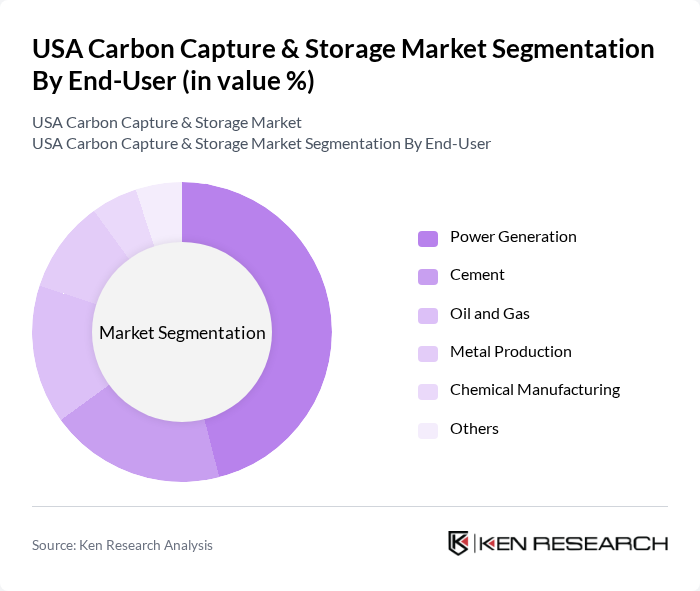

By End-User:The end-user segmentation includes Power Generation, Cement, Oil and Gas, Metal Production, Chemical Manufacturing, and Others. The Power Generation sector is the leading end-user of carbon capture technologies, driven by the need to comply with environmental regulations and reduce carbon emissions from fossil fuel-based power plants. The increasing demand for cleaner energy sources and the integration of CCS in new power generation projects further solidify its dominance in the market. Cement is also a rapidly growing segment due to decarbonization efforts in heavy industry .

The USA Carbon Capture & Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, Chevron, Occidental Petroleum (Oxy), Shell USA, TotalEnergies, Carbon Clean, Aker Carbon Capture, Linde, Air Products and Chemicals, Climeworks, NET Power, Summit Carbon Solutions, Denbury Inc., Fluor Corporation, Mitsubishi Heavy Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA carbon capture and storage market appears promising, driven by increasing investments in research and development, which are projected to reach $2 billion in future. Additionally, the integration of CCS with hydrogen production is gaining traction, as companies seek to leverage synergies between these technologies. As regulatory frameworks tighten and public awareness grows, the CCS market is expected to expand, fostering innovation and collaboration across various sectors, ultimately contributing to national climate goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-Combustion Capture Pre-Combustion Capture Oxy-Fuel Combustion Direct Air Capture Industrial Process Capture Others |

| By End-User | Power Generation Cement Oil and Gas Metal Production Chemical Manufacturing Others |

| By Application | Enhanced Oil Recovery (EOR) Geological Storage Carbon Utilization (e.g., in Building Materials, Chemicals, Fuels) Others |

| By Investment Source | Private Investments Public Funding International Grants Others |

| By Policy Support | Federal Incentives State Subsidies Tax Credits Others |

| By Technology | Chemical Absorption Physical Absorption Membrane Separation Catalytic Conversion Others |

| By Market Maturity | Emerging Technologies Established Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Energy Managers, Environmental Compliance Officers |

| Industrial Applications | 80 | Plant Managers, Process Engineers |

| Research Institutions | 60 | Research Scientists, Policy Analysts |

| Government Agencies | 40 | Regulatory Officials, Program Directors |

| Technology Providers | 50 | Product Development Managers, Sales Executives |

The USA Carbon Capture & Storage Market is valued at approximately USD 1.9 billion, driven by regulatory pressures, advancements in technology, and increased investments in sustainable energy solutions.