Region:Middle East

Author(s):Rebecca

Product Code:KRAB8155

Pages:88

Published On:October 2025

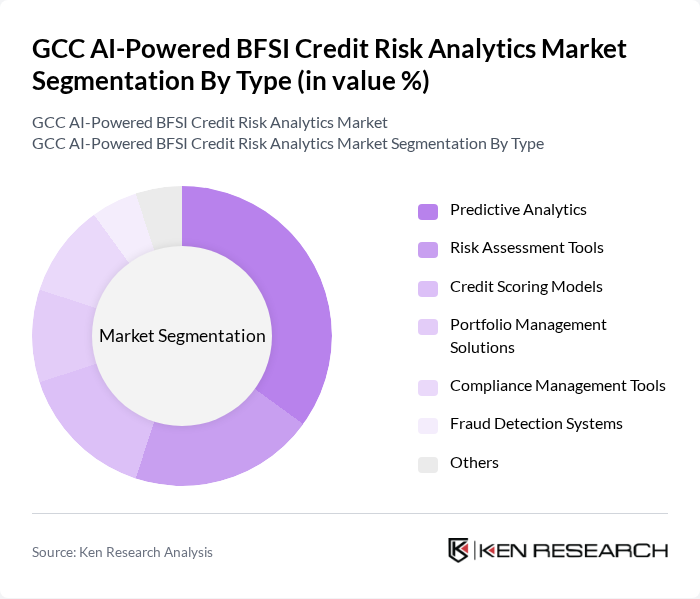

By Type:The market is segmented into various types, including Predictive Analytics, Risk Assessment Tools, Credit Scoring Models, Portfolio Management Solutions, Compliance Management Tools, Fraud Detection Systems, and Others. Among these, Predictive Analytics is the leading sub-segment, driven by its ability to forecast potential credit risks and enhance decision-making processes. The increasing reliance on data-driven insights in the BFSI sector has made predictive analytics a crucial tool for financial institutions.

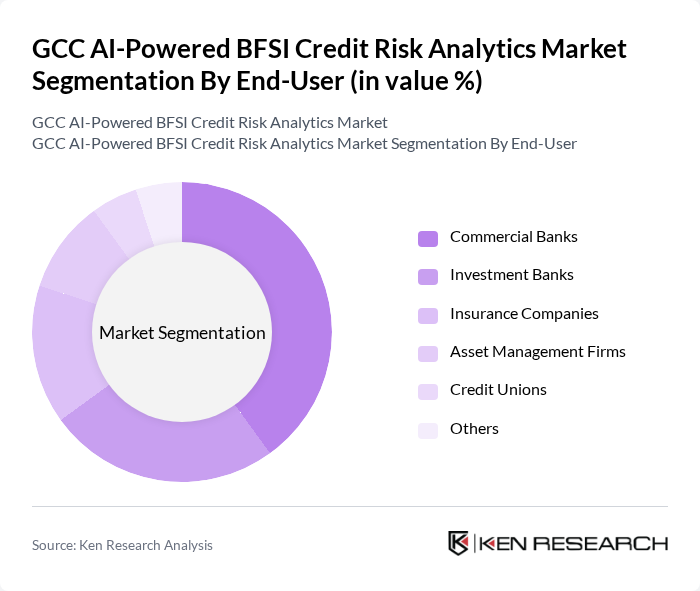

By End-User:The end-user segmentation includes Commercial Banks, Investment Banks, Insurance Companies, Asset Management Firms, Credit Unions, and Others. Commercial Banks are the dominant end-user segment, as they are the primary institutions utilizing credit risk analytics to assess loan applications and manage credit portfolios. The increasing competition among banks to offer personalized financial products has further fueled the demand for advanced analytics solutions.

The GCC AI-Powered BFSI Credit Risk Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, Experian, SAS Institute Inc., Moody's Analytics, Zoot Enterprises, RiskMetrics Group, Axioma, Credit Karma, Dun & Bradstreet, TransUnion, Equifax, Oracle Financial Services, IBM, Palantir Technologies, TIBCO Software Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered BFSI credit risk analytics market appears promising, driven by technological advancements and increasing regulatory pressures. Financial institutions are expected to prioritize investments in AI and machine learning to enhance risk assessment capabilities. Additionally, the integration of cloud-based solutions will facilitate real-time data processing, enabling more agile decision-making. As competition intensifies, organizations will increasingly focus on customer-centric services, leveraging analytics to tailor offerings and improve client satisfaction in the evolving financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Risk Assessment Tools Credit Scoring Models Portfolio Management Solutions Compliance Management Tools Fraud Detection Systems Others |

| By End-User | Commercial Banks Investment Banks Insurance Companies Asset Management Firms Credit Unions Others |

| By Application | Loan Underwriting Risk Monitoring Portfolio Optimization Regulatory Compliance Customer Segmentation Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banks Credit Risk Management | 150 | Risk Managers, Credit Analysts |

| Insurance Companies AI Integration | 100 | Data Scientists, Underwriting Managers |

| Investment Firms Risk Assessment Strategies | 80 | Portfolio Managers, Compliance Officers |

| Fintech Startups AI Solutions | 70 | Founders, Product Development Leads |

| Regulatory Bodies on Credit Risk Policies | 50 | Policy Makers, Financial Analysts |

The GCC AI-Powered BFSI Credit Risk Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in the banking and financial services sector for enhanced decision-making and risk management.