Region:Europe

Author(s):Geetanshi

Product Code:KRAB5846

Pages:93

Published On:October 2025

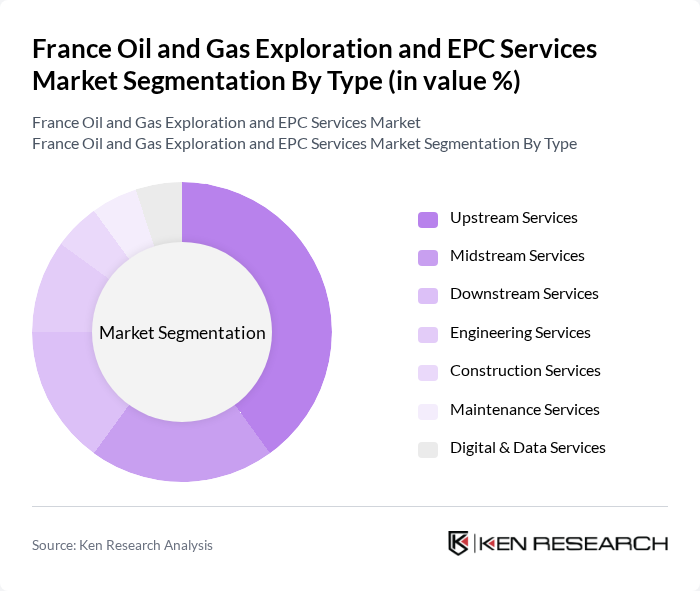

By Type:The market is segmented into upstream, midstream, downstream, engineering, construction, maintenance, and digital & data services. Upstream services currently lead the market, driven by increased exploration activities in both offshore and onshore fields. The segment’s growth is propelled by demand for advanced drilling technologies, seismic data analytics, and enhanced oil recovery solutions, as companies aim to optimize production and reduce operational costs. Midstream and downstream segments are supported by investments in pipeline infrastructure, storage, and refining capacity, while engineering and construction services benefit from modernization and expansion projects. Digital & data services are gaining traction due to the integration of IoT, AI, and predictive analytics for asset management and operational efficiency .

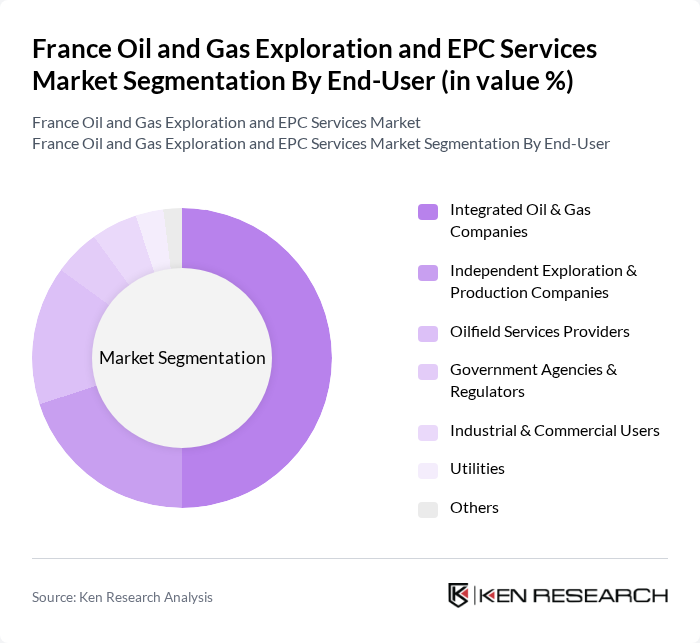

By End-User:The end-user segmentation includes integrated oil & gas companies, independent exploration & production companies, oilfield services providers, government agencies & regulators, industrial & commercial users, utilities, and others. Integrated oil & gas companies dominate this segment, leveraging their extensive operations across exploration, production, refining, and distribution. Their leadership is reinforced by significant investments in digital transformation, sustainability initiatives, and advanced technologies that optimize the entire value chain. Independent exploration and production companies and oilfield service providers contribute to innovation and flexibility, while government agencies and regulators play a key role in policy enforcement and market oversight .

The France Oil and Gas Exploration and EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, TechnipFMC plc, Technip Energies N.V., Vallourec S.A., CGG S.A., Schlumberger Limited, Saipem S.p.A., Subsea 7 S.A., Wood Group PLC, KBR, Inc., Aker Solutions ASA, Petrofac Limited, Worley Limited, Cosmo Tech, Skipper NDT, Uavia, MADIC group, Apizee France, TEMISTH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France oil and gas exploration market appears promising, driven by technological advancements and government support. As the sector adapts to environmental regulations, companies are increasingly focusing on sustainable practices and digital transformation. The integration of renewable energy sources into traditional oil and gas operations is expected to enhance resilience. Furthermore, strategic partnerships will likely emerge, fostering innovation and efficiency, positioning the market for growth in the coming years while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Services Midstream Services Downstream Services Engineering Services Construction Services Maintenance Services Digital & Data Services |

| By End-User | Integrated Oil & Gas Companies Independent Exploration & Production Companies Oilfield Services Providers Government Agencies & Regulators Industrial & Commercial Users Utilities Others |

| By Application | Exploration Production Refining Transportation & Storage Distribution Others |

| By Service Model | EPC (Engineering, Procurement & Construction) EPCM (Engineering, Procurement, Construction Management) Turnkey Services Consulting & Project Management Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 40 | CEOs, Exploration Managers |

| EPC Service Providers | 40 | Project Directors, Engineering Managers |

| Regulatory Bodies | 40 | Policy Analysts, Environmental Officers |

| Local Community Stakeholders | 40 | Community Leaders, Local Government Officials |

| Industry Experts and Consultants | 40 | Energy Analysts, Market Researchers |

The France Oil and Gas Exploration and EPC Services Market is valued at approximately USD 159 billion, reflecting the total value of oil and gas activities, including exploration, production, and engineering services, based on a five-year historical analysis.