Region:Middle East

Author(s):Dev

Product Code:KRAB7406

Pages:83

Published On:October 2025

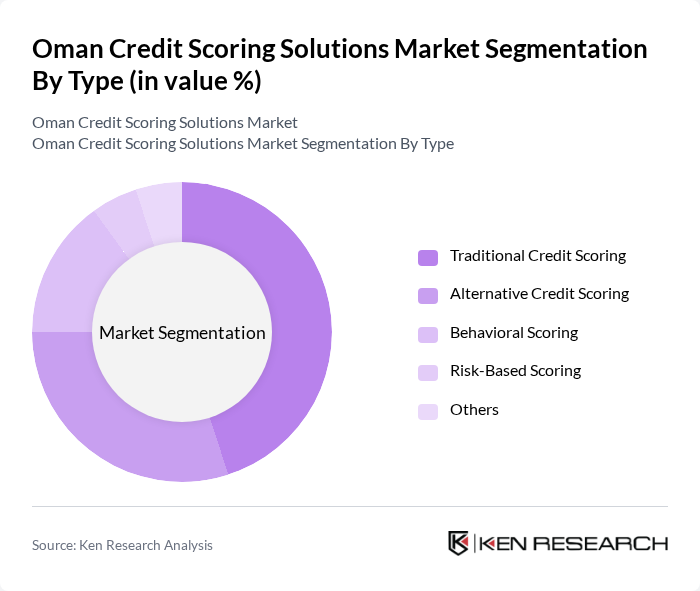

By Type:The market is segmented into various types of credit scoring solutions, including Traditional Credit Scoring, Alternative Credit Scoring, Behavioral Scoring, Risk-Based Scoring, and Others. Traditional Credit Scoring remains the most widely used method, leveraging historical credit data to assess risk. However, Alternative Credit Scoring is gaining traction as it incorporates non-traditional data sources, appealing to a broader range of consumers, especially those with limited credit histories.

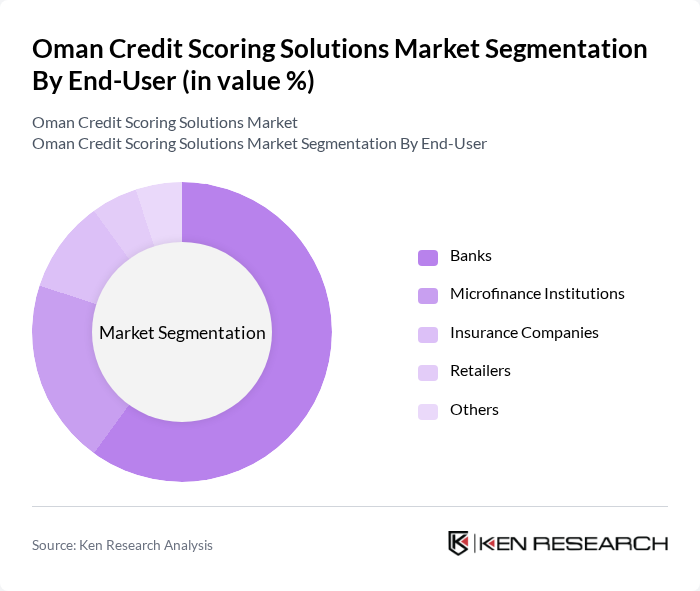

By End-User:The end-user segmentation includes Banks, Microfinance Institutions, Insurance Companies, Retailers, and Others. Banks are the leading end-users of credit scoring solutions, as they require robust systems to evaluate loan applications and manage credit risk effectively. Microfinance Institutions are also increasingly adopting these solutions to cater to underserved populations, while Insurance Companies utilize credit scores to assess risk in underwriting processes.

The Oman Credit Scoring Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Experian, TransUnion, Equifax, FICO, CRIF, Dun & Bradstreet, Creditinfo, CIBIL, ZestFinance, FinScore, CredoLab, LenddoEFL, ScoreSense, Credit Karma, ClearScore contribute to innovation, geographic expansion, and service delivery in this space.

The Oman credit scoring solutions market is poised for significant transformation as technological advancements and regulatory frameworks evolve. In the future, the integration of artificial intelligence and machine learning is expected to enhance credit assessment accuracy, while real-time scoring will become increasingly prevalent. Additionally, the focus on consumer-centric solutions will drive innovation, ensuring that credit scoring models are tailored to individual needs. As financial inclusion initiatives progress, the market will likely see a surge in demand for accessible credit solutions, fostering economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Credit Scoring Alternative Credit Scoring Behavioral Scoring Risk-Based Scoring Others |

| By End-User | Banks Microfinance Institutions Insurance Companies Retailers Others |

| By Application | Personal Loans Business Loans Credit Cards Mortgages Others |

| By Data Source | Credit Bureau Data Alternative Data Social Media Data Transactional Data Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Credit Scoring | 100 | Credit Risk Managers, Loan Officers |

| Fintech Credit Solutions | 80 | Product Managers, Data Analysts |

| Regulatory Compliance in Credit Scoring | 50 | Compliance Officers, Regulatory Analysts |

| Consumer Insights on Credit Access | 120 | Consumers, Financial Advisors |

| Market Trends in Credit Scoring Technology | 70 | Technology Officers, Business Development Managers |

The Oman Credit Scoring Solutions Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing consumer and business credit demand, as well as advancements in digital financial services and analytics technologies.