Region:Europe

Author(s):Shubham

Product Code:KRAB0545

Pages:94

Published On:August 2025

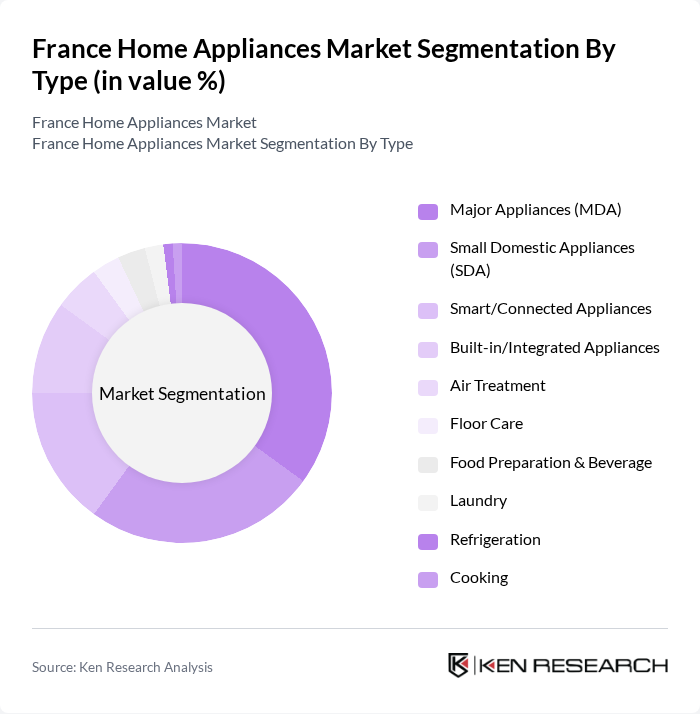

By Type:The market is segmented into various types of appliances, including Major Appliances (MDA), Small Domestic Appliances (SDA), Smart/Connected Appliances, Built-in/Integrated Appliances, Air Treatment, Floor Care, Food Preparation & Beverage, Laundry, Refrigeration, and Cooking. Each of these segments caters to different consumer needs and preferences, with a notable trend towards smart and energy-efficient products.

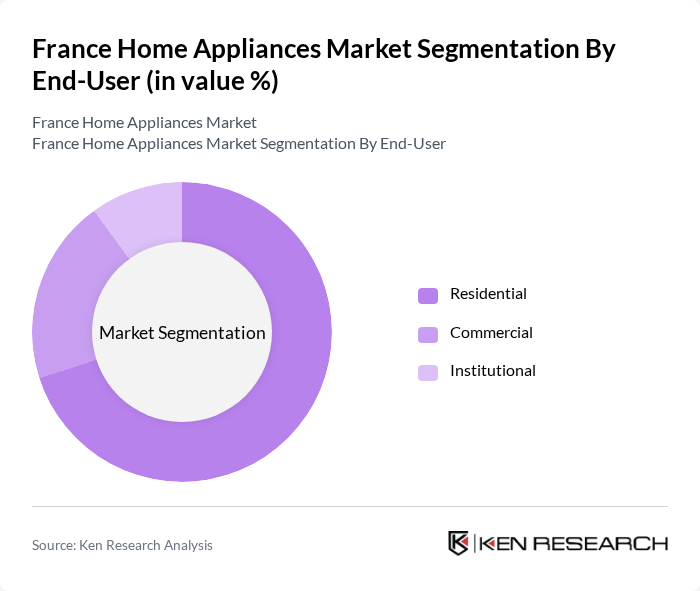

By End-User:The end-user segmentation includes Residential, Commercial, and Institutional categories. The residential segment is the largest, driven by increasing household incomes and a growing trend towards home automation. The commercial segment, including hospitality and foodservice, is also significant, as businesses invest in high-quality appliances to enhance service delivery.

The France Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, BSH Hausgeräte GmbH (Bosch, Siemens, Neff), Electrolux AB (including AEG), LG Electronics Inc., Samsung Electronics Co., Ltd., Miele & Cie. KG, Haier Group (including Candy, Hoover), Panasonic Corporation, Gorenje d.d. (a Hisense company), Arçelik A.?. (including Beko, Grundig), SEB Groupe (Tefal, Rowenta, Moulinex, Krups, WMF), De’Longhi Group (De’Longhi, Kenwood, Braun Household), SHARP Corporation, Indesit Company (part of Whirlpool), Smeg S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France home appliances market appears promising, driven by the increasing integration of smart technology and a growing emphasis on sustainability. As consumers become more environmentally conscious, the demand for eco-friendly and energy-efficient products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer preferences and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances (MDA) Small Domestic Appliances (SDA) Smart/Connected Appliances (cross-cutting) Built-in/Integrated Appliances Air Treatment (AC, air purifiers, dehumidifiers) Floor Care (vacuum cleaners, robot vacuums) Food Preparation & Beverage (blenders, coffee machines) Laundry (washing machines, dryers) Refrigeration (refrigerators, freezers) Cooking (ovens, cooktops, hoods, microwaves) |

| By End-User | Residential Commercial (hospitality, foodservice, laundromats) Institutional (healthcare, education, public facilities) |

| By Sales Channel | Offline Retail (GSS/Hypermarkets, specialty chains) Online Retail (e-commerce marketplaces, D2C) Distributors/Wholesalers (B2B) |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Energy Label | A to B (high efficiency) C to D (mid efficiency) E and below (legacy/low efficiency) |

| By Connectivity | Non-connected Wi?Fi/Voice Assistant Enabled App/IoT Ecosystem Integrated |

| By Installation | Freestanding Built-in/Integrated |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 120 | Homeowners, Renters, First-time Buyers |

| Kitchen Appliance Preferences | 100 | Home Cooks, Kitchen Designers |

| Energy Efficiency Awareness | 80 | Environmentally Conscious Consumers, Energy Auditors |

| Smart Appliance Adoption | 70 | Tech-savvy Consumers, Early Adopters |

| Post-purchase Satisfaction | 90 | Recent Appliance Buyers, Customer Service Representatives |

The France Home Appliances Market is valued at approximately USD 22 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, alongside rising disposable incomes and urbanization.