Region:Asia

Author(s):Geetanshi

Product Code:KRAA2043

Pages:100

Published On:August 2025

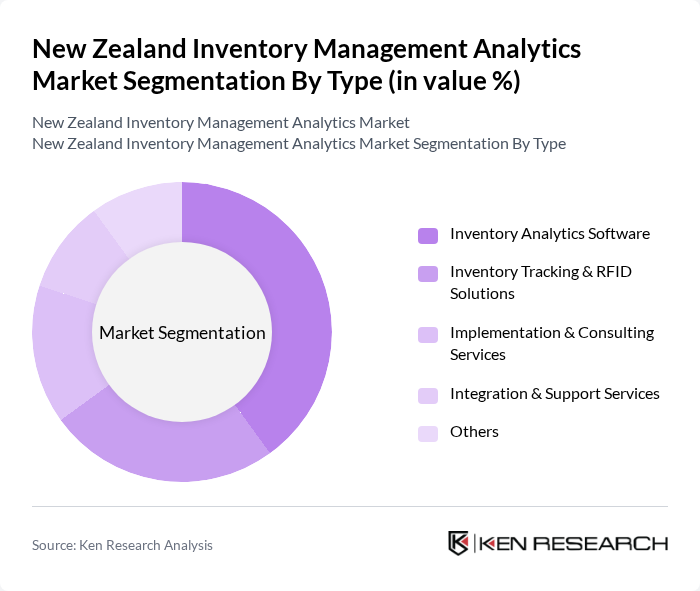

By Type:This segmentation includes various types of inventory management analytics solutions that cater to different business needs.

The leading subsegment in this category is Inventory Analytics Software, which is gaining traction due to its ability to provide actionable insights and enhance decision-making processes. Businesses are increasingly recognizing the value of data-driven strategies to manage inventory effectively, leading to a surge in demand for sophisticated software solutions. The trend towards automation, integration with ERP and POS systems, and real-time analytics further solidifies the dominance of this subsegment, as companies seek to streamline operations and reduce costs.

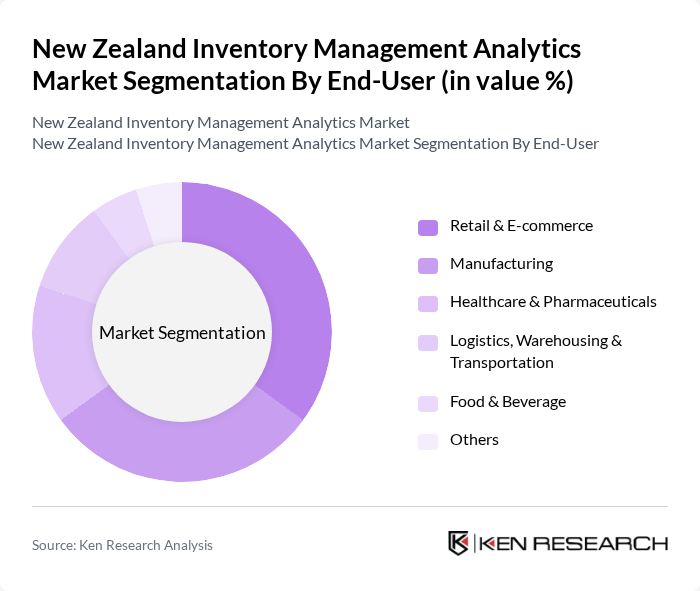

By End-User:This segmentation focuses on the various industries that utilize inventory management analytics solutions.

The Retail & E-commerce sector is the dominant end-user of inventory management analytics solutions, driven by the need for efficient stock management, omnichannel fulfillment, and customer satisfaction. The rapid growth of online shopping and digital commerce has necessitated advanced inventory tracking and analytics to meet consumer demands. Additionally, the manufacturing sector follows closely, as companies seek to optimize production processes, reduce excess inventory, and enhance supply chain visibility, further enhancing the market's growth.

The New Zealand Inventory Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Infor, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Epicor Software Corporation, NetSuite Inc., Fishbowl Inventory, Cin7 (New Zealand), StyleMatrix (New Zealand), Unleashed Software (New Zealand), TradeGecko (now QuickBooks Commerce), SkuVault, Brightpearl, Zoho Inventory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand inventory management analytics market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize data-driven decision-making, the integration of artificial intelligence and machine learning will enhance predictive analytics capabilities. Furthermore, the growing emphasis on sustainability practices will encourage companies to adopt eco-friendly inventory solutions, aligning with government initiatives aimed at promoting digital transformation and environmental responsibility in the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Analytics Software Inventory Tracking & RFID Solutions Implementation & Consulting Services Integration & Support Services Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics, Warehousing & Transportation Food & Beverage Others |

| By Application | Demand Forecasting & Planning Inventory Optimization Order & Fulfillment Management Supply Chain Visibility & Analytics Stock Replenishment Automation Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Consumer Goods Automotive Electronics Food and Beverage Healthcare Others |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Coordinators |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Planners |

| E-commerce Inventory Solutions | 90 | eCommerce Managers, Logistics Analysts |

| Technology Adoption in Inventory Management | 60 | IT Managers, System Integrators |

| Small Business Inventory Practices | 50 | Business Owners, Financial Managers |

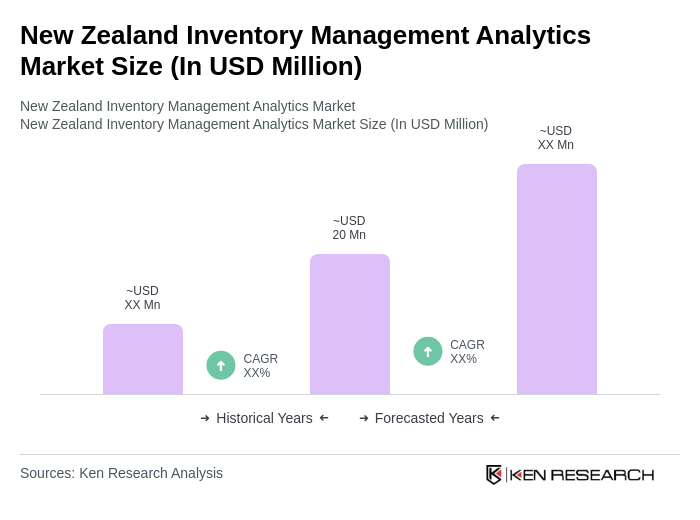

The New Zealand Inventory Management Analytics Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of advanced analytics technologies and the demand for real-time data insights in inventory management.