Region:Europe

Author(s):Shubham

Product Code:KRAC0890

Pages:90

Published On:August 2025

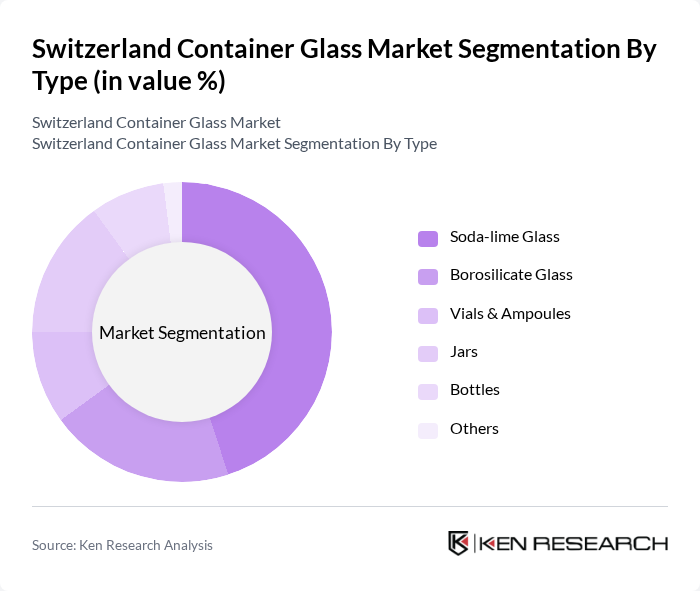

By Type:The container glass market can be segmented into various types, including Soda-lime Glass, Borosilicate Glass, Vials & Ampoules, Jars, Bottles, and Others. Each type serves distinct applications across different industries, with soda-lime glass being the most widely used due to its cost-effectiveness and versatility. Specialty glass types, such as borosilicate and flint glass, are increasingly adopted for high-end applications in pharmaceuticals and luxury beverages .

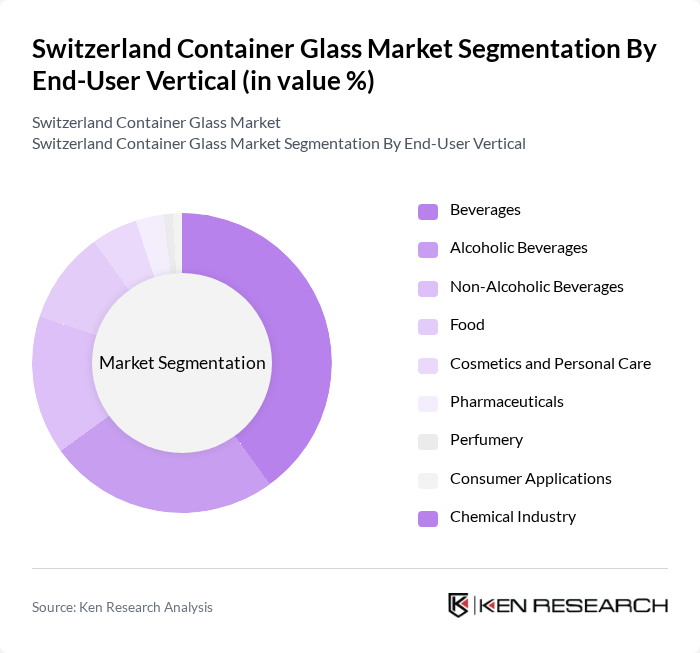

By End-User Vertical:The end-user verticals for container glass include Beverages, Alcoholic Beverages, Non-Alcoholic Beverages, Food, Cosmetics and Personal Care, Pharmaceuticals, Perfumery, Consumer Applications, and the Chemical Industry. The beverage sector, particularly alcoholic beverages, is a significant driver of demand due to the premium nature of glass packaging. Growth in premium and luxury products, expansion in e-commerce, and rising health and wellness consciousness are further supporting demand for glass containers in Switzerland .

The Switzerland Container Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vetropack Holding AG, Glasi Hergiswil AG, Glas Trösch AG, Wilco AG, Sigg Switzerland AG, Terxo AG, Glas Köchlin AG, Müller + Krempel AG, Vetrorecycling AG, Vetroreal AG, Zwiesel Kristallglas AG, Supermatic Plastic Packaging GmbH, FILL ME AG, Ardagh Group S.A., Verallia S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Switzerland container glass market appears promising, driven by increasing consumer awareness of sustainability and the ongoing shift towards eco-friendly packaging solutions. Innovations in glass recycling technologies are expected to enhance the efficiency of glass production, reducing costs and environmental impact. Additionally, the growth of e-commerce is likely to further influence packaging trends, with a focus on lightweight and customizable glass containers to meet diverse consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Soda-lime Glass Borosilicate Glass Vials & Ampoules Jars Bottles Others |

| By End-User Vertical | Beverages Alcoholic Beverages (Beer, Wine, Spirits, Cider, Other Fermented Drinks) Non-Alcoholic Beverages (Juices, Carbonated Drinks, Dairy-based Drinks, Other Non-Alcoholic) Food (Jam, Jelly, Marmalades, Honey, Sausages, Condiments, Oil, Pickles) Cosmetics and Personal Care Pharmaceuticals (excluding vials and ampoules) Perfumery Consumer Applications Chemical Industry |

| By Color | Green Amber Flint (Clear) Other Colors |

| By Distribution Channel | Direct Sales Retail Outlets E-commerce Platforms Wholesale Distributors |

| By Application | Packaging Storage Transportation Display |

| By Price Range | Economy Mid-Range Premium |

| By Sustainability Level | Recycled Glass Virgin Glass Eco-Friendly Coatings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Industry Packaging | 60 | Packaging Managers, Product Development Leads |

| Food Industry Container Usage | 50 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Glass Packaging | 40 | Regulatory Affairs Specialists, Production Managers |

| Cosmetics and Personal Care Packaging | 40 | Brand Managers, Packaging Engineers |

| Recycling and Sustainability Initiatives | 40 | Sustainability Managers, Environmental Compliance Officers |

The Switzerland Container Glass Market is valued at approximately USD 500 million, reflecting a significant growth trend driven by increasing demand for sustainable packaging solutions and the rise in the food and beverage sectors.