Region:Asia

Author(s):Geetanshi

Product Code:KRAA9198

Pages:84

Published On:November 2025

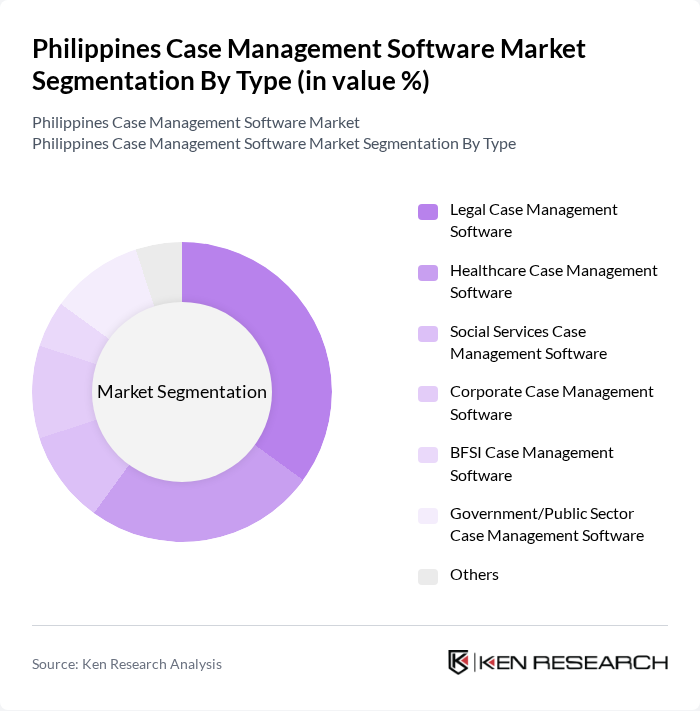

By Type:The market is segmented into various types of case management software, each catering to specific industry needs. The primary segments include Legal Case Management Software, Healthcare Case Management Software, Social Services Case Management Software, Corporate Case Management Software, BFSI Case Management Software, Government/Public Sector Case Management Software, and Others. Among these, Legal Case Management Software is currently the leading segment, driven by the increasing complexity of legal cases, the need for efficient document and workflow management, and the growing adoption of cloud-based legal technology in law firms .

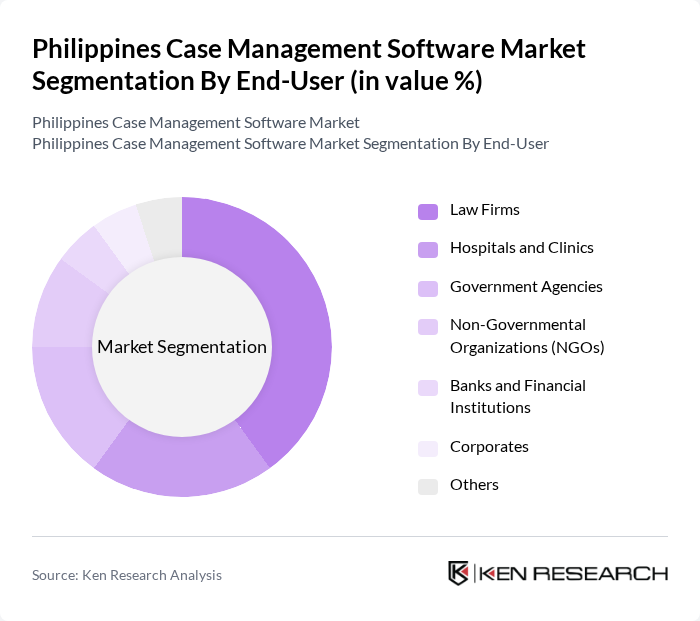

By End-User:The end-user segmentation includes Law Firms, Hospitals and Clinics, Government Agencies, Non-Governmental Organizations (NGOs), Banks and Financial Institutions, Corporates, and Others. Law Firms are the dominant end-user segment, driven by the increasing need for efficient case management solutions to handle a growing number of cases, improve client service, and ensure compliance with evolving legal standards .

The Philippines Case Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyCase, Clio, PracticePanther, Legal Files, CaseGuard, Zola Suite, CaseFox, Rocket Matter, SmartAdvocate, TimeSolv, CaseManager, iManage, Thomson Reuters Legal Tracker, ProLaw, Aderant, SAP SE, Salesforce, Inc., Microsoft Corporation, Oracle Corporation, NetSuite (Oracle), LexisNexis, KPMG Philippines, Pointwest Technologies Corporation, Exist Software Labs, Inc., Yondu, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines case management software market appears promising, driven by ongoing digital transformation efforts and increasing demand for efficiency. As organizations continue to embrace remote work solutions and prioritize user-friendly interfaces, the market is likely to witness significant advancements. Furthermore, the integration of AI and machine learning technologies will enhance analytics capabilities, enabling better decision-making. With government support and a growing emphasis on data security, the market is poised for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Legal Case Management Software Healthcare Case Management Software Social Services Case Management Software Corporate Case Management Software BFSI Case Management Software Government/Public Sector Case Management Software Others |

| By End-User | Law Firms Hospitals and Clinics Government Agencies Non-Governmental Organizations (NGOs) Banks and Financial Institutions Corporates Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Functionality | Case Tracking Document Management Reporting and Analytics Communication Tools Workflow Automation Compliance Management Integration with Third-Party Systems Others |

| By Industry Vertical | Legal Healthcare Social Services Corporate BFSI Government/Public Sector Others |

| By User Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Geographic Presence | Metro Manila Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Case Management Software | 100 | IT Managers, Healthcare Administrators |

| Clinic Management Systems | 60 | Clinic Owners, Practice Managers |

| Telehealth Case Management Solutions | 50 | Telehealth Coordinators, IT Support Staff |

| Long-term Care Facilities Software | 40 | Facility Managers, Care Coordinators |

| Health Insurance Case Management Tools | 70 | Claims Managers, IT Directors |

The Philippines Case Management Software Market is valued at approximately USD 40 million, reflecting a significant growth trend driven by the increasing adoption of digital solutions across various sectors, including legal, healthcare, and government.