Region:Middle East

Author(s):Rebecca

Product Code:KRAC4651

Pages:98

Published On:October 2025

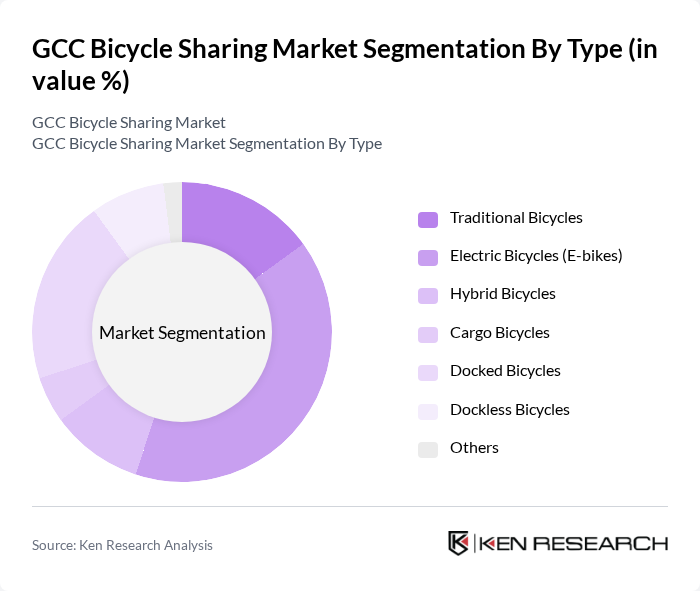

By Type:The bicycle-sharing market can be segmented into various types, including Traditional Bicycles, Electric Bicycles (E-bikes), Hybrid Bicycles, Cargo Bicycles, Docked Bicycles, Dockless Bicycles, and Others. Among these, Electric Bicycles (E-bikes) are gaining significant traction due to their convenience and appeal to a broader audience, including those who may not typically cycle. The demand for E-bikes is driven by their ability to cover longer distances with less effort, making them a preferred choice for daily commuters and recreational users alike.

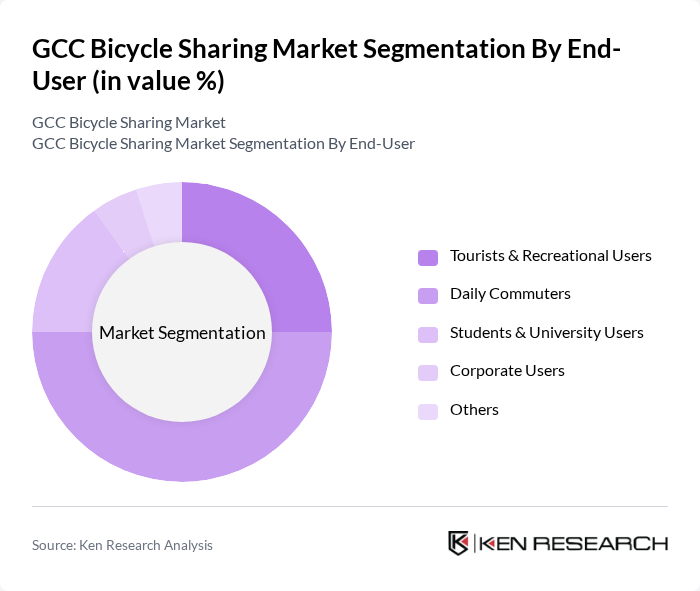

By End-User:The end-user segmentation includes Tourists & Recreational Users, Daily Commuters, Students & University Users, Corporate Users, and Others. Daily Commuters represent the largest segment, driven by the increasing need for efficient and cost-effective transportation solutions in urban areas. The rise in remote work and flexible schedules has also contributed to a growing interest in bicycle-sharing services among professionals seeking alternative commuting options.

The GCC Bicycle Sharing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem BIKE, Byky (Nextbike UAE), Qick Bikeshare, Lime, Cyacle (Abu Dhabi), YAS Cycles, QMIC Masarak (Qatar Mobility Innovations Center), and S’hail (Dubai Integrated Mobility Platform) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC bicycle sharing market appears promising, driven by increasing urbanization and government support for sustainable transport. As cities expand, the integration of bicycle sharing with public transport systems is likely to enhance accessibility and convenience for users. Furthermore, the development of smart bicycle sharing solutions, utilizing IoT technology, is expected to improve operational efficiency and user experience. These trends indicate a growing acceptance of cycling as a viable transport option in urban areas, fostering a healthier lifestyle among residents.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Bicycles Electric Bicycles (E-bikes) Hybrid Bicycles Cargo Bicycles Docked Bicycles Dockless Bicycles Others |

| By End-User | Tourists & Recreational Users Daily Commuters Students & University Users Corporate Users Others |

| By Pricing Model | Pay-Per-Ride Subscription-Based Membership Plans Corporate/Institutional Plans Others |

| By Distribution Channel | Mobile Applications Kiosks/Stations Online Platforms Partnerships with Local Businesses Others |

| By Geographic Coverage | Urban Areas Suburban Areas Tourist Attractions University Campuses Others |

| By Duration of Rental | Short-Term Rentals (Hourly/Daily) Long-Term Rentals (Weekly/Monthly) Others |

| By Fleet Size | Small Fleet (<100 Bicycles) Medium Fleet (100–500 Bicycles) Large Fleet (>500 Bicycles) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 120 | Daily commuters, university students |

| Tourists in Major Cities | 80 | International tourists, travel agencies |

| Local Government Officials | 50 | City planners, transportation policy makers |

| Bicycle Sharing Operators | 65 | Business owners, operational managers |

| Environmental Advocates | 40 | Sustainability experts, NGO representatives |

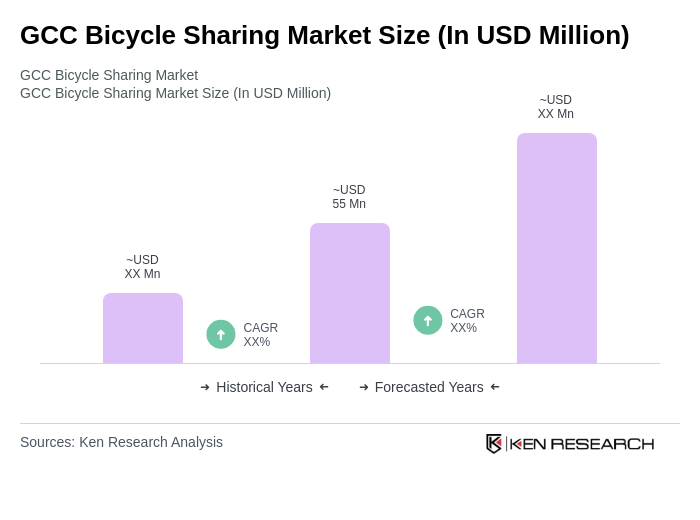

The GCC Bicycle Sharing Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is attributed to urbanization, government initiatives for sustainable transport, and increased awareness of cycling's health and environmental benefits.