Region:Asia

Author(s):Rebecca

Product Code:KRAB2923

Pages:83

Published On:October 2025

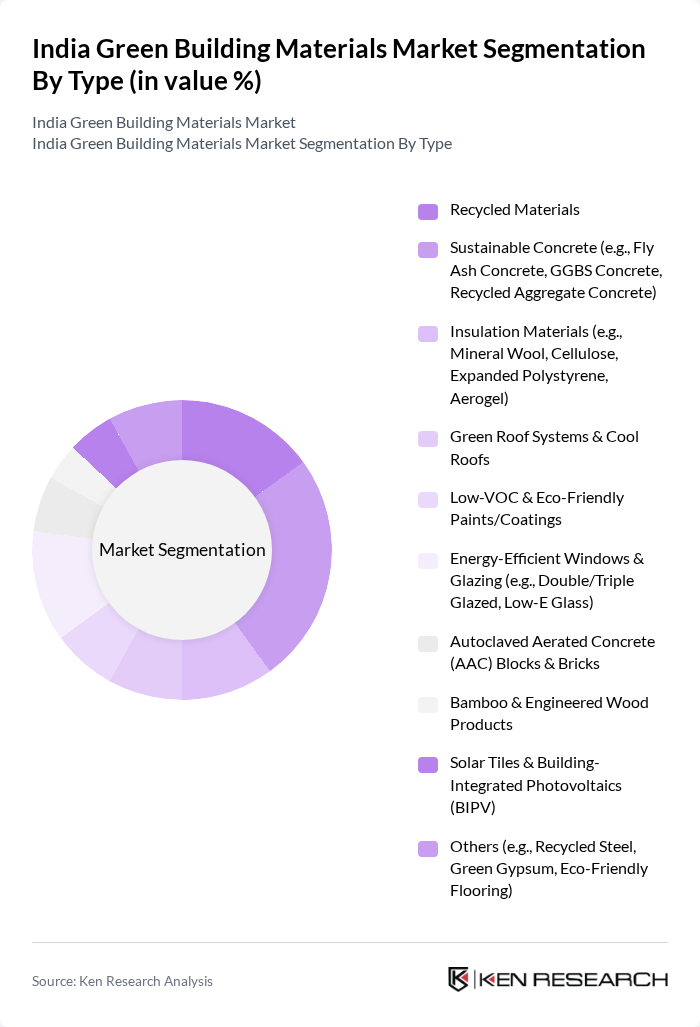

By Type:The market is segmented into various types of green building materials, each catering to specific construction needs. The subsegments include Recycled Materials, Sustainable Concrete (such as Fly Ash Concrete, GGBS Concrete, and Recycled Aggregate Concrete), Insulation Materials (including Mineral Wool, Cellulose, Expanded Polystyrene, and Aerogel), Green Roof Systems & Cool Roofs, Low-VOC & Eco-Friendly Paints/Coatings, Energy-Efficient Windows & Glazing (like Double/Triple Glazed and Low-E Glass), Autoclaved Aerated Concrete (AAC) Blocks & Bricks, Bamboo & Engineered Wood Products, Solar Tiles & Building-Integrated Photovoltaics (BIPV), and Others (such as Recycled Steel, Green Gypsum, and Eco-Friendly Flooring). The adoption of these materials is driven by their ability to enhance energy efficiency, reduce environmental impact, and comply with national green building standards .

