Region:Europe

Author(s):Dev

Product Code:KRAB0425

Pages:85

Published On:August 2025

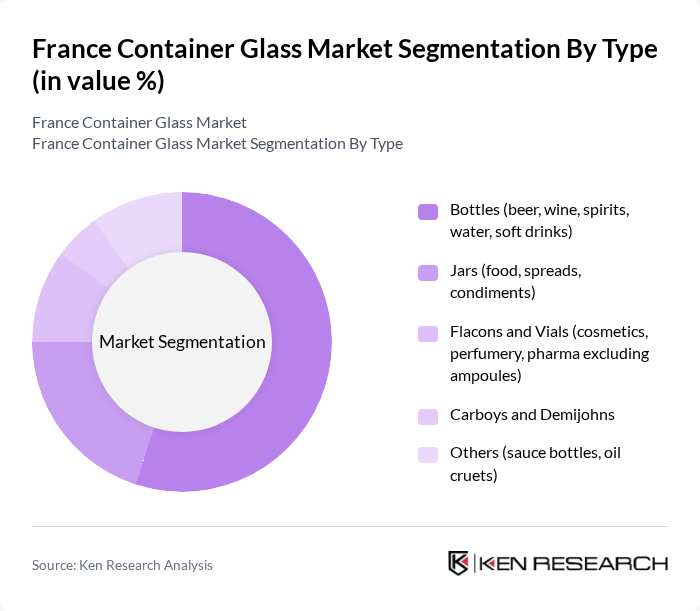

By Type:The container glass market can be segmented into various types, including bottles, jars, flacons and vials, carboys and demijohns, and others. Among these, bottles, particularly for beverages, dominate the market due to the increasing consumption of alcoholic and non-alcoholic drinks. The trend towards premiumization in the beverage sector has also led to a rise in demand for aesthetically pleasing and functional glass bottles .

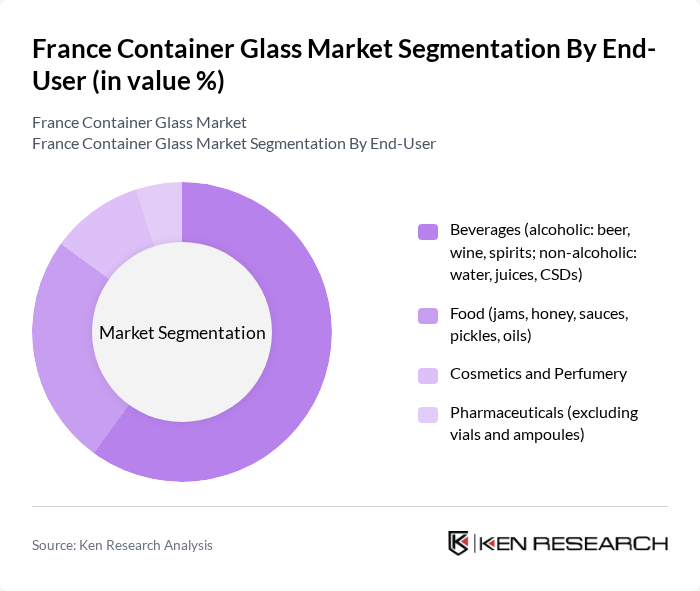

By End-User:The end-user segmentation includes beverages, food, cosmetics and perfumery, and pharmaceuticals. The beverage sector, particularly alcoholic beverages, is the leading end-user, driven by the growing trend of craft beers and premium wines. The increasing health consciousness among consumers has also led to a rise in demand for bottled water and juices, further solidifying the beverage sector's dominance .

