Region:Europe

Author(s):Shubham

Product Code:KRAB4972

Pages:91

Published On:October 2025

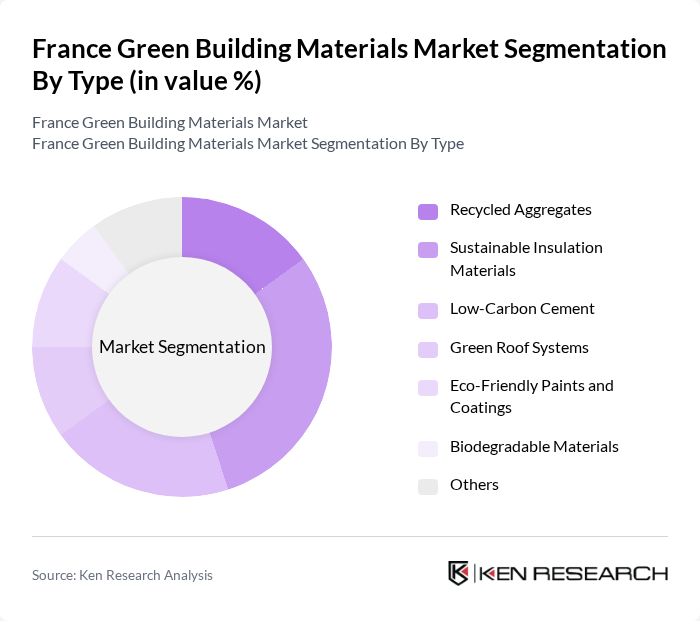

By Type:The market is segmented into various types of green building materials, including Recycled Aggregates, Sustainable Insulation Materials, Low-Carbon Cement, Green Roof Systems, Eco-Friendly Paints and Coatings, Biodegradable Materials, and Others. Sustainable Insulation Materials currently lead the market due to their essential role in enhancing energy efficiency and meeting regulatory requirements for thermal performance. The growing trend towards energy-efficient construction and renovation projects has significantly increased the demand for these materials, as they help reduce energy consumption and improve indoor comfort. Recycled Aggregates are also gaining traction for their cost-effectiveness and environmental benefits, while Low-Carbon Cement is increasingly adopted to meet carbon reduction targets .

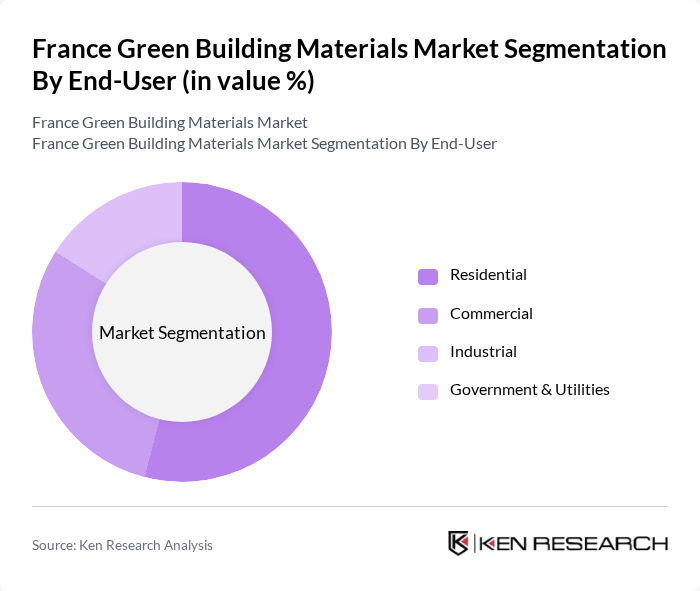

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the most significant contributor to the market, accounting for over half of total revenue, driven by increasing consumer awareness of sustainable living and energy-efficient homes. The trend towards eco-friendly housing solutions and regulatory mandates for new residential buildings have led to a surge in demand for green building materials in residential construction, making it a key focus area for manufacturers and suppliers. The Commercial sector follows closely, with businesses seeking to enhance sustainability profiles and reduce operational costs through energy-efficient buildings .

The France Green Building Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, Lafarge (Holcim Group), Knauf Insulation, Rockwool International, BASF SE, Kingspan Group, Sika AG, Etex Group, CEMEX S.A.B. de C.V., Wienerberger AG, Tarkett S.A., Soprema Group, Vicat Group, Interface, Inc., Owens Corning contribute to innovation, geographic expansion, and service delivery in this space .

The future of the green building materials market in France appears promising, driven by increasing regulatory support and consumer demand for sustainability. In future, the integration of smart technologies and energy-efficient solutions is expected to become standard in new constructions. Additionally, the ongoing expansion of eco-friendly building codes will likely enhance the market landscape, encouraging innovation and investment in sustainable materials. As awareness of environmental issues continues to grow, the market is poised for significant transformation.

| Segment | Sub-Segments |

|---|---|

| By Type | Recycled Aggregates Sustainable Insulation Materials Low-Carbon Cement Green Roof Systems Eco-Friendly Paints and Coatings Biodegradable Materials Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Infrastructure Development Landscaping |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Material Source | Local Sourcing Imported Materials Recycled Sources |

| By Price Range | Budget-Friendly Options Mid-Range Products Premium Offerings |

| By Certification Type | LEED Certified BREEAM Certified HQE Certified ISO Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Green Building Projects | 60 | Homeowners, Architects, Contractors |

| Commercial Green Building Developments | 50 | Property Developers, Project Managers, Sustainability Consultants |

| Public Sector Green Initiatives | 40 | Government Officials, Urban Planners, Environmental Policy Makers |

| Green Material Suppliers | 45 | Manufacturers, Distributors, Sales Managers |

| End-User Feedback on Green Materials | 55 | Homeowners, Commercial Property Managers, Facility Managers |

The France Green Building Materials Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by increasing environmental awareness, government regulations, and a demand for sustainable construction practices.