Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1028

Pages:84

Published On:October 2025

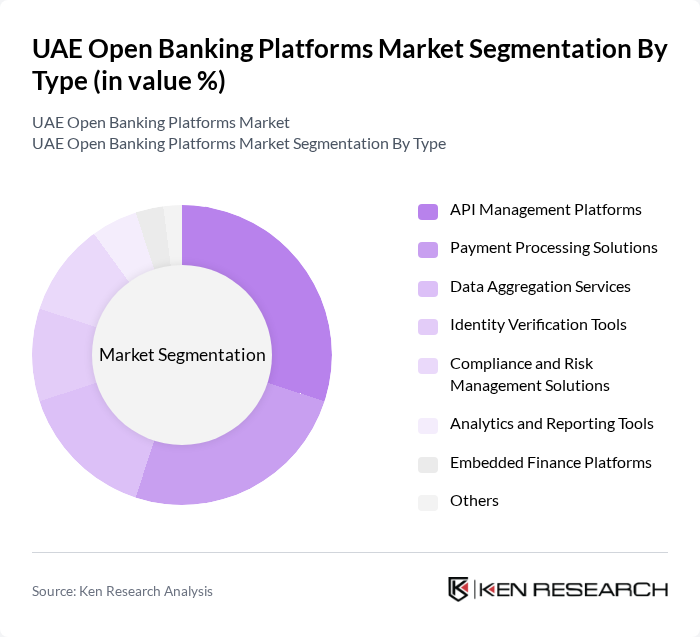

By Type:The market is segmented into various types, including API Management Platforms, Payment Processing Solutions, Data Aggregation Services, Identity Verification Tools, Compliance and Risk Management Solutions, Analytics and Reporting Tools, Embedded Finance Platforms, and Others. API Management Platforms are leading due to their critical role in enabling secure data sharing and integration between banks and fintechs. The demand for seamless connectivity, real-time payment capabilities, and enhanced customer experiences drives the growth of this segment, with embedded finance and analytics tools also gaining traction as banks and fintechs seek to personalize offerings and optimize operations.

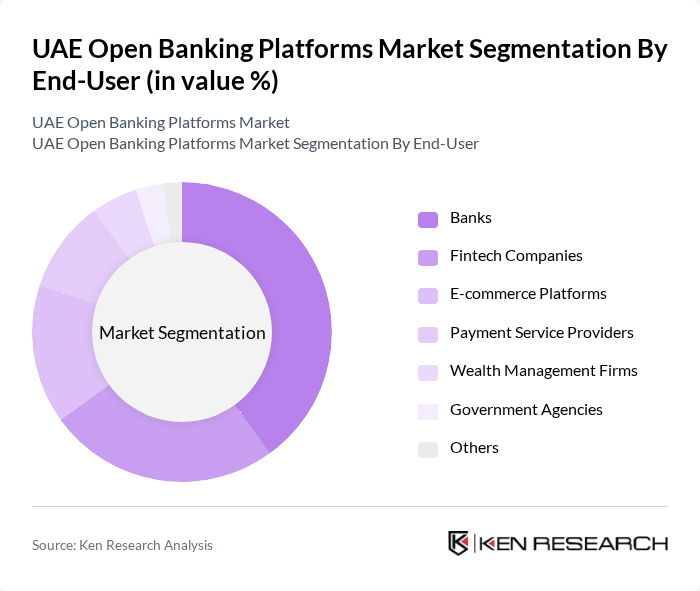

By End-User:The end-user segmentation includes Banks, Fintech Companies, E-commerce Platforms, Payment Service Providers, Wealth Management Firms, Government Agencies, and Others. Banks are the dominant end-user segment, leveraging open banking to enhance their service offerings and improve customer engagement. The increasing collaboration between traditional banks and fintechs is driving this trend, as banks seek to innovate and remain competitive in a rapidly evolving financial landscape. Fintech companies and e-commerce platforms are also expanding their use of open banking to offer embedded financial services and personalized payment solutions.

The UAE Open Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank (ADCB), First Abu Dhabi Bank (FAB), Dubai Islamic Bank, Mashreq Bank, Abu Dhabi Islamic Bank (ADIB), RAKBANK, PayBy, YAP, Fintech Galaxy, Tarabut Gateway, Lean Technologies, Zand, DAPI, TrueLayer, Tabby, Yalla Compare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE open banking platforms market appears promising, driven by technological advancements and evolving consumer preferences. As digital banking continues to gain traction, the integration of artificial intelligence and machine learning will enhance personalized financial services. Additionally, the collaboration between banks and fintech companies is expected to foster innovation, leading to the development of new products that cater to diverse consumer needs. This dynamic environment will likely create a competitive landscape that encourages continuous improvement and customer-centric solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | API Management Platforms Payment Processing Solutions Data Aggregation Services Identity Verification Tools Compliance and Risk Management Solutions Analytics and Reporting Tools Embedded Finance Platforms Others |

| By End-User | Banks Fintech Companies E-commerce Platforms Payment Service Providers Wealth Management Firms Government Agencies Others |

| By Business Model | B2B (Business to Business) B2C (Business to Consumer) B2B2C (Business to Business to Consumer) Platform-as-a-Service (PaaS) Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services API Development & Integration Services Others |

| By Customer Segment | Retail Customers Small and Medium Enterprises (SMEs) Large Enterprises Startups Others |

| By Geographic Presence | UAE GCC Region MENA Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Executives | 60 | CEOs, CTOs, and Heads of Digital Banking |

| Fintech Startups | 50 | Founders, Product Managers, and Compliance Officers |

| Consumer Insights | 120 | Retail Banking Customers, Digital Banking Users |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Industry Experts | 40 | Consultants, Financial Analysts, and Academics |

The UAE Open Banking Platforms Market is valued at approximately USD 5.6 billion, reflecting significant growth driven by digitization, consumer adoption of app-based financial solutions, and regulatory support for open banking initiatives.