Region:Asia

Author(s):Shubham

Product Code:KRAB1305

Pages:84

Published On:October 2025

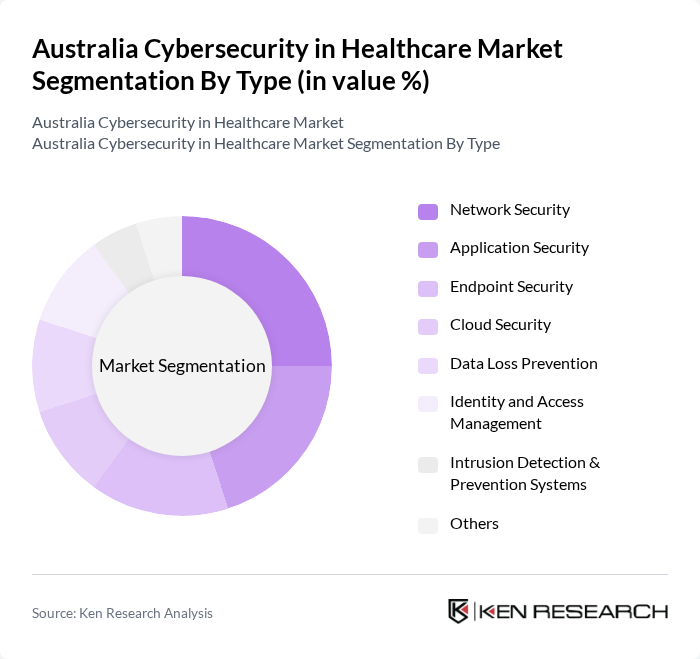

By Type:The market is segmented into Network Security, Application Security, Endpoint Security, Cloud Security, Data Loss Prevention, Identity and Access Management, Intrusion Detection & Prevention Systems, and Others. Each segment addresses specific vulnerabilities in healthcare IT environments. Network Security and Application Security are prioritized due to the prevalence of ransomware and phishing attacks, while Cloud Security and Identity and Access Management are rapidly growing as healthcare organizations migrate to cloud-based platforms and telehealth solutions .

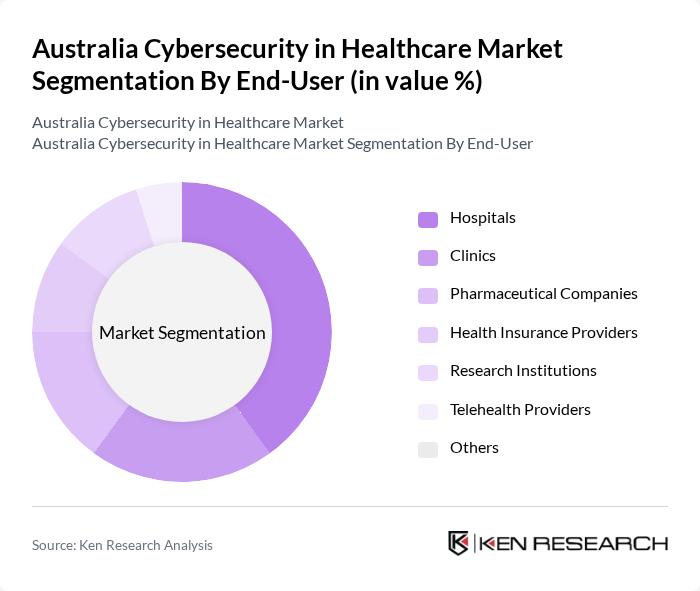

By End-User:The end-user segmentation comprises Hospitals, Clinics, Pharmaceutical Companies, Health Insurance Providers, Research Institutions, Telehealth Providers, and Others. Hospitals and large clinics are the dominant end-users, reflecting their extensive digital infrastructure and the volume of sensitive data managed. Telehealth Providers and Health Insurance Providers are seeing rapid growth in cybersecurity demand due to increased remote care and digital claims processing .

The Australia Cybersecurity in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Fortinet, McAfee, Check Point Software Technologies, Cisco Systems, Trend Micro, IBM Security, FireEye (now Trellix), Sophos, CrowdStrike, RSA Security, CyberArk Software, Proofpoint, Mimecast, Splunk, Broadcom (Symantec), Telstra, Tesserent, CyberCX, Secure Code Warrior contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in Australia's healthcare sector appears promising, driven by technological advancements and increasing regulatory pressures. As organizations continue to adopt cloud-based solutions and integrate AI technologies, the demand for innovative cybersecurity measures will grow. Additionally, the ongoing emphasis on patient-centric security will lead to the development of tailored solutions that enhance data protection. Overall, the market is poised for significant evolution, with a focus on resilience and adaptability in the face of emerging threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Loss Prevention Identity and Access Management Intrusion Detection & Prevention Systems Others |

| By End-User | Hospitals Clinics Pharmaceutical Companies Health Insurance Providers Research Institutions Telehealth Providers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Managed Services Training and Education |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| By Compliance Standards | ISO/IEC 27001 HIPAA Compliance GDPR Compliance NIST Cybersecurity Framework |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Cybersecurity Strategies | 100 | IT Security Managers, Chief Information Officers |

| Healthcare Provider Cybersecurity Budgets | 80 | Finance Directors, Procurement Officers |

| Telehealth Security Measures | 60 | Telehealth Coordinators, IT Specialists |

| Cybersecurity Training Programs | 50 | HR Managers, Compliance Officers |

| Incident Response Protocols | 70 | Risk Management Officers, Cybersecurity Analysts |

The Australia Cybersecurity in Healthcare Market is valued at approximately USD 970 million, reflecting significant growth driven by increased digitization, rising cyber threats, and regulatory compliance requirements within the healthcare sector.