Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3854

Pages:94

Published On:November 2025

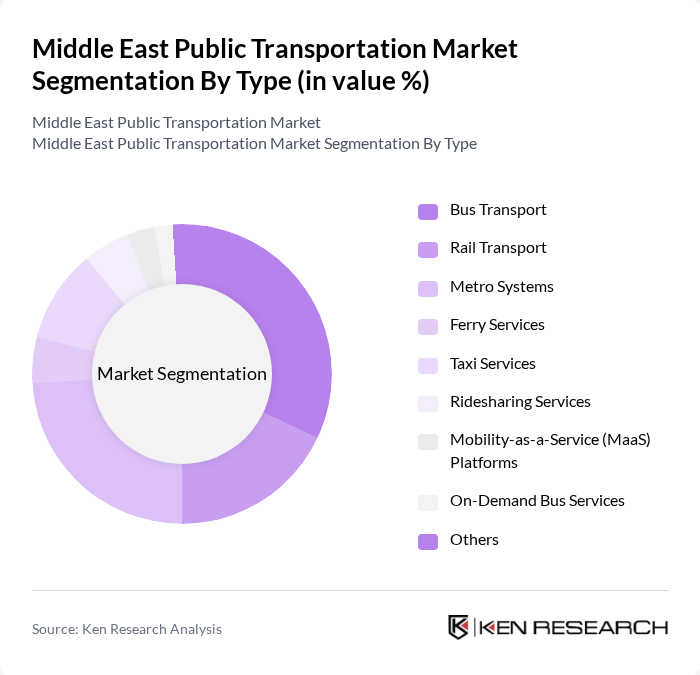

By Type:The public transportation market in the Middle East is segmented into bus transport, rail transport, metro systems, ferry services, taxi services, ridesharing services, Mobility-as-a-Service (MaaS) platforms, on-demand bus services, and others.Bus transportandmetro systemsare the most prominent, owing to their extensive networks, affordability, and ability to serve high-density urban corridors. The surge in urban population and the need for reliable, efficient commuting options have intensified demand for these segments. The adoption of electrified fleets and integrated ticketing systems is further enhancing the appeal and operational efficiency of these services .

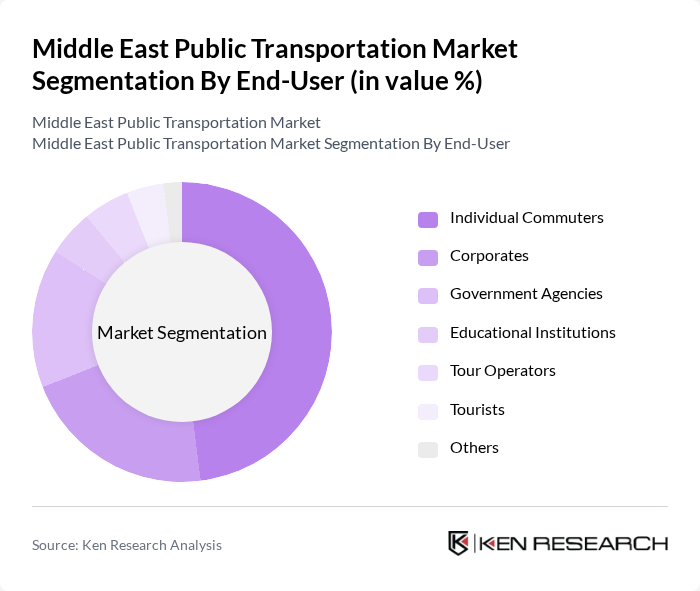

By End-User:The end-user segmentation of the public transportation market includes individual commuters, corporates, government agencies, educational institutions, tour operators, tourists, and others.Individual commutersform the largest segment, propelled by urbanization and the need for affordable, efficient mobility. Corporates and government agencies are significant contributors, investing in employee and public service transport solutions. The rise of digital ticketing and corporate mobility programs is further shaping end-user preferences .

The Middle East Public Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roads and Transport Authority (RTA) – Dubai, UAE, Saudi Public Transport Company (SAPTCO) – Saudi Arabia, Mowasalat (Karwa) – Qatar, Qatar Rail – Qatar, Mwasalat – Oman, Bahrain Public Transport Company – Bahrain, Kuwait Public Transport Company (KPTC) – Kuwait, Emirates Transport – UAE, Dubai Taxi Corporation – UAE, TransAD (Integrated Transport Centre, Abu Dhabi) – UAE, Saudi Railway Company (SAR) – Saudi Arabia, Etihad Rail – UAE, National Transport Authority (UAE), Public Transport Authority (Kuwait), Careem (Uber) – Regional, Yutong Bus Co. (Regional Supplier), MAN Truck & Bus Middle East, Volvo Buses Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of public transportation in the Middle East appears promising, driven by urbanization and technological advancements. In future, the integration of smart technologies, such as real-time tracking and AI-based traffic management, is expected to enhance operational efficiency. Additionally, the focus on sustainable transport solutions will likely lead to increased investments in electric and hybrid vehicles. As governments prioritize public transit, partnerships with private sectors will become crucial in developing innovative solutions that meet the growing demand for efficient transportation.

| Segment | Sub-Segments |

|---|---|

| By Type | Bus Transport Rail Transport Metro Systems Ferry Services Taxi Services Ridesharing Services Mobility-as-a-Service (MaaS) Platforms On-Demand Bus Services Others |

| By End-User | Individual Commuters Corporates Government Agencies Educational Institutions Tour Operators Tourists Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology | Electric Vehicles Hybrid Vehicles Autonomous Vehicles Smart Ticketing Systems Integrated Mobility Solutions Others |

| By Application | Daily Commuting Tourism Freight Transport Emergency Services School Transport Others |

| By Investment Source | Public Funding Private Investments International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Bus Services | 100 | Transport Managers, City Planners |

| Metro Rail Systems | 80 | Operations Directors, Safety Officers |

| Tram and Light Rail Networks | 60 | Project Managers, Urban Development Specialists |

| Ride-Sharing and Micro-Mobility Solutions | 50 | Business Development Managers, Marketing Directors |

| Public Transport User Experience | 90 | Commuters, Customer Service Representatives |

The Middle East Public Transportation Market is valued at approximately USD 11 billion, reflecting a comprehensive analysis of various public transport modes, including buses, metro, rail, and emerging mobility services, driven by urbanization and government infrastructure investments.