Region:Middle East

Author(s):Shubham

Product Code:KRAC1405

Pages:81

Published On:October 2025

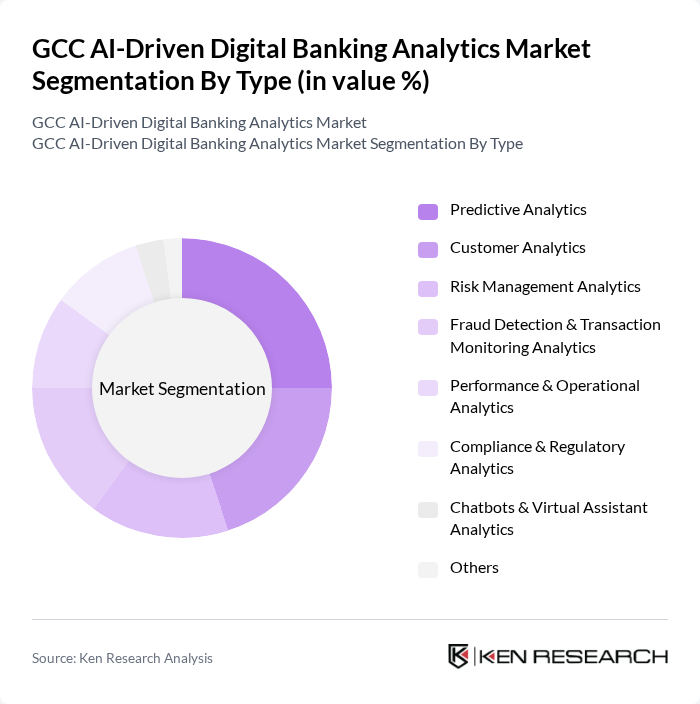

By Type:The market is segmented into specialized analytics solutions tailored to banking needs. Subsegments include Predictive Analytics (for forecasting customer behavior and credit risk), Customer Analytics (for personalization and segmentation), Risk Management Analytics (for real-time risk assessment), Fraud Detection & Transaction Monitoring Analytics (for identifying suspicious activities), Performance & Operational Analytics (for process optimization), Compliance & Regulatory Analytics (for automated regulatory reporting), Chatbots & Virtual Assistant Analytics (for conversational banking), and Others. These analytics types are integral to improving operational resilience, regulatory compliance, and customer engagement in the GCC banking sector.

