Region:Middle East

Author(s):Rebecca

Product Code:KRAB7957

Pages:84

Published On:October 2025

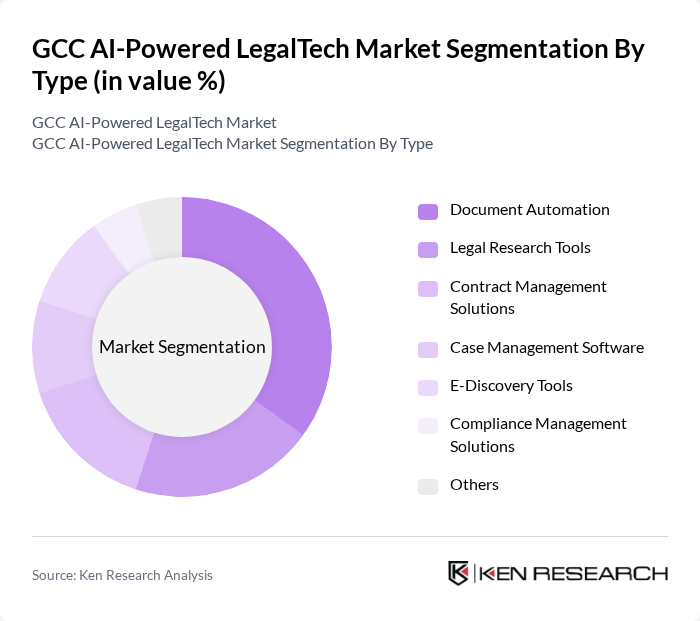

By Type:The market is segmented into various types, including Document Automation, Legal Research Tools, Contract Management Solutions, Case Management Software, E-Discovery Tools, Compliance Management Solutions, and Others. Among these, Document Automation is currently the leading sub-segment, driven by the increasing need for efficiency in document handling and the reduction of manual errors. Legal professionals are increasingly adopting these solutions to streamline workflows and enhance productivity.

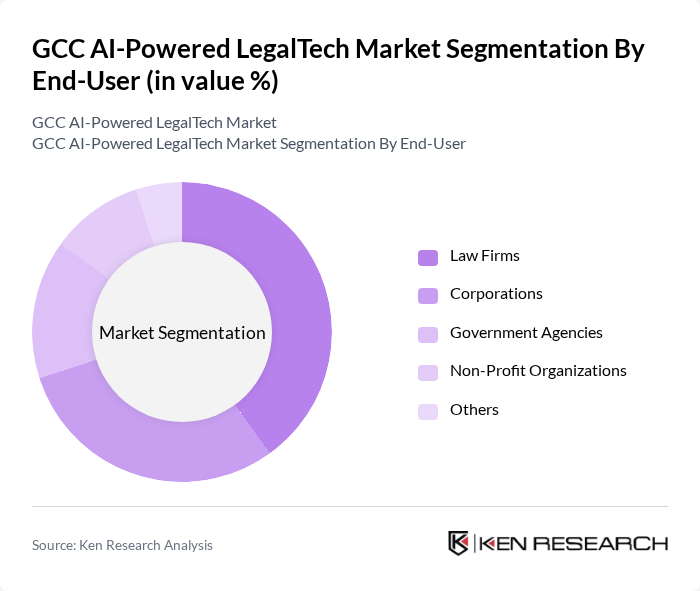

By End-User:The end-user segmentation includes Law Firms, Corporations, Government Agencies, Non-Profit Organizations, and Others. Law Firms are the dominant end-user segment, as they are increasingly leveraging AI-powered solutions to enhance their service offerings and improve client satisfaction. The growing competition among law firms to provide faster and more accurate legal services is driving the adoption of these technologies.

The GCC AI-Powered LegalTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as LegalZoom, Clio, Thomson Reuters, LexisNexis, Everlaw, ROSS Intelligence, iManage, Zola Suite, MyCase, PracticePanther, CaseGuard, LawGeex, LegalSifter, Brightflag, ContractPodAi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered LegalTech market appears promising, driven by ongoing technological advancements and increasing legal complexities. As firms continue to embrace digital transformation, the integration of AI solutions will likely enhance operational efficiency and client service. Additionally, the growing emphasis on compliance and data security will push firms to adopt innovative technologies that align with regulatory requirements, fostering a more competitive landscape in the legal sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Document Automation Legal Research Tools Contract Management Solutions Case Management Software E-Discovery Tools Compliance Management Solutions Others |

| By End-User | Law Firms Corporations Government Agencies Non-Profit Organizations Others |

| By Application | Litigation Support Contract Review Compliance Monitoring Risk Management Others |

| By Sales Channel | Direct Sales Online Sales Reseller Partnerships Others |

| By Distribution Mode | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Departments | 100 | General Counsels, Legal Operations Managers |

| Law Firms Utilizing AI Tools | 80 | Partners, IT Directors |

| Legal Tech Startups | 60 | Founders, Product Managers |

| Regulatory Bodies and Legal Associations | 50 | Policy Makers, Legal Advisors |

| End-users of AI Legal Solutions | 70 | Lawyers, Paralegals |

The GCC AI-Powered LegalTech Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in legal processes, which enhance efficiency and reduce operational costs for law firms and corporations.