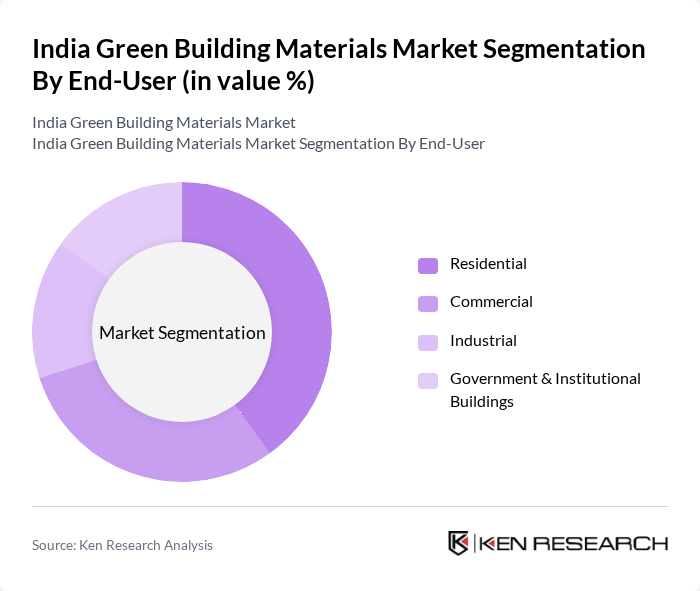

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Institutional Buildings. Each segment has unique requirements and preferences for green building materials, influenced by factors such as budget, sustainability goals, and regulatory compliance. The residential sector is witnessing a surge in demand for eco-friendly materials as homeowners become more environmentally conscious, while commercial and government projects are increasingly adopting green certifications to enhance their sustainability profiles. The residential segment remains the largest and fastest-growing end use, reflecting heightened consumer awareness and policy incentives .

The India Green Building Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain India Pvt. Ltd., UltraTech Cement Ltd., ACC Limited, Tata Steel Limited, JSW Steel Ltd., Birla Aerocon (CK Birla Group), Knauf Insulation India Pvt. Ltd., EcoGreen Products Pvt. Ltd., Greenply Industries Ltd., Asian Paints Ltd., Godrej & Boyce Manufacturing Co. Ltd., Mahindra Lifespace Developers Ltd., HIL Limited (CK Birla Group), Armstrong World Industries India Pvt. Ltd., RAK Ceramics India Pvt. Ltd., Visaka Industries Ltd., Ramco Industries Ltd., JSW Cement Ltd., Everest Industries Ltd., Owens Corning India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India green building materials market appears promising, driven by increasing urbanization and a shift towards sustainable construction practices. As cities expand, the demand for eco-friendly materials is expected to rise significantly. Additionally, the integration of smart technologies and circular economy principles will likely enhance the efficiency and sustainability of building projects. With ongoing government support and rising consumer awareness, the market is poised for substantial growth in future, fostering a more sustainable built environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Recycled Materials Sustainable Concrete (e.g., Fly Ash Concrete, GGBS Concrete, Recycled Aggregate Concrete) Insulation Materials (e.g., Mineral Wool, Cellulose, Expanded Polystyrene, Aerogel) Green Roof Systems & Cool Roofs Low-VOC & Eco-Friendly Paints/Coatings Energy-Efficient Windows & Glazing (e.g., Double/Triple Glazed, Low-E Glass) Autoclaved Aerated Concrete (AAC) Blocks & Bricks Bamboo & Engineered Wood Products Solar Tiles & Building-Integrated Photovoltaics (BIPV) Others (e.g., Recycled Steel, Green Gypsum, Eco-Friendly Flooring) |

| By End-User | Residential Commercial Industrial Government & Institutional Buildings |

| By Region | North India South India East India West India |

| By Application | New Residential Construction New Commercial Construction Infrastructure Projects (e.g., Airports, Metro, Smart Cities) Renovation and Retrofitting of Existing Buildings |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Green Bonds |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Channel | Direct Sales (B2B) Online Retail & E-commerce Distributors and Wholesalers Others (e.g., Project Contractors, Green Building Consultants) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Architectural Firms | 60 | Lead Architects, Sustainability Consultants |

| Construction Companies | 50 | Project Managers, Site Engineers |

| Material Suppliers | 40 | Sales Managers, Product Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| End-Users (Homeowners & Developers) | 50 | Homeowners, Real Estate Developers |

The India Green Building Materials Market is valued at approximately USD 14 billion, driven by increasing awareness of sustainable construction practices and government initiatives promoting green building standards.