Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5777

Pages:82

Published On:October 2025

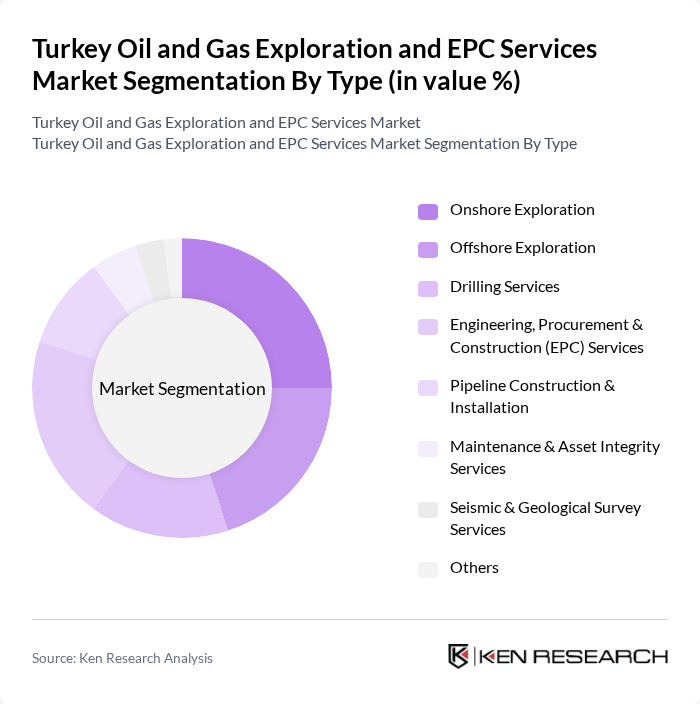

By Type:The market is segmented into Onshore Exploration, Offshore Exploration, Drilling Services, Engineering, Procurement & Construction (EPC) Services, Pipeline Construction & Installation, Maintenance & Asset Integrity Services, Seismic & Geological Survey Services, and Others.Onshore Explorationis driven by new shale oil discoveries and increased domestic drilling activity, whileOffshore Explorationbenefits from recent natural gas finds in the Black Sea.Drilling ServicesandEPC Servicesare experiencing growth due to modernization of existing infrastructure and expansion of new projects.Pipeline Construction & Installationis supported by the reopening of the Iraq-Turkey pipeline and new LNG import terminals.Maintenance & Asset Integrity Servicesare increasingly important as aging assets require upgrades.Seismic & Geological Survey Servicesare in demand for both onshore and offshore resource assessment, and theOtherssegment includes ancillary services such as environmental monitoring and logistics .

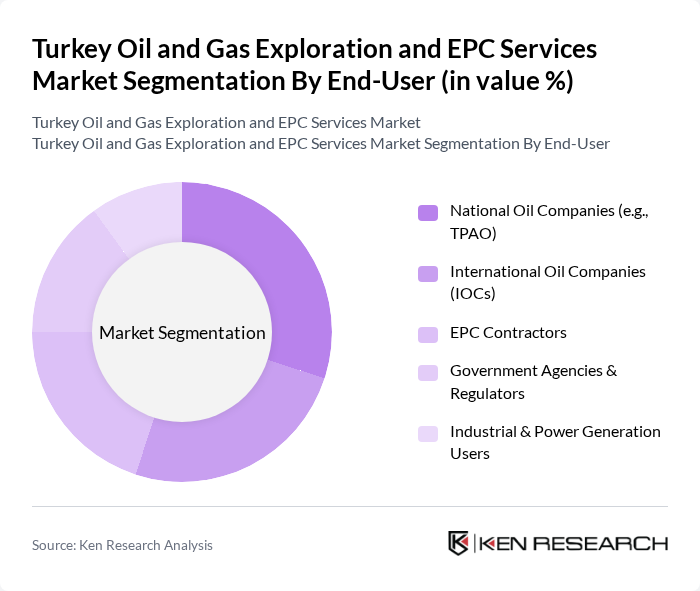

By End-User:The end-user segmentation includes National Oil Companies (e.g., TPAO), International Oil Companies (IOCs), EPC Contractors, Government Agencies & Regulators, and Industrial & Power Generation Users.National Oil Companieslead the market due to their involvement in major domestic projects and strategic partnerships.International Oil Companiesare expanding their presence through joint ventures and offshore exploration.EPC Contractorsplay a critical role in infrastructure development and modernization.Government Agencies & Regulatorsdrive policy implementation and compliance, whileIndustrial & Power Generation Usersrepresent the downstream demand for oil and gas products .

The Turkey Oil and Gas Exploration and EPC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TPAO (Türkiye Petrolleri Anonim Ortakl???), SOCAR Turkey Enerji A.?., Enka ?n?aat ve Sanayi A.?., Petkim Petrokimya Holding A.?., Karpowership, Rönesans Holding, Çal?k Enerji Sanayi ve Ticaret A.?., Aygaz A.?., Zorlu Enerji Elektrik Üretim A.?., Siemens Türkiye, Genel Energy plc, Eni S.p.A., TotalEnergies SE, Halliburton Company, Schlumberger Limited, Trillion Energy International Inc., BOTA? (Boru Hatlar? ile Petrol Ta??ma A.?.) contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey oil and gas exploration market is poised for significant transformation, driven by a combination of technological advancements and government initiatives. In future, the integration of digital technologies and sustainable practices will likely reshape operational efficiencies. Additionally, the focus on local content requirements will encourage domestic participation in the sector, fostering economic growth. As the government continues to invest in infrastructure, the market is expected to attract both local and international players, enhancing competition and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Offshore Exploration Drilling Services Engineering, Procurement & Construction (EPC) Services Pipeline Construction & Installation Maintenance & Asset Integrity Services Seismic & Geological Survey Services Others |

| By End-User | National Oil Companies (e.g., TPAO) International Oil Companies (IOCs) EPC Contractors Government Agencies & Regulators Industrial & Power Generation Users |

| By Application | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) Petrochemical & Gas Processing |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Incentives |

| By Regulatory Compliance | Environmental Compliance Safety Standards Local Content Requirements Quality Assurance & Certification |

| By Project Size | Small Scale Projects (< $50 million) Medium Scale Projects ($50–$500 million) Large Scale Projects (> $500 million) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 60 | CEOs, Exploration Managers |

| Gas Production Firms | 50 | Operations Directors, Project Managers |

| EPC Service Providers | 45 | Business Development Managers, Engineering Leads |

| Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

| Industry Associations | 42 | Executive Directors, Research Analysts |

The Turkey Oil and Gas Exploration and EPC Services Market is valued at approximately USD 13 billion, driven by increasing energy demands, government initiatives for domestic production, and Turkey's strategic position as a transit hub for oil and gas.