Region:Europe

Author(s):Rebecca

Product Code:KRAA0374

Pages:84

Published On:August 2025

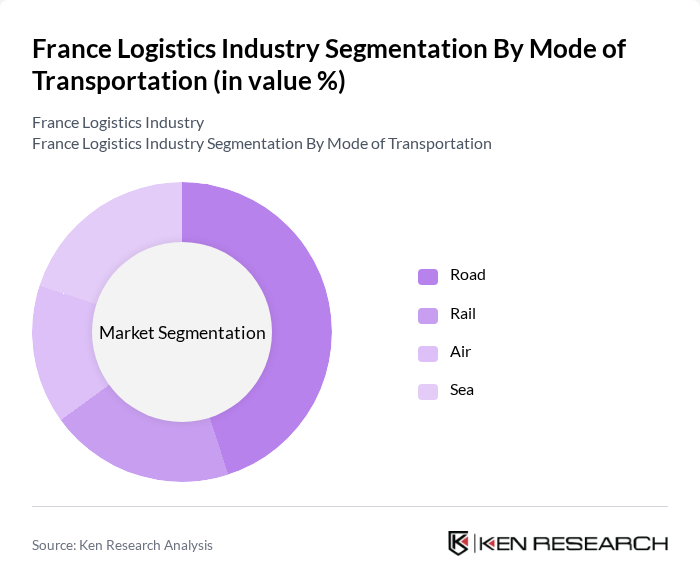

By Mode of Transportation:The logistics industry in France is segmented by mode of transportation, which includes road, rail, air, and sea. Each mode plays a crucial role in the overall logistics framework. Road transport is the most widely used due to its flexibility, extensive network, and ability to provide door-to-door services across both urban and rural areas. Rail transport is preferred for bulk and heavy goods, offering cost-effective and sustainable solutions for long-distance shipments. Air transport is essential for high-value and time-sensitive deliveries, supporting France's role in international trade. Sea transport is vital for large-volume international shipments, especially through major ports such as Marseille, and is recognized for its cost efficiency and lower carbon emissions compared to air .

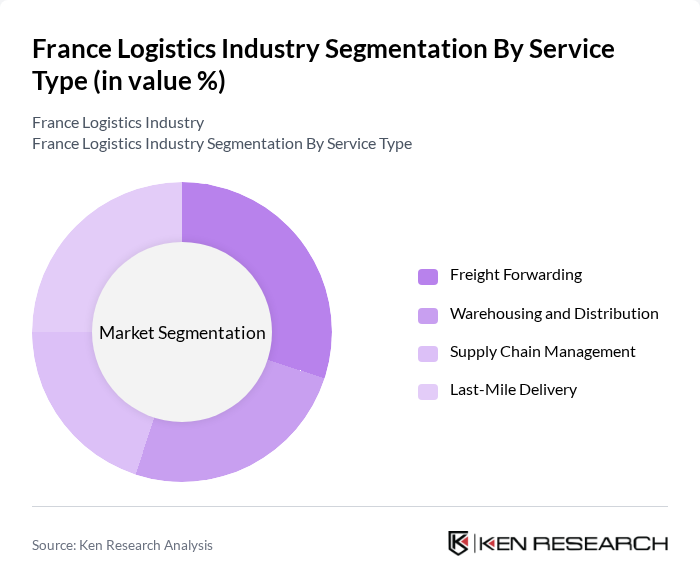

By Service Type:The logistics industry is also segmented by service type, which includes freight forwarding, warehousing and distribution, supply chain management, and last-mile delivery. Freight forwarding is critical for managing the movement of goods across borders and coordinating multimodal shipments. Warehousing and distribution ensure efficient storage, inventory management, and timely dispatch of goods. Supply chain management integrates logistics functions, leveraging technology to optimize processes and reduce costs. Last-mile delivery, increasingly important due to e-commerce growth, focuses on the final leg of the delivery process to consumers, emphasizing speed and reliability .

The France Logistics Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, XPO Logistics, DB Schenker, Kuehne + Nagel, DPDgroup (La Poste Group), Bolloré Logistics, CMA CGM, STEF, FM Logistic, Dachser, Rhenus Logistics, ID Logistics, Groupe CAT, UPS Supply Chain Solutions, DHL Supply Chain & Global Forwarding contribute to innovation, geographic expansion, and service delivery in this space.

The logistics industry in France is poised for transformative growth driven by technological advancements and increased e-commerce demand. As companies invest in automation and data analytics, operational efficiencies are expected to improve significantly. Additionally, government infrastructure investments will enhance connectivity, further supporting logistics operations. However, addressing labor shortages and regulatory compliance will be crucial for sustaining growth. Overall, the sector is likely to evolve rapidly, adapting to changing consumer behaviors and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Rail Air Sea |

| By Service Type | Freight Forwarding Warehousing and Distribution Supply Chain Management Last-Mile Delivery |

| By End-User Industry | Retail Manufacturing Automotive Healthcare Food and Beverage |

| By Region | Northern France Southern France Central France |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Managers, Supply Chain Executives |

| Manufacturing Supply Chain | 50 | Operations Managers, Procurement Specialists |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Last-Mile Delivery Services | 40 | Delivery Operations Managers, Fleet Coordinators |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Logistics Coordinators |

The France Logistics Industry is valued at approximately USD 258 billion, driven by the demand for efficient supply chain solutions, e-commerce growth, and advancements in digital technologies like AI and IoT, enhancing logistics operations.