Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7938

Pages:87

Published On:October 2025

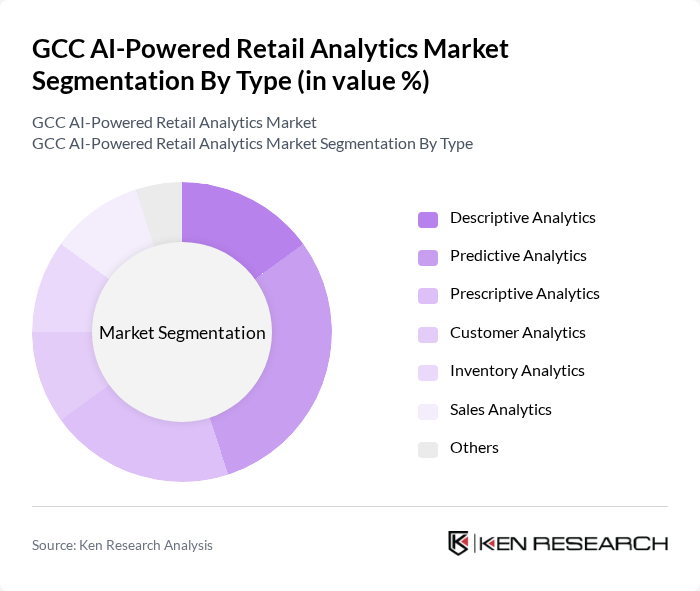

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Customer Analytics, Inventory Analytics, Sales Analytics, and Others. Each of these sub-segments plays a crucial role in helping retailers understand their data and make informed decisions. Among these, Predictive Analytics is currently leading the market due to its ability to forecast trends and consumer behavior effectively, allowing retailers to tailor their strategies accordingly.

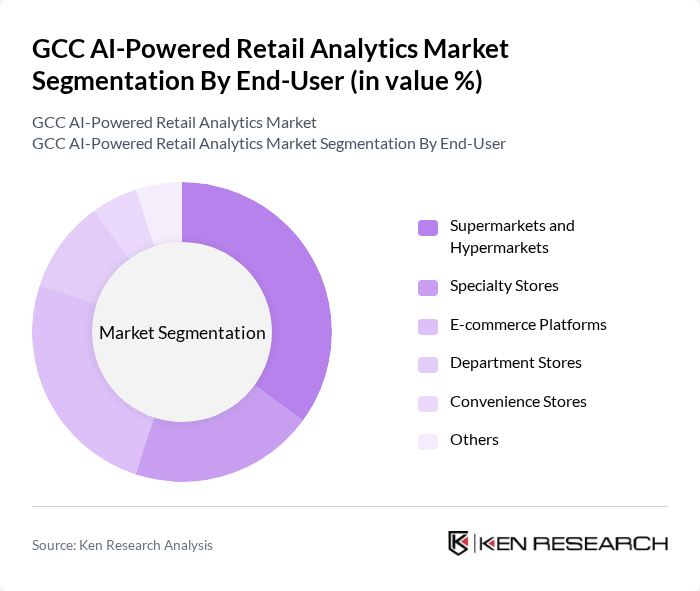

By End-User:The end-user segmentation includes Supermarkets and Hypermarkets, Specialty Stores, E-commerce Platforms, Department Stores, Convenience Stores, and Others. Supermarkets and Hypermarkets dominate this segment due to their vast customer base and the need for efficient inventory management and customer insights. The increasing shift towards online shopping has also led to a significant rise in the adoption of analytics solutions among E-commerce Platforms.

The GCC AI-Powered Retail Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute Inc., Tableau Software, QlikTech International AB, Google LLC, Adobe Inc., Nielsen Holdings PLC, Teradata Corporation, Sisense Inc., Domo Inc., Looker (part of Google Cloud), MicroStrategy Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI-powered retail analytics market appears promising, driven by technological advancements and evolving consumer expectations. As retailers increasingly adopt predictive analytics and integrate AI with IoT, they will enhance operational efficiencies and customer engagement. Furthermore, the rise of subscription-based analytics services will democratize access to advanced tools, enabling even smaller retailers to leverage data insights. This transformation is expected to foster innovation and drive growth across the retail landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Customer Analytics Inventory Analytics Sales Analytics Others |

| By End-User | Supermarkets and Hypermarkets Specialty Stores E-commerce Platforms Department Stores Convenience Stores Others |

| By Application | Customer Behavior Analysis Sales Forecasting Inventory Management Pricing Optimization Marketing Campaign Analysis Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retail Analytics | 100 | Retail Managers, Data Analysts |

| Electronics Retail Insights | 80 | IT Managers, Business Intelligence Analysts |

| Grocery Sector AI Adoption | 70 | Operations Managers, Supply Chain Analysts |

| Consumer Behavior Analytics | 90 | Marketing Directors, Customer Experience Managers |

| Omni-channel Retail Strategies | 85 | eCommerce Managers, Digital Transformation Leads |

The GCC AI-Powered Retail Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of AI technologies in retail, enhancing customer experience and operational efficiency.