Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8104

Pages:96

Published On:October 2025

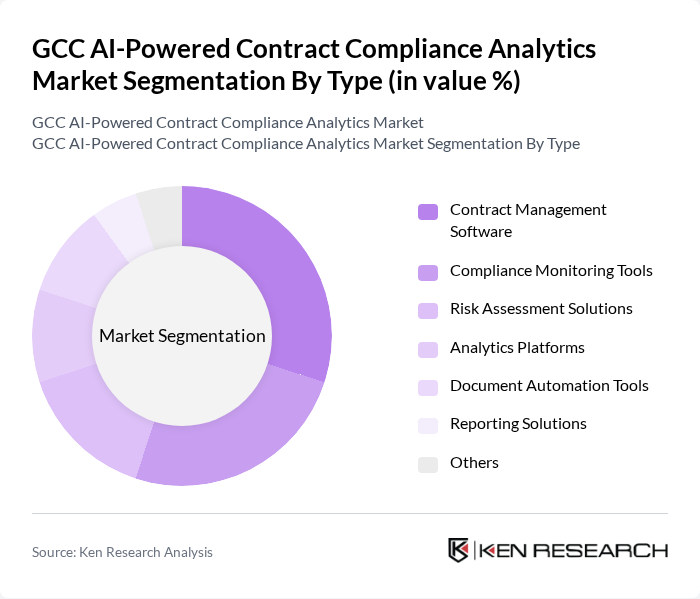

By Type:The market is segmented into various types of AI-powered contract compliance analytics solutions, including Contract Management Software, Compliance Monitoring Tools, Risk Assessment Solutions, Analytics Platforms, Document Automation Tools, Reporting Solutions, and Others. Each of these sub-segments plays a crucial role in enhancing contract compliance and operational efficiency.

The leading sub-segment in the market is Contract Management Software, which accounts for a significant portion of the market share. This dominance is attributed to the increasing need for organizations to manage contracts efficiently, reduce risks, and ensure compliance with regulatory requirements. The growing trend of digital transformation across industries has further propelled the adoption of contract management software, making it an essential tool for businesses aiming to streamline their operations and enhance compliance.

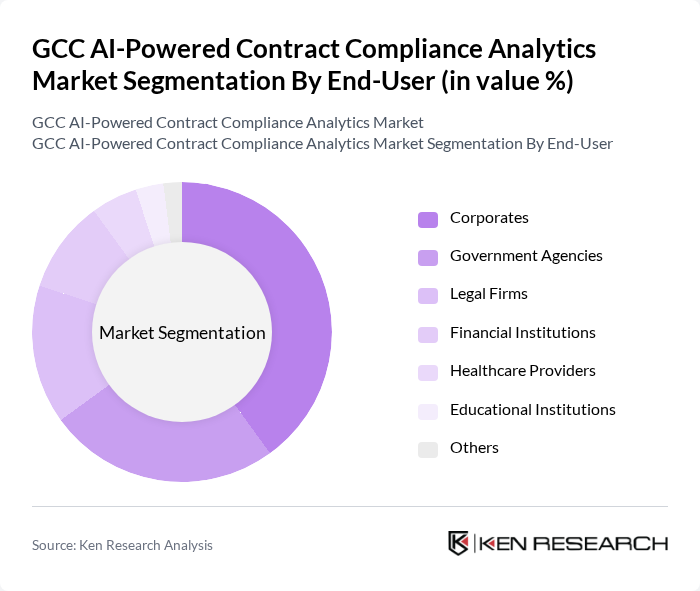

By End-User:The market is segmented by end-users, including Corporates, Government Agencies, Legal Firms, Financial Institutions, Healthcare Providers, Educational Institutions, and Others. Each end-user category has unique requirements and challenges that AI-powered contract compliance analytics solutions address.

Corporates represent the largest end-user segment, driven by the need for efficient contract management and compliance solutions to mitigate risks and enhance operational efficiency. The increasing complexity of contracts and regulatory requirements has led organizations to invest in AI-powered analytics tools that provide insights and streamline compliance processes. This trend is particularly evident in sectors such as finance and healthcare, where compliance is critical.

The GCC AI-Powered Contract Compliance Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, DocuSign, Inc., Coupa Software Incorporated, Icertis, Inc., ContractWorks, Agiloft, Inc., Concord, JAGGAER, Zycus, SirionLabs, Ariba, Inc., Contract Logix, LegalSifter contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered contract compliance analytics market appears promising, driven by technological advancements and increasing regulatory pressures. As organizations prioritize compliance and risk management, the integration of AI and machine learning will become essential. Furthermore, the shift towards cloud-based solutions will facilitate easier access to analytics tools, enabling businesses to leverage real-time data for informed decision-making. This trend is expected to enhance operational efficiency and compliance accuracy across various sectors in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Contract Management Software Compliance Monitoring Tools Risk Assessment Solutions Analytics Platforms Document Automation Tools Reporting Solutions Others |

| By End-User | Corporates Government Agencies Legal Firms Financial Institutions Healthcare Providers Educational Institutions Others |

| By Industry | Financial Services Healthcare Manufacturing Retail Energy Telecommunications Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers Others |

| By Region | GCC Countries Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Compliance | 100 | Compliance Officers, Risk Managers |

| Healthcare Contract Management | 80 | Legal Advisors, Procurement Managers |

| Manufacturing Sector Analytics | 70 | Operations Managers, Contract Administrators |

| Telecommunications Compliance Analytics | 60 | Regulatory Affairs Specialists, Legal Counsel |

| Energy Sector Contract Compliance | 90 | Contract Managers, Compliance Analysts |

The GCC AI-Powered Contract Compliance Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in contract management and the need for enhanced compliance due to regulatory pressures.