Jakarta Data Center Market Overview

- The Jakarta Data Center Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the surging demand for cloud services, accelerated digital transformation, and the rapid expansion of e-commerce in the region. The proliferation of internet connectivity, adoption of AI and IoT, and the need for secure, scalable data storage and processing capabilities have further fueled the market's momentum .

- Jakarta, as the capital city of Indonesia, leads the data center market due to its strategic geographic location, advanced infrastructure, and the increasing presence of global and regional technology companies. The city's supportive business climate, government-backed digital economy initiatives, and robust connectivity have established Jakarta as a core hub for data center investments and operations .

- The Indonesian government strengthened data privacy and security requirements for data centers through Government Regulation No. 71 of 2019 on the Implementation of Electronic Systems and Transactions, issued by the President of the Republic of Indonesia. This regulation mandates that all public electronic system operators store and process data within Indonesian territory, comply with strict data protection standards, and implement robust cybersecurity measures. These requirements are designed to safeguard consumer information, enhance digital trust, and stimulate further investment in the data center sector .

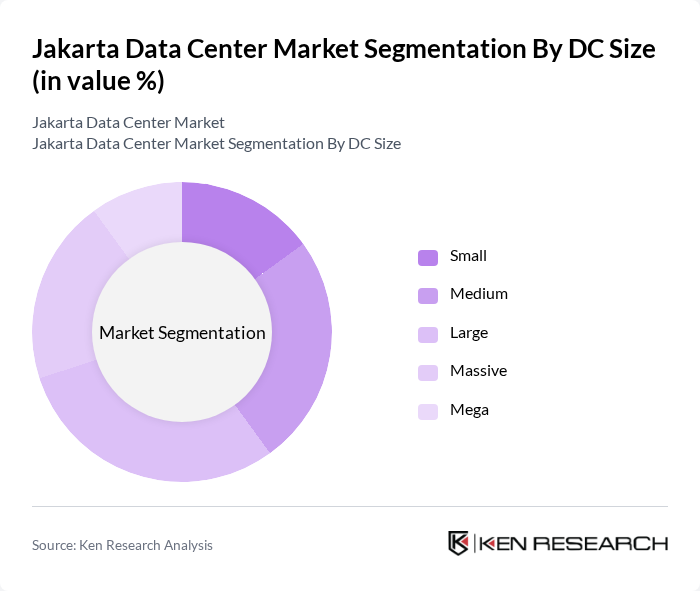

Jakarta Data Center Market Segmentation

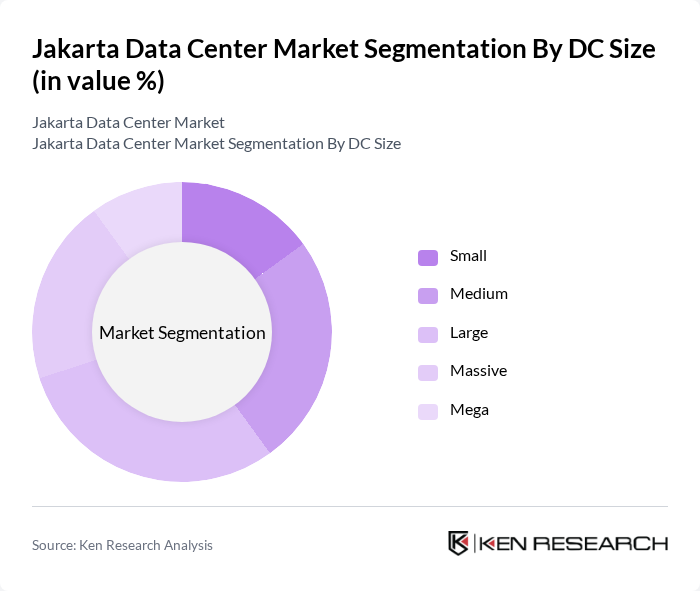

By DC Size:The Jakarta Data Center Market is segmented by data center size, including small, medium, large, massive, and mega data centers. Each category addresses distinct market needs: small and medium facilities typically serve local enterprises and startups, while large, massive, and mega data centers cater to hyperscale cloud providers, multinational corporations, and organizations with high-density computing and storage requirements. The surge in digital services, cloud adoption, and AI-driven workloads has intensified demand for larger-scale data centers .