The France Container Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Verallia France, O-I France (O-I Glass), Ardagh Glass Packaging – Europe, Saverglass, Stoelzle Glass Group, Heinz-Glas, SGD Pharma (France), Gerresheimer (Primary Packaging Glass, perfumery/cosmetics), BA Glass (France market supply), Vetropack (France import/supply), Verescence (perfumery and cosmetics glass), Arc Group (Arc France – glass containers and tableware), Bormioli Luigi (perfumery/spirits premium glass), Zignago Vetro (France supply for cosmetics/food), Owens-Illinois Puy-Guillaume Plant (site-level reference) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France container glass market appears promising, driven by increasing consumer awareness of sustainability and health. As the demand for eco-friendly packaging continues to rise, manufacturers are likely to invest in innovative production techniques and recycling technologies. Additionally, the growth of e-commerce and home delivery services is expected to further boost the demand for glass containers, as consumers seek safe and sustainable packaging options for their purchases. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles (beer, wine, spirits, water, soft drinks) Jars (food, spreads, condiments) Flacons and Vials (cosmetics, perfumery, pharma excluding ampoules) Carboys and Demijohns Others (sauce bottles, oil cruets) |

| By End-User | Beverages (alcoholic: beer, wine, spirits; non-alcoholic: water, juices, CSDs) Food (jams, honey, sauces, pickles, oils) Cosmetics and Perfumery Pharmaceuticals (excluding vials and ampoules) |

| By Application | Primary Packaging Secondary Refill/Reuse and Storage On-trade and Off-trade Distribution |

| By Distribution Channel | Direct to Beverage/Food/Beauty Brands (B2B) Through Fillers and Contract Packers Distributors/Wholesalers |

| By Price Range | Standard/Commodity Value-Added (decorated, colored, embossed) Premium/Luxury (perfumery, spirits) |

| By Material/Color | Flint (clear) Amber Green (including dead-leaf, emerald) Others (blue, black, specialty tints) |

| By Recycling Content | High cullet content (?50% recycled) Low-to-moderate cullet content (<50% recycled) |

| By Region | Île-de-France and Northern France Western France Eastern France (Grand Est, Bourgogne–Franche-Comté) Southern France (Nouvelle-Aquitaine, Occitanie, Provence–Alpes–Côte d’Azur) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Packaging Sector | 120 | Packaging Managers, Product Development Heads |

| Food Packaging Industry | 100 | Quality Assurance Managers, Supply Chain Coordinators |

| Pharmaceutical Glass Containers | 80 | Regulatory Affairs Specialists, Production Managers |

| Recycling and Sustainability Initiatives | 70 | Sustainability Officers, Environmental Compliance Managers |

| Retail and Distribution Channels | 90 | Logistics Managers, Sales Directors |

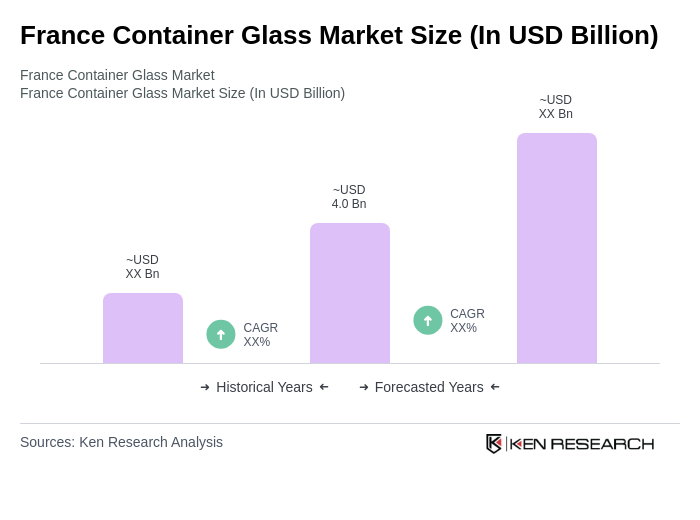

The France Container Glass Market is valued at approximately USD 4.0 billion, reflecting the significant demand for glass packaging in sectors such as beverages, food, cosmetics, and pharmaceuticals within the country's industrial ecosystem.