Region:Europe

Author(s):Shubham

Product Code:KRAB3186

Pages:84

Published On:October 2025

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Among these, Individual Health Insurance is currently the leading sub-segment, driven by the increasing awareness of personal health management and the growing trend of self-insurance among consumers. Family Health Insurance is also gaining traction as families seek comprehensive coverage for all members.

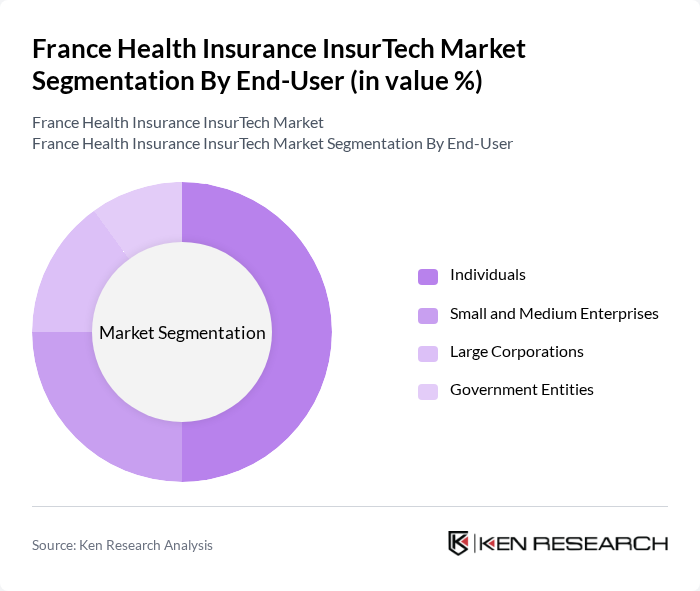

By End-User:The market is segmented by end-users, including Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. The Individual segment is the most significant, as more people are opting for personal health insurance plans to ensure better healthcare access. SMEs are also increasingly investing in health insurance for their employees, recognizing its importance in attracting and retaining talent.

The France Health Insurance InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alan, Luko, Qare, Shift Technology, Leocare, Daba, Assurly, Lovys, Healthily, WeSave, YAPILI, Lifen, Doctolib, MyHealthBox, Cegedim contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France Health Insurance InsurTech market appears promising, driven by ongoing technological advancements and a shift towards digital health solutions. As consumer preferences evolve, companies are likely to focus on enhancing customer experience through personalized offerings and improved engagement strategies. Additionally, the integration of telemedicine and AI-driven products will play a crucial role in shaping the market landscape, enabling insurers to meet the growing demand for innovative and cost-effective health insurance solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Small and Medium Enterprises Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Policy Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Customer Segment | Young Adults Families Seniors |

| By Payment Model | Pay-as-you-go Subscription-based One-time Payment |

| By Coverage Area | National Coverage International Coverage Regional Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Providers | 150 | CEOs, Product Managers, Compliance Officers |

| Policyholders | 200 | Individual Policyholders, Family Plan Holders |

| Healthcare Professionals | 100 | Doctors, Hospital Administrators, Clinic Managers |

| InsurTech Startups | 80 | Founders, CTOs, Business Development Managers |

| Regulatory Bodies | 50 | Policy Analysts, Regulatory Affairs Specialists |

The France Health Insurance InsurTech Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by the adoption of digital health solutions and the demand for personalized insurance products.