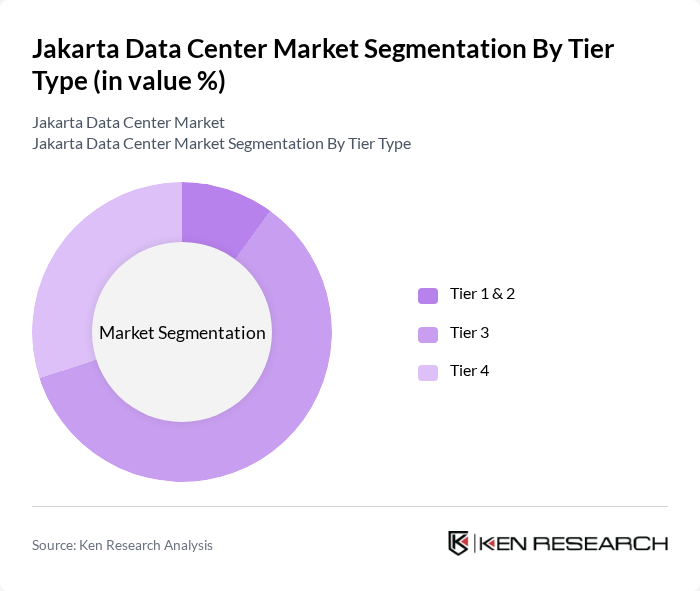

By Tier Type:The market is also segmented by tier type, which includes Tier 1 & 2, Tier 3, and Tier 4 data centers. Tier 3 data centers are particularly prominent in Jakarta, offering a balance between operational reliability, redundancy, and cost efficiency, making them suitable for a wide range of business applications. The increasing emphasis on uptime, disaster recovery, and regulatory compliance has driven the adoption of Tier 3 and Tier 4 facilities, especially among financial institutions, hyperscalers, and enterprises with mission-critical workloads .

Jakarta Data Center Market Competitive Landscape

The Jakarta Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telkomsigma, DCI Indonesia, NTT Global Data Centers Indonesia, Indosat Ooredoo Hutchison, Biznet Data Center, Princeton Digital Group, Alibaba Cloud, Microsoft Azure, Google Cloud, Amazon Web Services (AWS), EdgeConneX, Equinix, Digital Realty, OVHcloud, Iron Mountain contribute to innovation, geographic expansion, and service delivery in this space.

Jakarta Data Center Market Industry Analysis

Growth Drivers

- Increasing Demand for Cloud Services:The Jakarta data center market is experiencing a surge in demand for cloud services, driven by a projected increase in cloud adoption rates. In future, the cloud services market in Indonesia is expected to reach approximately $1.8 billion, reflecting a year-on-year growth of 20%. This growth is fueled by businesses transitioning to cloud-based solutions for enhanced scalability and flexibility, as well as the need for remote work capabilities, which have become essential post-pandemic.

- Expansion of Digital Infrastructure:The Indonesian government has committed to investing $1.5 billion in digital infrastructure in future, aiming to improve internet connectivity and data center capabilities. This investment is expected to enhance the overall digital ecosystem, facilitating the growth of data centers in Jakarta. Improved infrastructure will support higher bandwidth and lower latency, making Jakarta an attractive location for both local and international businesses seeking reliable data services.

- Government Initiatives for Data Localization:The Indonesian government has implemented data localization laws requiring companies to store data within national borders. In future, it is estimated that 75% of businesses will comply with these regulations, driving demand for local data centers. This initiative not only enhances data security but also promotes the growth of the local data center market, as companies seek to establish facilities that meet regulatory requirements and ensure data sovereignty.

Market Challenges

- High Operational Costs:Operating a data center in Jakarta involves significant costs, with average operational expenses estimated at $1.5 million annually per facility. These costs include energy consumption, maintenance, and staffing. As energy prices continue to rise, data center operators face challenges in maintaining profitability while providing competitive pricing for their services, which can hinder market growth and investment.

- Regulatory Compliance Complexities:Navigating the regulatory landscape in Indonesia poses challenges for data center operators. Compliance with various laws, including data protection and energy efficiency regulations, can be cumbersome and costly. In future, it is anticipated that compliance costs will increase by 20%, further straining resources for operators. This complexity can deter new entrants and limit the expansion of existing facilities, impacting overall market growth.

Jakarta Data Center Market Future Outlook

The Jakarta data center market is poised for significant transformation, driven by technological advancements and evolving consumer demands. As businesses increasingly adopt hybrid cloud solutions, the need for flexible and scalable data center services will rise. Additionally, the integration of IoT technologies will enhance operational efficiencies, while a growing emphasis on sustainability will push operators to adopt greener practices. These trends indicate a dynamic market landscape, with opportunities for innovation and investment in the coming years.

Market Opportunities

- Growth in AI and Machine Learning Applications:The increasing adoption of AI and machine learning technologies presents a significant opportunity for data centers in Jakarta. In future, the AI market in Indonesia is projected to reach $1.5 billion, driving demand for high-performance computing resources. Data centers can capitalize on this trend by offering specialized services tailored to AI workloads, enhancing their competitive edge in the market.

- Partnerships with Telecom Providers:Collaborations with telecom providers can create synergies that enhance service offerings in the Jakarta data center market. In future, partnerships are expected to increase by 40%, enabling data centers to leverage improved connectivity and expand their customer base. These alliances can facilitate the development of innovative solutions, such as edge computing, which will be crucial for meeting the demands of a digitally connected society.