Region:Middle East

Author(s):Shubham

Product Code:KRAC0889

Pages:99

Published On:August 2025

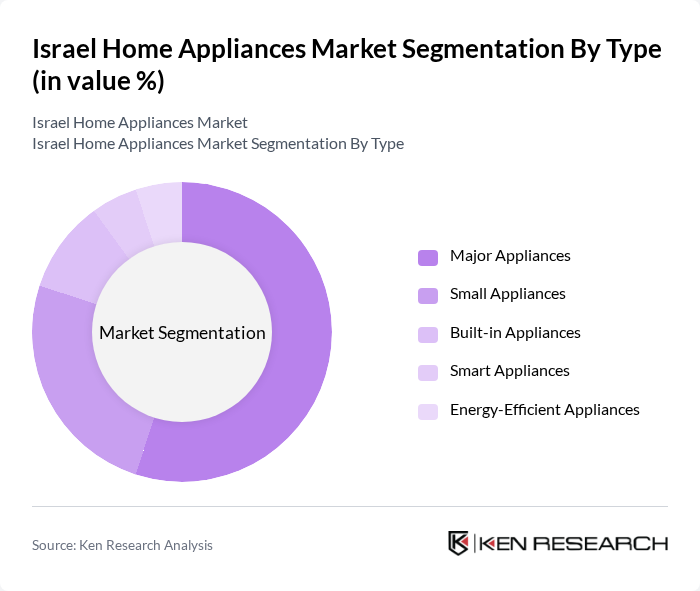

By Type:The market is segmented into various types of appliances, including major appliances, small appliances, built-in appliances, smart appliances, and energy-efficient appliances. Major appliances, such as refrigerators, washing machines, and air conditioners, dominate the market due to their essential role in daily household activities. Small appliances, including coffee makers, vacuum cleaners, and blenders, also hold a significant share as they cater to convenience and efficiency in modern living. The adoption of smart and energy-efficient appliances is increasing, driven by consumer interest in connectivity, automation, and sustainability .

By End-User:The home appliances market is divided into residential and commercial segments. The residential segment is the largest, driven by the increasing number of households, urbanization, and the demand for modern conveniences. The commercial segment, while smaller, is growing due to the expansion of businesses and the need for efficient appliances in restaurants, hotels, and offices. Growth in both segments is further supported by the proliferation of multi-branded and specialty retail outlets, as well as online distribution channels .

The Israel Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Electra Consumer Products Ltd., Whirlpool Israel Ltd., Samsung Electronics Israel Ltd., LG Electronics Israel Ltd., Haier Israel Ltd., Bosch Home Appliances Israel, Miele Israel Ltd., Philips Israel Ltd., Gorenje Israel Ltd., BSH Home Appliances Ltd., Sharp Electronics Israel Ltd., Panasonic Israel Ltd., Electrolux Israel Ltd., Smeg Israel Ltd., Arçelik A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The Israel home appliances market is poised for significant transformation as consumer preferences shift towards smart and energy-efficient products. With urbanization and rising disposable incomes, the demand for innovative appliances is expected to grow. Additionally, the increasing focus on sustainability will drive manufacturers to develop eco-friendly products. As e-commerce continues to expand, companies will need to enhance their online presence to capture the evolving consumer base, ensuring they remain competitive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances (Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Ovens, Air Conditioners, Other Major Appliances) Small Appliances (Coffee/Tea Makers, Food Processors, Grills and Roasters, Vacuum Cleaners, Other Small Appliances) Built-in Appliances Smart Appliances Energy-Efficient Appliances |

| By End-User | Residential Commercial |

| By Sales Channel | Multi-Branded Stores Flagship Stores Specialty Stores Online Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Technology | Smart Conventional Hybrid Energy Star Rated IoT Enabled |

| By Region | Central Region Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 120 | Homeowners, Renters, First-time Buyers |

| Kitchen Appliance Preferences | 90 | Chefs, Home Cooks, Kitchen Designers |

| Energy Efficiency Awareness | 60 | Environmentally Conscious Consumers, Utility Company Professionals |

| Post-Purchase Satisfaction | 100 | Recent Appliance Buyers, Customer Service Professionals |

| Retail Experience Feedback | 70 | Retail Staff, Store Managers, Customer Experience Specialists |

The Israel Home Appliances Market is valued at approximately USD 460 million, reflecting a five-year historical analysis. This valuation indicates a growing demand for modern and energy-efficient appliances among consumers in Israel.