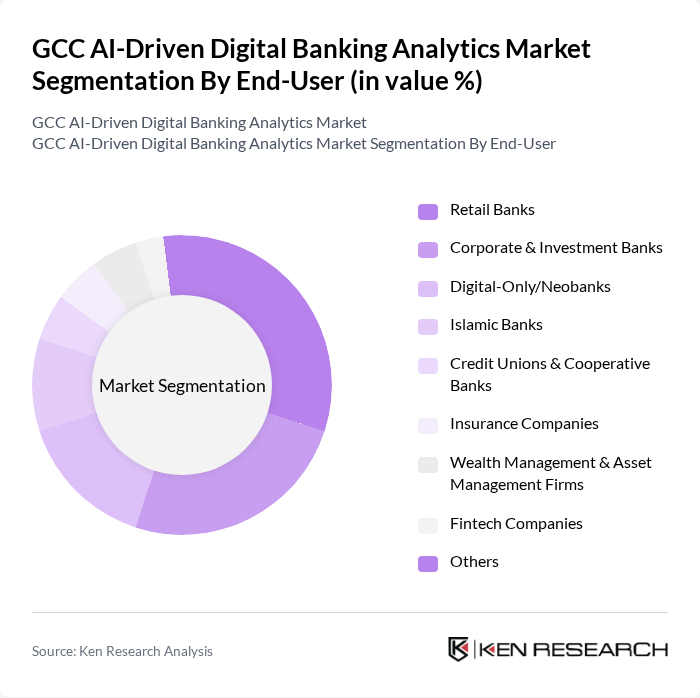

By End-User:The end-user segmentation reflects the diversity of banking institutions utilizing AI-driven analytics. Segments include Retail Banks (driving adoption for mass-market personalization), Corporate & Investment Banks (leveraging analytics for risk and portfolio optimization), Digital-Only/Neobanks (focused on digital customer journeys), Islamic Banks (adopting AI for Sharia-compliant solutions), Credit Unions & Cooperative Banks (streamlining member services), Insurance Companies (for claims and risk analytics), Wealth Management & Asset Management Firms (for portfolio analytics), Fintech Companies (for product innovation), and Others. Each segment benefits from tailored analytics solutions to address unique operational and regulatory requirements.

The GCC AI-Driven Digital Banking Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FIS Global, Temenos AG, Oracle Financial Services, SAS Institute Inc., Fiserv, Inc., Infosys Finacle, TCS BaNCS, ACI Worldwide, Finastra, Experian, NICE Actimize, FICO, ComplyAdvantage, Palantir Technologies, Refinitiv, Mambu, Backbase, Nucleus Software, Q2 Holdings, Inc., InfrasoftTech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-driven digital banking analytics market appears promising, driven by technological advancements and evolving consumer expectations. As banks increasingly adopt AI and machine learning, they will enhance operational efficiencies and customer experiences. Additionally, the shift towards open banking models will foster innovation and collaboration among financial institutions and fintech companies, creating a dynamic ecosystem that supports growth and adaptability in the face of emerging challenges and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Customer Analytics Risk Management Analytics Fraud Detection & Transaction Monitoring Analytics Performance & Operational Analytics Compliance & Regulatory Analytics Chatbots & Virtual Assistant Analytics Others |

| By End-User | Retail Banks Corporate & Investment Banks Digital-Only/Neobanks Islamic Banks Credit Unions & Cooperative Banks Insurance Companies Wealth Management & Asset Management Firms Fintech Companies Others |

| By Application | Customer Relationship Management & Personalization Marketing Optimization & Campaign Analytics Operational Efficiency & Process Automation Compliance & Regulatory Reporting Risk Assessment & Credit Scoring Fraud Detection & Anti-Money Laundering (AML) Product & Service Innovation Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking AI Solutions | 60 | Product Managers, Digital Transformation Leads |

| Corporate Banking Analytics | 50 | Relationship Managers, Risk Analysts |

| Fintech Innovations in Payments | 40 | CTOs, Innovation Officers |

| Customer Experience Enhancement | 55 | Customer Experience Managers, Marketing Directors |

| Fraud Detection and Prevention | 45 | Compliance Officers, Security Analysts |

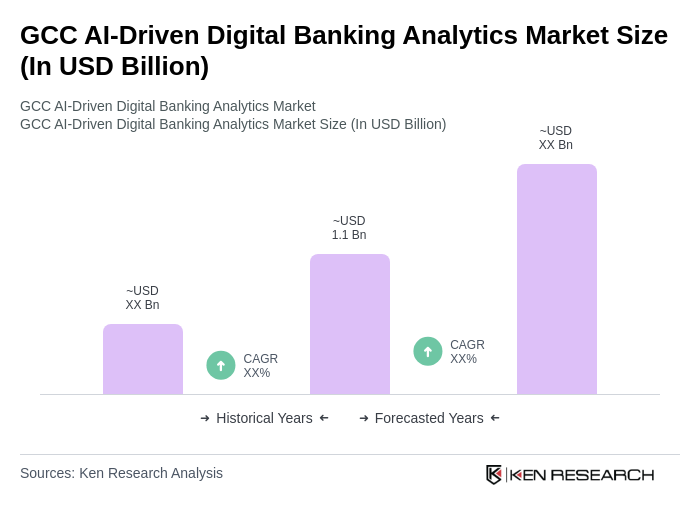

The GCC AI-Driven Digital Banking Analytics Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of AI technologies in banking, enhancing customer experience, operational efficiency, and risk management.