Region:Europe

Author(s):Rebecca

Product Code:KRAC0243

Pages:94

Published On:August 2025

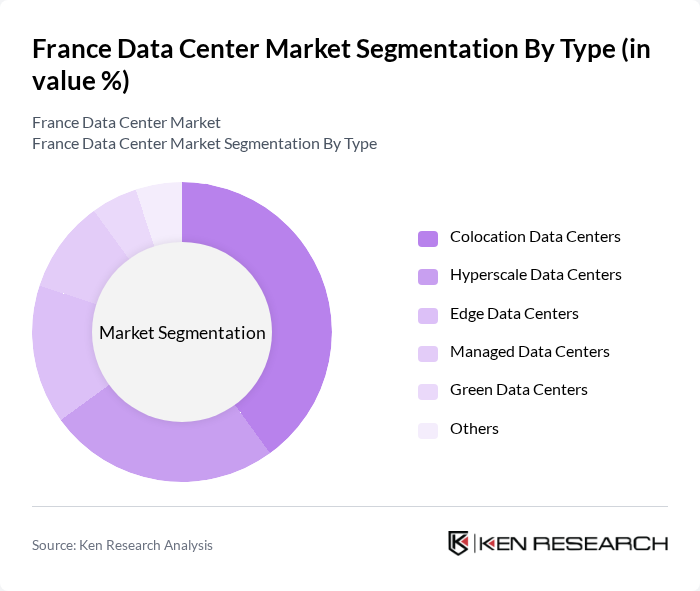

By Type:The market is segmented into Colocation Data Centers, Hyperscale Data Centers, Edge Data Centers, Managed Data Centers, Green Data Centers, and Others. Colocation Data Centers are currently leading the market due to their flexibility and cost-effectiveness, allowing businesses to share resources while maintaining control over their data. The increasing trend of outsourcing IT infrastructure and the need for scalable, secure environments are further propelling the growth of this segment.

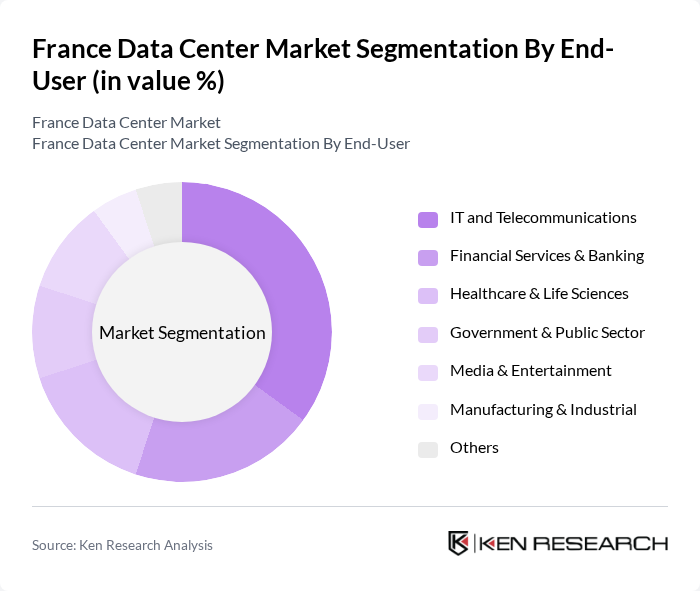

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services & Banking, Healthcare & Life Sciences, Government & Public Sector, Media & Entertainment, Manufacturing & Industrial, and Others. The IT and Telecommunications sector is the dominant segment, driven by the increasing demand for cloud computing and data storage solutions. As businesses continue to digitize their operations and prioritize data security and compliance, the reliance on data centers for IT infrastructure is expected to grow significantly.

The France Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Digital Realty, OVHcloud, Interxion (a Digital Realty company), Scaleway, Colt Technology Services, KDDI Corporation, NTT Communications, Telehouse, Global Switch, DATA4 Group, 3i Infrastructure, GTT Communications, Claranet, Orange Business Services, Iliad Datacenter, Bouygues Telecom, Atos, Thésée DataCenter, Euclyde Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France data center market appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to embrace cloud computing and IoT, the demand for data centers is expected to rise significantly. Furthermore, the focus on sustainability and energy efficiency will likely lead to innovations in data center design and operation, ensuring that they meet both regulatory requirements and environmental standards. Strategic investments in renewable energy sources will also play a crucial role in shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Hyperscale Data Centers Edge Data Centers Managed Data Centers Green Data Centers Others |

| By End-User | IT and Telecommunications Financial Services & Banking Healthcare & Life Sciences Government & Public Sector Media & Entertainment Manufacturing & Industrial Others |

| By Application | Cloud Services Big Data Analytics Disaster Recovery & Business Continuity Content Delivery & Streaming High Performance Computing (HPC) Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Colocation Services Others |

| By Ownership Model | Owned Data Centers Leased Data Centers Managed Services Joint Venture Data Centers Others |

| By Deployment Type | On-Premises Off-Premises Hybrid Edge Others |

| By Investment Source | Private Investments Public Funding Venture Capital Infrastructure Funds Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Hyperscale Data Centers | 80 | Cloud Architects, Operations Managers |

| Edge Computing Solutions | 60 | Network Engineers, Infrastructure Planners |

| Managed Services | 70 | Service Delivery Managers, Technical Account Managers |

| Energy Efficiency Initiatives | 40 | Sustainability Managers, Facility Managers |

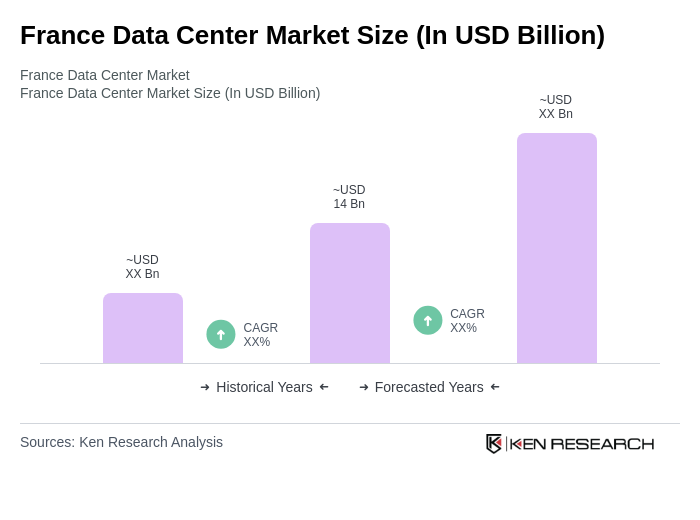

The France Data Center Market is valued at approximately USD 14 billion, driven by increasing demand for cloud services, big data analytics, and disaster recovery solutions. This growth reflects a robust performance in the digital infrastructure sector.